This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Q2 2024: Bonds Recover in May and June after Initial Sell-Off

July 1, 2024

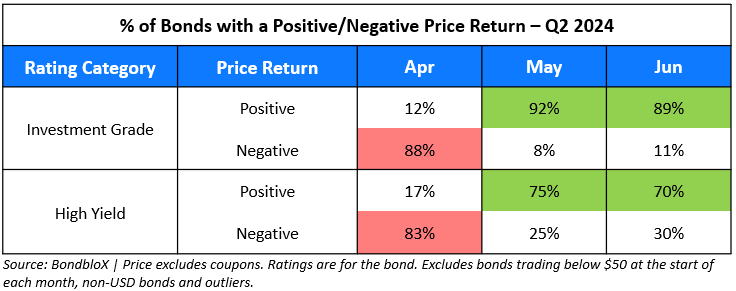

Q2 2024 was a relatively modest one with 60% of dollar bonds in our universe delivering a negative price return (ex-coupon). Among this, 54% of high yield (HY) bonds delivered positive returns, outperforming investment grade (IG) bonds where 63% ended in the red. The quarter can we viewed as being predominantly driven by Treasuries, but in two separate parts – the first of which was in April, being a poor month for bonds as markets priced out rate cuts by the Fed amid consistently solid data out of the US. From initially pricing-in over 50bp in rate cuts, markets only priced-in one rate cut during the month. However, as economic data softened in May and further weakened in June, bond investors witnessed positive price returns as seen in the table above.

Looking at H1 2024, HY outperformed IG bonds owing to the relatively higher impact that duration has on the latter. 62% of HY bonds ended higher, whereas 66% of IG bonds ended lower. Both, Q1 and Q2 saw a similar tone with 59% and 60% of dollar bonds ending lower respectively. While February saw a sharp sell-off in Q1 (74% of bonds lower) due to significantly stronger economic data, April mimicked the same in Q2. Akin to Q1, the other two months partly compensated for the sell-off seen in each of these months. Moving forward, markets are set to continue vigilantly following data and its implications thereof on Treasuries and dollar bonds alike.

After several bouts of volatility during the quarter, Treasury yields moved higher across the board, with the curve bear steepening. The 2Y and 10Y yields ended 13bp and 20bp higher respectively. While the 2Y and 10Y yield closed aggressively higher by 40bp and 48bp in April, touching 5.02% and 4.68% respectively, they eased subsequently in May by 16-18bp and further in June by 10-13bp.

US economic data moved through three stages in each of the months - from strong to resilient and currently, to a moderation. Looking the latest numbers in June, CPI and Core CPI have softened to 3.3% and 3.4% (from 3.5% and 3.6%). The ISM Manufacturing Index sank further into contraction territory to 48.7 and retail sales have been mixed. To summarize, data stayed resilient enough through May, for Fed speakers to not strongly indicate a need to cut rates, but has since, softened to the extent required to possibly needing one, if not more. The FOMC's June dot plots have indicated only a 25bp rate cut by end-2024, but markets are currently pricing-in a 50bp cut. A tussle between both, the markets and the Fed, amid the constantly evolving economic data has seen Treasuries move in a large range during the quarter. Separately, Treasury auctions in June have seen solid demand, especially the recent 5Y auction and the 10Y auction early last month.

Looking at the performance of bonds across regions, the Asian HY space saw the biggest gains again in Q2, up over 3.1%, adding to its Q1 returns of over 6.3%. All other regions performed stably during the quarter, with no major rally or dips. Z-spread also remained stable during the quarter.

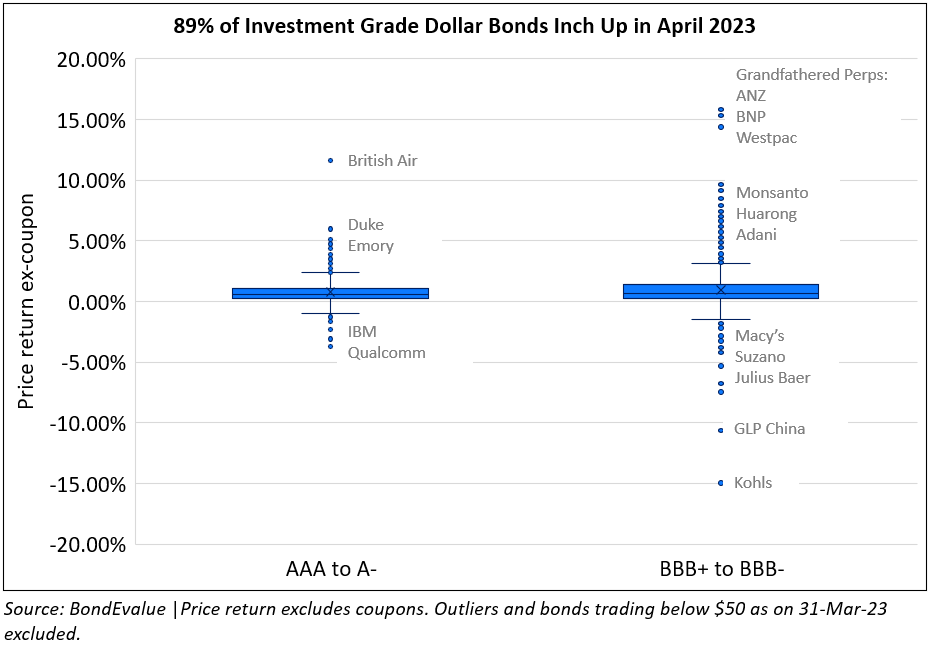

The IG-space saw no notable names among the gainers with only select bonds making up the list including Ricoh, Aroundtown, Pepsico and Prosus. The biggest drop in the AAA to A- space were long duration dollar bonds of issuers like Coca-Cola, Manulife, Israel etc., owing to the broad move higher in long-dated Treasury yields through the quarter. Among the losers in the BBB+ to BBB- space, were bonds of Macy's and Hudson Pacific that fell ~8-10%.

In the HY space, the prominent top gainers saw Chinese property developers like Longfor, Seazen, Gemdale and Wanda rise over 24% after the PBOC announced a whole host of measures to support the property sector, including a RMB 300bn ($42bn) relending program. Vanke's dollar bonds were also among the top gainers, helped by the property measures and other updates like selling its headquarters project for $309mn, securing $2.8bn in loans and paying off its dollar bond due in June. Other popular gainers included Volcan's bonds that rallied 23% after remarks about avoiding haircuts and planning asset sales, and Carvana's bonds, after it expected an unexpected bump in quarterly retail sales and core profits. Embarq's dollar bonds dropped the most, by over 74% after some of its bond investors claimed that debt issued by the firm to fund its leveraged buyout by Apollo Global Management triggered an event of default on an existing bond However, while the telecommunications firm won a legal battle against them, its 7.995% 2036s have not recovered. iHeartMedia's bonds were the next biggest loser, down over 34% after its revenues missed expectations, whilst also reporting losses.

Issuance Volumes

In Q2 2024, global corporate dollar bond issuances stood at nearly $700bn, 29% lower than the prior quarter which was at $983bn. In comparison to Q2 2023, issuance volumes were 16% higher.

Asia ex-Japan & Middle East G3 issuances in Q2 2024 stood at $87bn, 21% lower than Q1 2023, but 71% higher than that of Q2 2023. 77% of the volumes in the recently concluded quarter came from IG issuers while HY contributed to 21% of deal volumes, with the remainder taken up by unrated issuers.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

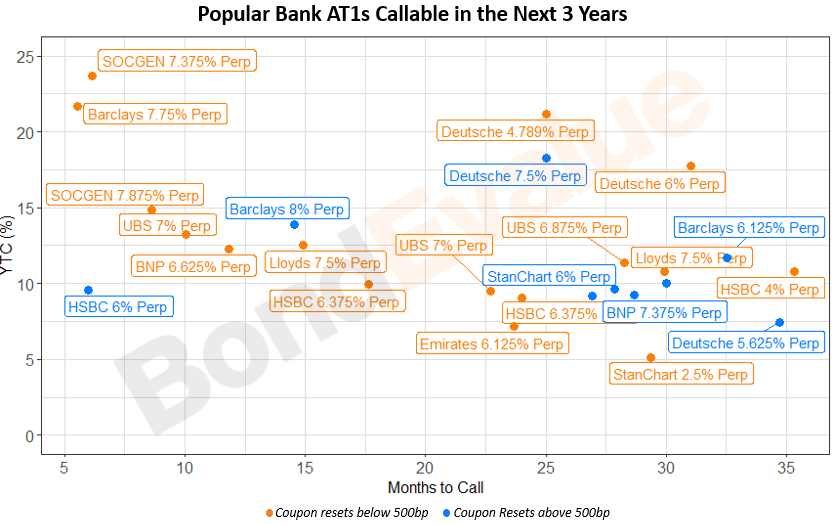

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023