This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Clover Aviation, GuocoLand, KDB Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 18, 2021

Wall Street saw another leg higher with the S&P and Nasdaq up 0.8% and 0.5% on Friday. Most sectors ended in the green led by Consumer Discretionary and Financials, up 1.8% an 1.5% respectively. US 10Y Treasury yields eased 2bp to 1.53%. European stocks also moved higher with the DAX, CAC and FTSE up 0.8%, 0.6% and 0.4% respectively on Friday. Brazil’s Bovespa ended 1.3% higher. In the Middle East, UAE’s ADX was 0.3% higher and Saudi TASI was up 0.6%. Asian markets have started the week with a soft open – Shanghai, HSI, Nikkei and STI are down 0.4%, 0.3%, 0.2% and 0.1% respectively. US IG and CDS spreads were flat and HY CDS spreads were 0.3bp tighter. EU Main CDS spreads were 0.4bp tighter and Crossover CDS spreads were flat. Asia ex-Japan CDS spreads were flat.

US Core Retail Sales came at 0.8% MoM in September, higher than forecasts of 0.5% while the New York Empire State Manufacturing Index came at 19.8 vs. forecasts of 27 for October. The weekly Michigan consumer sentiment and current conditions indices also disappointed at 67.2 and 71.4 vs. expectations of 73.1 and 82. Meanwhile, the PBOC gave its take on Evergrande saying that the risks were ‘controllable’.

China’s Q3 GDP print came at 4.9% YoY, missing expectations of 5.2%. Industrial production rose by 3.1% in September, below the 4.5% forecast. However, Retail Sales was higher at 4.4% vs. expectations of a 3.3% growth.

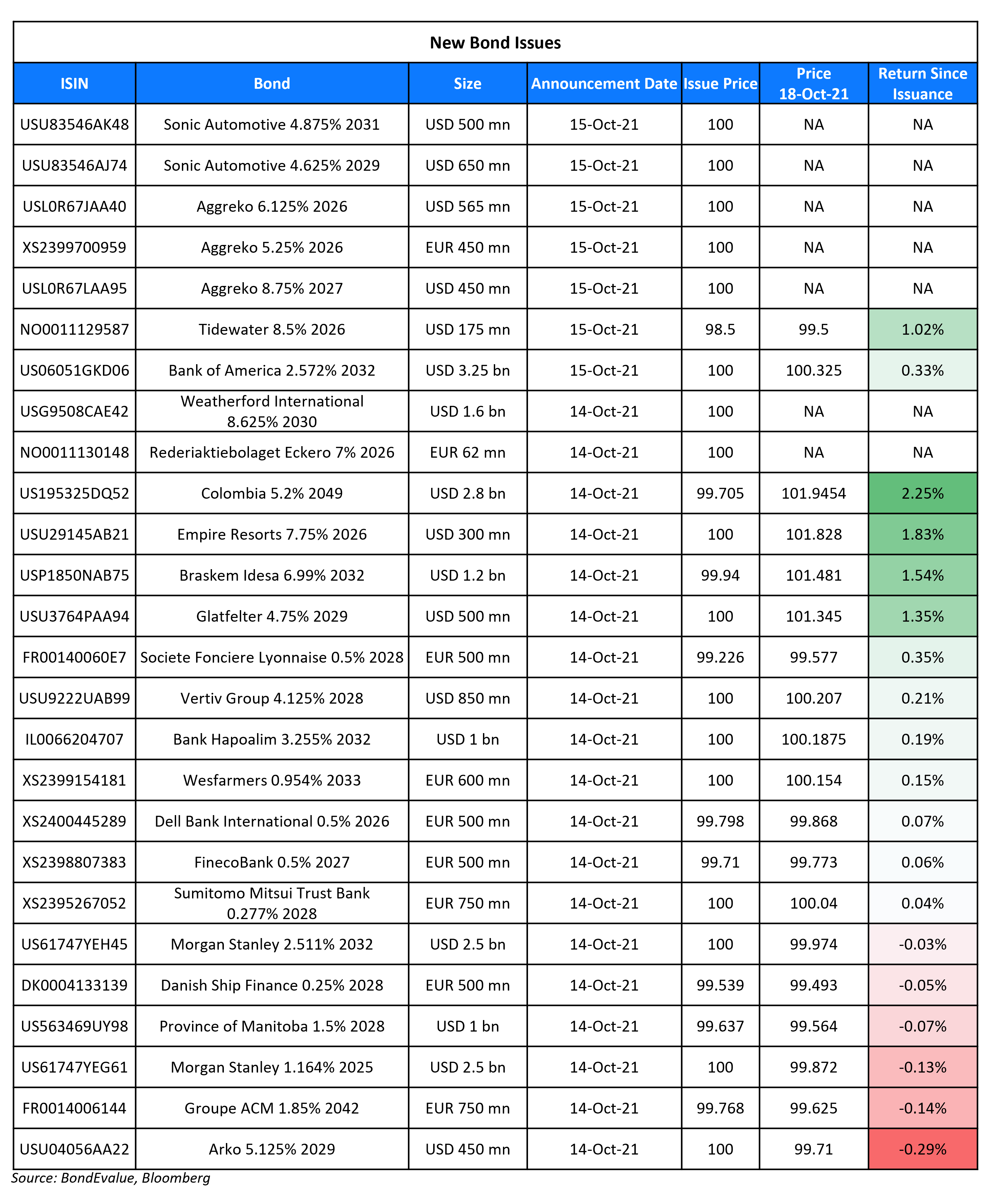

New Bond Issues

- Clover Aviation Capital $ 3Y at T+225bp area

-

GuocoLand S$ 5Y at 3.5% area

-

Korea Development Bank $ 3.25Y green at T+40bp area; $ 5.5/10Y at T+55/70bp area

-

ASB Bank $ 5/10Y at T+80/105bp area

Bank of America raised $3.25bn via a 11NC10 bond at a yield of 2.572%, 15bp inside initial guidance of T+115bp area. The bonds have expected ratings of A2/A-. The bonds are callable on 20 October 2031 at par, and anytime on and after 20 July 2032 at 100. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Indofood CBP Sukses Makmur hires for $ bond

- Hunan Xiangjiang New Area Development Group hires for $ bond

- Muang Thai Life hires for $ tier 2 bond

- Hualu Holdings hires for $ debut bond

- IOI Corp hires for $ senior bond alongside tender offer

- Hibiscus Petroleum hires for $ 5NC2 bond

- Chengdu Hi-Tech Investment Group hires for $ bond

- China plans for $ 4bn 3/5/10/30Y bond

Rating Changes

- Moody’s upgrades Minsur to Ba2; stable outlook

- Moody’s changes Romania’s outlook to stable; affirms Baa3 rating

- Moody’s downgrades RiseSun to B1/B2; outlook negative

- China Aoyuan Downgraded To ‘B’ On Elevated Leverage And Tightened Liquidity; Outlook Negative

- Fitch Downgrades Peru to ‘BBB’; Outlook Stable

- Moody’s affirms Hopson’s B2 rating; changes outlook to negative

- Moody’s affirms Zensun’s B2/B3 ratings; changes outlook to negative

- Moody’s affirms Jingrui’s B2/B3 ratings; changes outlook to negative

- Moody’s affirms Garfunkelux’s B2 rating, changes outlook to Positive

Term of the Day

144A

144A bonds refer to privately placed debt instruments that can be traded among qualified institutional buyers (QIBs) and with a shorter holding period of six months. These bonds get their name from Rule 144A, which exempts the securities from SEC registration that typically requires extensive documentation and a two-year holding period. 144A bonds can be issued with a lesser amount of documentation as the underlying assumption is that QIBs are sophisticated investors who do not need the same level of information and protection as individual investors. The SEC defines a QIB as institutional investors that have at least $100mn in assets under management.

Talking Heads

On the view that China can contain Evergrande’s risk – Yi Gang, People’s Bank of China Governor

“Overall, we can contain the Evergrande risk.” “The rights and interests of creditors and shareholders will be fully respected in strict accordance with the law. And also the law has clearly indicated the seniority of those liabilities,” he said. “I think we can prevent systemic risk.” “The growth momentum has moderated somewhat.” “Economic growth [has] slowed down a little, but the trajectory of the economic recovery remains unchanged.”

“The Chinese economy is doing well in general, but we still face some challenges,” he said. “We are keeping a close eye on all these problems.”

“In recent years, this company did not operate and manage itself well. It failed to conduct prudent operations according to changing market conditions, and it blindly diversified and expanded its business.” On the real estate sector performance, “in some cities, the property prices surged too fast, causing the approval and issuance of personal mortgages to be restrained,” Zou said. “Once housing prices stabilise, the supply and demand of mortgages in those cities will be normalized too,” he said.

“We are more sure of the timeline for the Fed’s taper than for Treasury’s coupon-auction cuts.” “There’s pros and cons to Treasury starting cuts in November or waiting until February. This uncertainty will provide some relative-value trading opportunities along the yield curve, probably most particularly around the 20-year point.”

“I worry a little bit that this wonderful world we’ve been living in of low volatility, everything going up, may come to a stop with higher volatility.” “If I were an investor, I would recognize that I’m riding a huge liquidity wave thanks to the Fed, but I would remember that waves tend to break at some point, so I would be very attentive,” he said. “Things will get worse before they get better.” “So we’re going to have more shortages of goods. We’re going to have higher prices. Inflation will remain in the 4 to 5% level.”

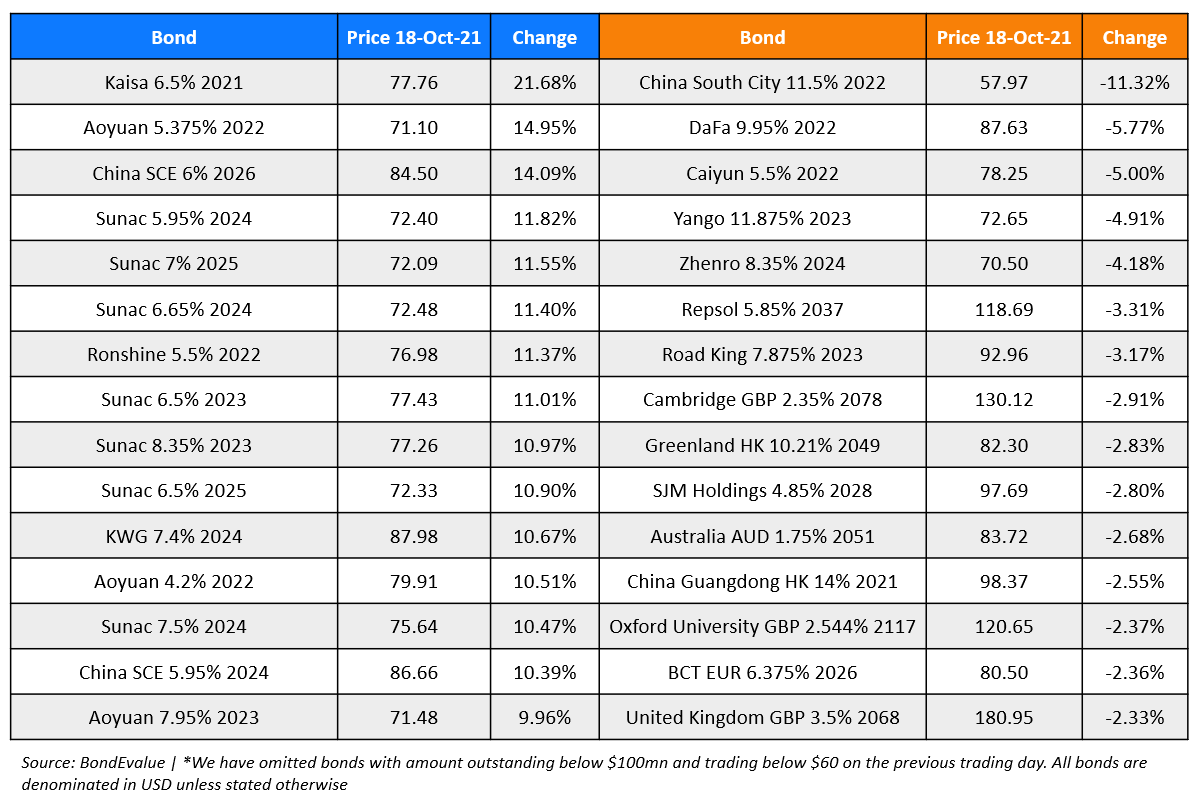

Top Gainers & Losers – 18-Oct-21*

Go back to Latest bond Market News

Related Posts: