This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Screener

What are bond screeners?

Bond screeners are a tool to screen or filter for bonds based on an individual’s custom criteria. With several thousands of bonds currently available to investors, it can be difficult to decide which bond to buy. A bond screener can help investors and advisors to filter out bonds that do not meet their criteria, so that they have a shorter, more relevant bond list to pick from. Common filters in bond screeners include country, currency, industry, yield, maturity, credit rating and type of bond.

Using bond screeners effectively

Investors can use bond screeners to select specific parameters that meet their investment objectives. Let us take the following example into consideration. An investor may be looking to create a portfolio of perpetual and callable bonds across the Banking and Financial Services sectors in China, USA, Germany and a few other countries. He/she may also be interested in looking at USD denominated bonds offering a yield between 5-10% in particular. These parameters can be selected to give a list of all relevant bonds. Specific bonds can then be selected from the list as per his/her preference to build a portfolio.

Features of BondbloX’s bond screener

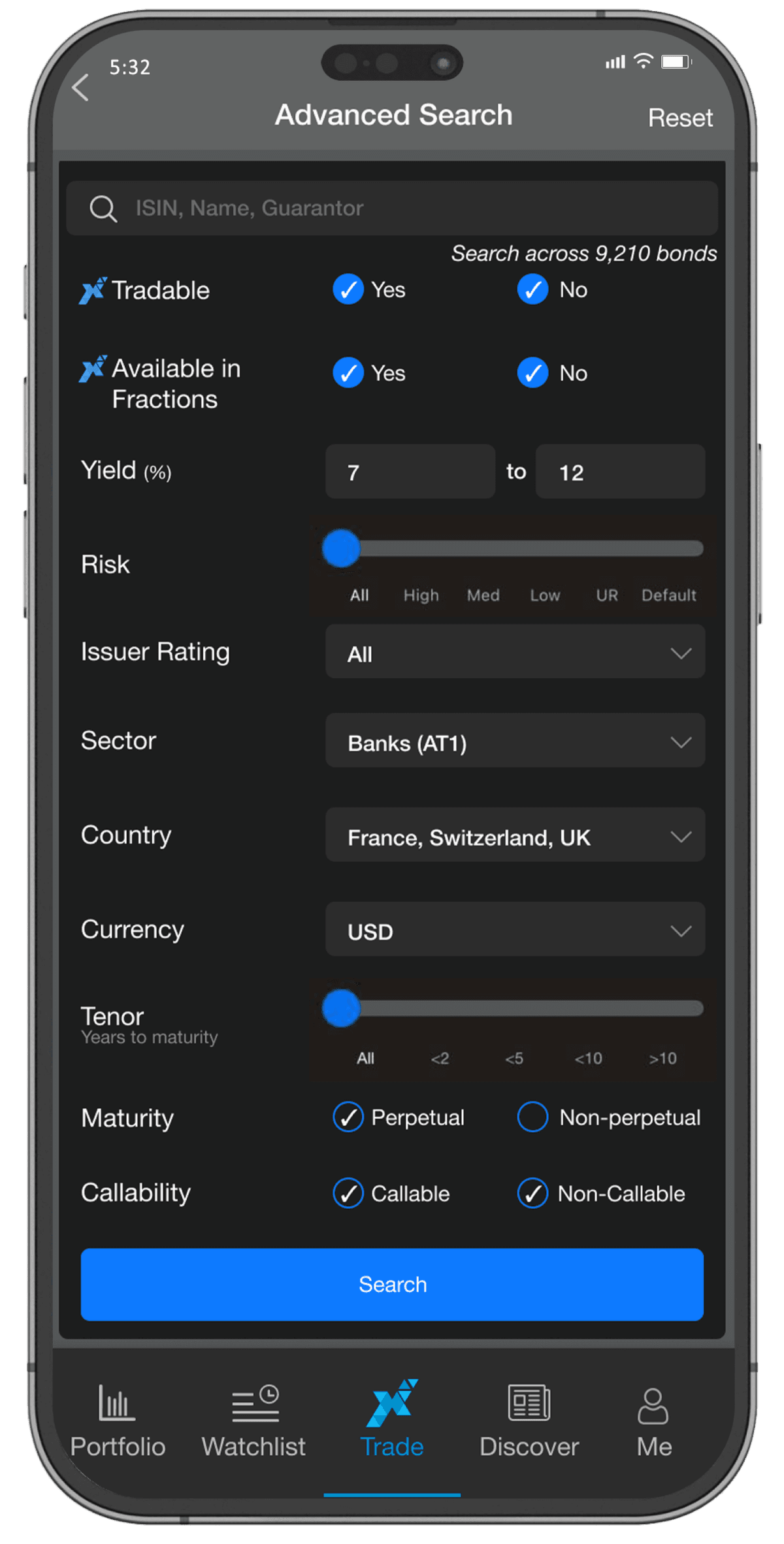

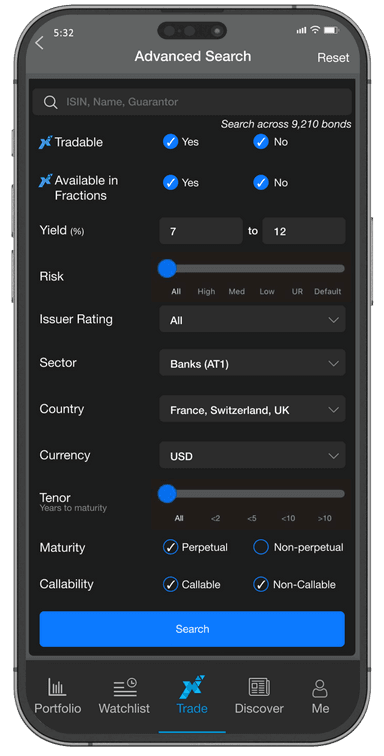

Continuing with the above example, BondbloX’s “Advanced Search” screener helps assist investors filter the bond universe with custom parameters as displayed in the image below. Let us explore each of these features available in this section.

Search Box

BondbloX screener’s search box enables investors to find bonds based on the Issuer name, ISIN code, or the guarantor’s name.

Risk

Risk is a unique screener feature to filter for bonds based on investors’ risk appetite. The risk scale is accordingly categorized as: High, Medium, Low, Unrated, All.

Issuer Rating

The creditworthiness of the bond issuer can be filtered for under the “Credit Ratings” filter. BondbloX currently provides a Fitch rating scale from AAA to D and also includes unrated bonds.

Sector

The BondbloX app has several sectors across the spectrum to choose bonds from. Some examples include banking, real estate, oil and gas, wireless telecommunications etc.

Country

Since investors may prefer bonds that are from their home country or only a select few countries, BondbloX provides a filter for bonds from 135 countries.

Maturity

Also, investors can choose maturity ranges among which they can filter for bonds. Investors who want less uncertainty may choose shorter maturities, while those who have medium/long-term needs may choose accordingly. BondbloX’s maturity buckets are classified into the following:

- Less than 2 years

- Less than 5 years

- Less than 10 years

- More than 10 years

Perpetual & Callable Bonds

Perpetual bonds are popular among the investor community and typically offer higher yields than most other bonds. BondbloX’s screener enables investors to filter for both, fixed-for-life perpetual bonds and perps with a call option. Additionally, investors can filter for callable bonds alone.

You can access the screener by clicking on the Advanced Search feature on the app.