This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Manulife, EDF Price Bonds; Markets Await CPI, FOMC

June 12, 2024

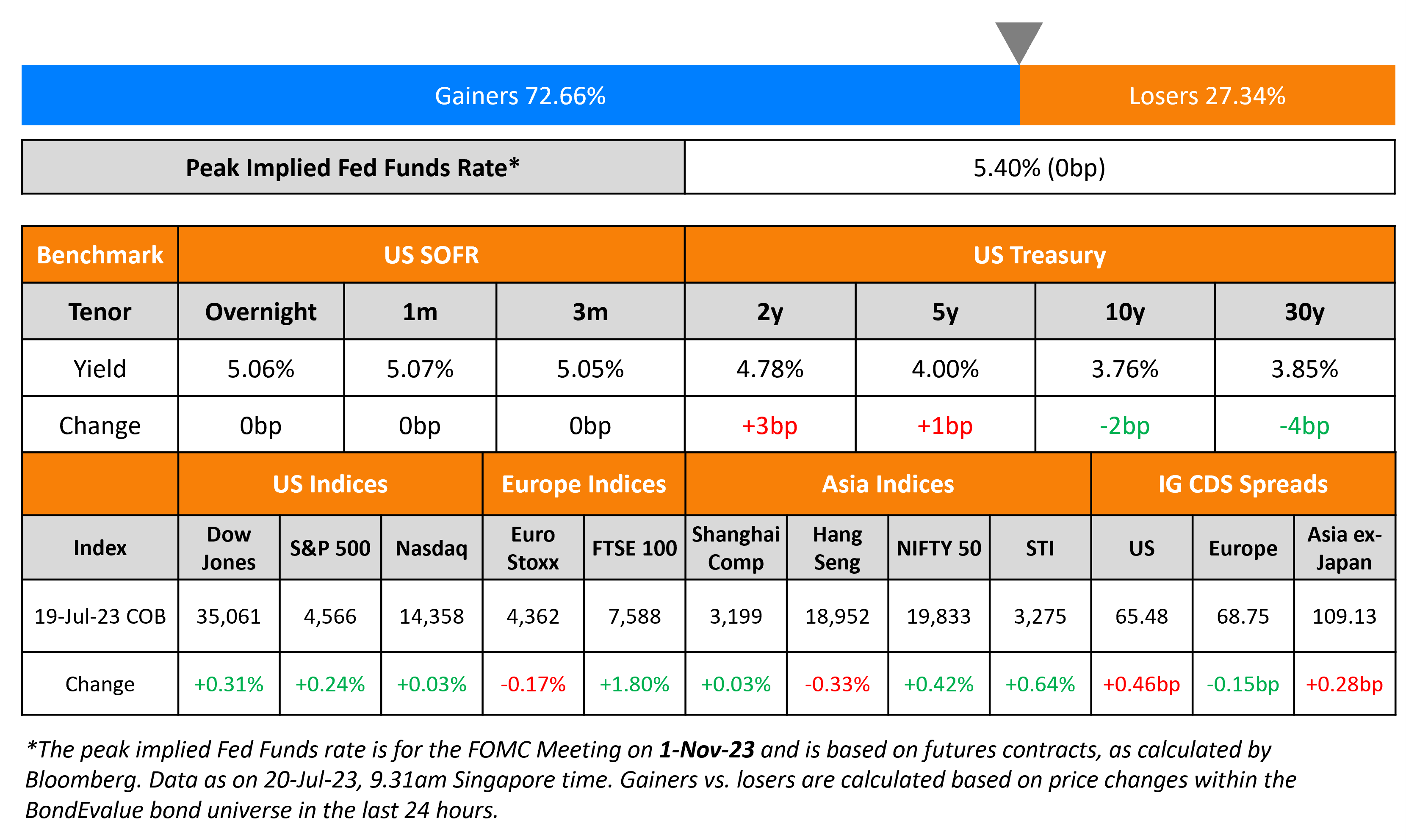

US Treasuries ticked higher across the curve with yields down by ~4bp. The US Treasury’s $39bn 10Y auction witnessed strong demand at a yield of 4.438%, stopping through the pre-auction yield of 4.458%. The bid-to-cover stood at 2.67x, much higher than the previous 10Y auction’s 2.49x, with indirect bidders taking ~75% of the offering vs. 66% priorly. Markets await the inflation report later today and the FOMC meeting following that, where new dot plots are expected to be released while rates are set to remain unchanged. US headline CPI is expected to stay unchanged at 3.4% while the Core CPI is expected to come down slightly to 3.5% in May from 3.6% in April. US equity markets ended higher, with the S&P and Nasdaq up by 0.3% and 0.9% respectively. US IG and HY CDS spreads widened by 0.5bp and 1.5bp respectively.

European equity markets ended lower, with the political risk from France weighing on markets. Europe’s iTraxx main CDS spreads were 2.3bp wider and crossover spreads were wider by 8.5bp. Asian equity indices have opened lower this morning. Asia ex-Japan CDS spreads were 0.1bp tighter.

New Bond Issues

- Henan Civil Aviation Development $ 3Y Green at 3.6% area

- Linyi City Construction Investment $ 3Y at 7.1% area

Manulife Financial raised S$500mn via a 10NC5 bond at a yield of 4.275%, 32.5bp inside initial guidance of 4.60% area. The subordinated notes is rated A- (S&P). Proceeds will be used for general corporate purposes including investment in subsidiaries and potential future redemptions of existing bonds.

EDF raised €3bn via a three-trancher. It raised:

- €1bn via a 7Y bond at a yield of 4.152%, 20bp inside initial guidance of MS+145bp area. The bond was priced at a new issue premium of 14.2bp over its existing 4.25% bonds due January 2032.

- €750mn via a 12Y bond at a yield of 4.444%, 20bp inside initial guidance of 175bp area.

- €1.25bn via a 20Y bond at a yield of 4.815%, 20bp inside initial guidance of MS+220bp area.

Net proceeds will be allocated to EU-Taxonomy aligned (a) nuclear energy capital expenditures in existing French nuclear reactors in relation to their life time extension (b) renewable power projects and hydropower generation (c) transmission and distribution of electricity in France.

New Bonds Pipeline

- REC Limited hires for $ Long 5Y Green bond

Rating Changes

- Fitch Upgrades TAQA to ‘AA’; Removes UCO; Stable Outlook

- Daimler Truck Holding AG Upgraded To ‘A-‘ From ‘BBB+’ On Resilient Profitability And Cash Flow; Outlook Stable

- Sotheby’s Downgraded To ‘B-‘ From ‘B’ On Elevated Leverage; Outlook Negative

- Fitch Revises Goodyear’s Outlook to Negative; Affirms IDR at ‘BB-‘

Term of the Day

Special Drawing Rights (SDR)

Special Drawing Rights (SDR) issued by the IMF to its member countries’ central banks are a reserve asset that can be exchanged for hard currencies with another central bank. The value of an SDR is set daily based on a basket of five major international currencies: the USD (43.38%), the EUR (29.31%), the CNY (12.28%), the JPY (7.59%) and the GBP (7.44%). An allocation of SDRs requires approval by IMF members holding 85% of the total votes and US is the biggest holding 16.5% of the votes.

Talking Heads

On European Bonds Becoming More Attractive – Bill Gross

“There’s coming a point where European bonds are more attractive than Treasury bonds… In terms of attraction, the German 10-year bunds and French 10-year, their spreads have narrowed significantly in the past month or two relative to Treasuries”

On Higher Coupon Payments Keeping Demand for Credit High – BofA

Total income generated by the corporate bond market should be about 15% higher in 2024 vs 2023… “That extra coupon cash should help keep IG technicals stronger for the remainder of 2024”

On Zero-Coupon Bond Pile Ballooning to Near Half-a-Trillion Dollars

Barclays’ strategist Andres Mok and Demi Hu

“Treasury yields rallied in May amid softer-than-expected data as well as a surge in flows into long-term bond funds following the dovish FOMC meeting”

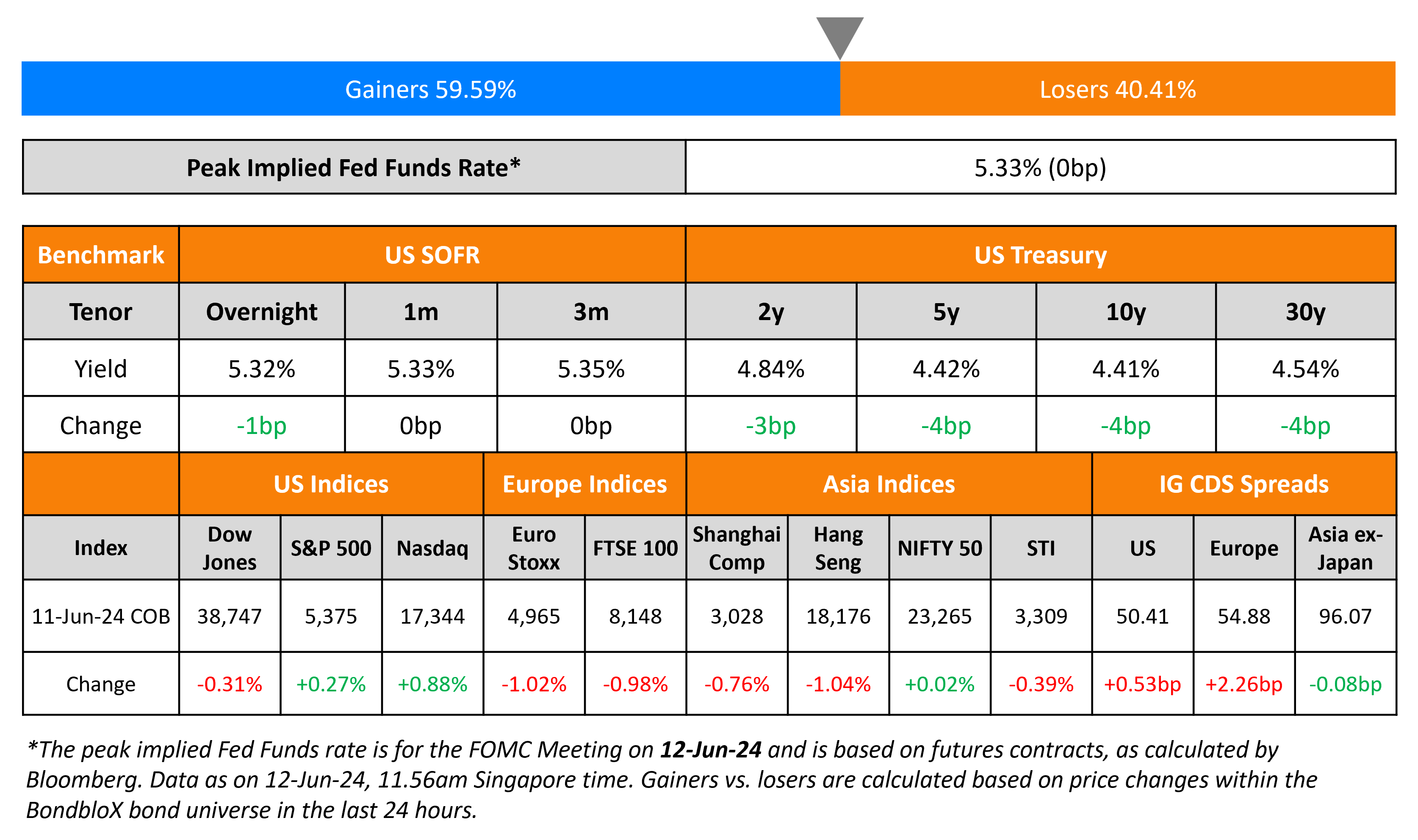

Top Gainers & Losers- 12-June-24*

Go back to Latest bond Market News

Related Posts: