This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 20, 2021

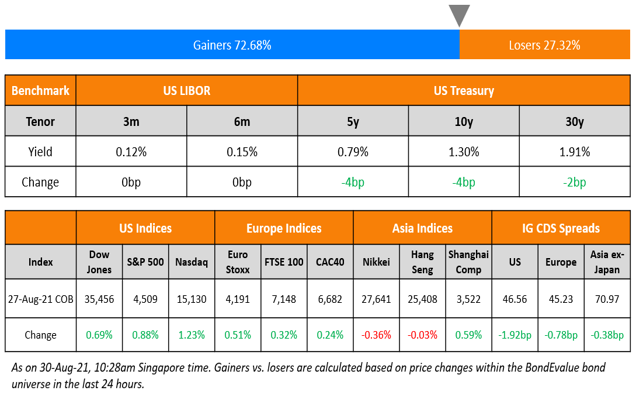

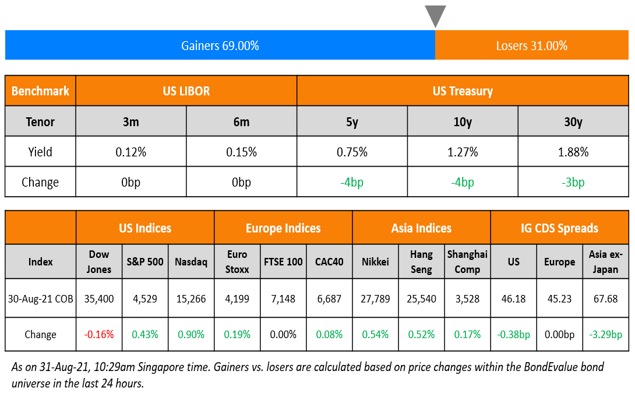

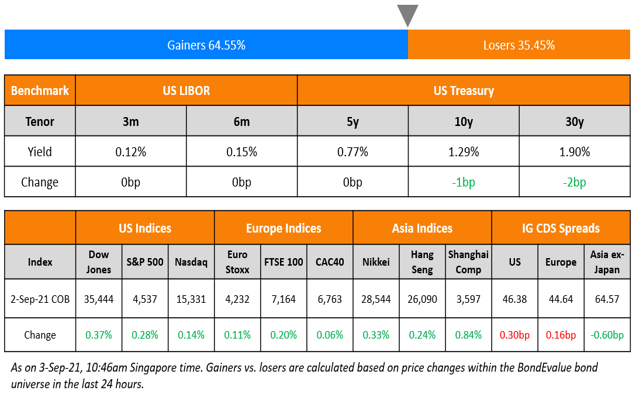

US markets reversed their early losses ending the day slightly stronger as better than expected jobless claims seemed to mitigate the taper fears after the release of FOMC minutes – S&P and Nasdaq gained 0.1% each. Most sectors ended in the green. IT and Healthcare up 1% and 0.9% respectively, led the gains while Energy, down 2.7% pulled down the indices. European markets closed lower – CAC was down 2.4%, FTSE 1.5% and CAX 1.3% lower. Saudi’s TASI and UAE’s ADX extended their losses and were down 1.3% and 1% respectively. Brazil’s Bovespa reversed its losses and was up 0.5%. Most Asian markets started in the red – HSI, Shanghai and Nikkei were down between 0.7% and 1.7% while Singapore’s STI was up 0.7%. US 10Y Treasury yields fell 2bp to 1.24%. US IG tightened slightly by 0.1bp while the HY CDS spreads widened 1.4bp. EU Main and Crossover CDS spreads widened 0.7bp and 2.9bp respectively. Asia ex-Japan CDS spreads were 6.1bp tighter.

US jobless claims for the prior week came at 348k, the lowest since the onset of the pandemic and falling for the third straight week vs. 377k in the previous week. The 4-week moving average was at 377.75k, down 19k from the previous week. Pre-pandemic, on March 14, 2020 the average was 225.5K. Hong Kong’s CPI (YoY) for July stood at 3.7% vs. 0.7% in June.

Advanced Two-Day Course on Bonds | 26-27 Aug

If you are a finance professional or investor who would like to learn about bonds from senior bankers, sign up for our upcoming course with Singapore Management University on 26-27 August.

The course is designed for private bankers, relationship managers and advisors, and covers both theoretic concepts as well as real-world examples. SkillsFuture Singapore Funding is available for Singaporeans and PRs. Click on the link below to sign up.

New Bond Issues

.png)

Deutsche Bank raised $300mn via a 34Y green zero-coupon Formosa at an annual internal rate of return or 3.5%. Proceeds of DB’s new notes will be used to help fund eligible green assets, including renewable energy projects such as wind or solar power plants and the improvement of energy efficiency for commercial buildings.

Shandong Gold Group raised $600mn via a two-trancher. It raised $300mn via a 3Y bond at a yield of 2.4%, 80bp inside the initial guidance of 3.2% area. It also raised $300mn via a 5Y bond at a yield of 2.8%, 70bp inside the initial guidance of 3.5% area. The bonds have expected ratings of BBB- and received combined orders of over $10bn, 16.7x issue size. The bonds will be issued by wholly owned offshore subsidiary SDG Finance and guaranteed by the parent.

Anhui Transportation Holding Group raised $400mn via a 5Y bond at a yield of 1.664%, 55bp inside the initial guidance of T+145bp area. The bonds have expected ratings of A3/A- and received orders over $4.8bn, 12x issue size. APAC investors took 99% and EMEA 1%. Banks and financial institutions received 60%, fund/asset managers and hedge funds 35%, and insurers/sovereigns and others 5%. Proceeds will be used for interest payment and refinancing. Wholly owned offshore subsidiary Anhui Transportation Holding Group (H.K.) is the issuer and Anhui Transportation Holding Group the guarantor. Anhui Transportation Holding Group is a state-owned investor and operator of toll roads in China’s Anhui province.

New Bonds Pipeline

- Perusahaan Pengelola Asset hires for $ bond

Rating Changes

-

Fitch Upgrades Devon Energy’s Long-Term IDR to ‘BBB+’; Outlook Stable

-

Moody’s downgrades KIPCO’s ratings to Ba2 from Ba1, maintains negative outlook

-

Fitch Downgrades CLISA’s IDRs to ‘RD’ on Exchange Completion; Subsequently Upgrades to ‘CCC’

- Iochpe-Maxion S.A. Outlook Revised To Positive From Negative On Improved Profitability And Leverage; Ratings Affirmed

-

Fitch Revises VF Ukraine’s Outlook to Positive on Sovereign Action; Affirms at ‘B’

-

Fitch Places AXA Singapore on Watch Negative Pending HSBC Acquisition

- Fitch Assigns Turkmenistan ‘B+’ IDR; Outlook Stable

Term of the Day:

Market Value Leverage

Market Value Leverage (MVL) or Market Value based Leverage is a metric used by Moody’s to measure a company’s debt with respect to its investment portfolio. Moody’s measures it as the company’s “adjusted net debt divided by the estimated market value of its investment portfolio”.

Moody’s downgraded KIPCO to Ba2 from Ba1 with a negative outlook based on insufficient market value leverage (MVL). Moody’s said that KIPCO’s MVL as of June 2021 stands at 48.5% and with the additional capital, this will improve to 40-45%, still higher than the guidance of 40% required for the Ba1 rating.

Talking Heads

On the bond market signalling confidence in Fed policy outlook

Gennadiy Goldberg, senior U.S. rates strategist at TD Securities

“It was the June meeting that was the breaking point.” He said that the Fed’s message was “Yes, we were OK with higher inflation for some time but not to an extreme.”

Kristina Hooper, chief global market strategist at Invesco

“There’s always a risk that the market reacts to the Fed, that the Fed appears overly aggressive, but I think that is extremely unlikely with this Fed,” she said.

“Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year.”

In a note by Eric Beinstein, JPMorgan strategist and team

“Overseas demand looks set to remain robust.”

Tom Moulds, portfolio manager at Bluebay Asset Management

“The pickup for U.S. dollar versus other currencies is attractive and should fuel increased demand for dollar debt,” Moulds said.

John Taylor, portfolio manager at AllianceBernstein

“Every time U.S. yields sell off more than global yields, it becomes a buying opportunity for global investors where yields are relatively stuck.”

“Although most of the items have been mentioned many times in previous regulatory documents, the fact that the guidelines were issued jointly by multiple departments shows the level of attention.” “It will become a guiding document for the management of the credit market.”

Carmen Tsang, head of sustainable banking for greater China at Crédit Agricole CIB

“It may not be enough of an incentive for a borrower to go through the internal efforts to set high-level ESG targets just for one single transaction.”

Patrick Jin, associate director at Sustainalytics

“The ultimate goal of sustainability-linked debt is to drive the sustainable development of a company, not just to issue a label.” “We hope to promote such debt. Companies shouldn’t think they can achieve carbon neutrality just by issuing green bonds or by borrowing green loans.”

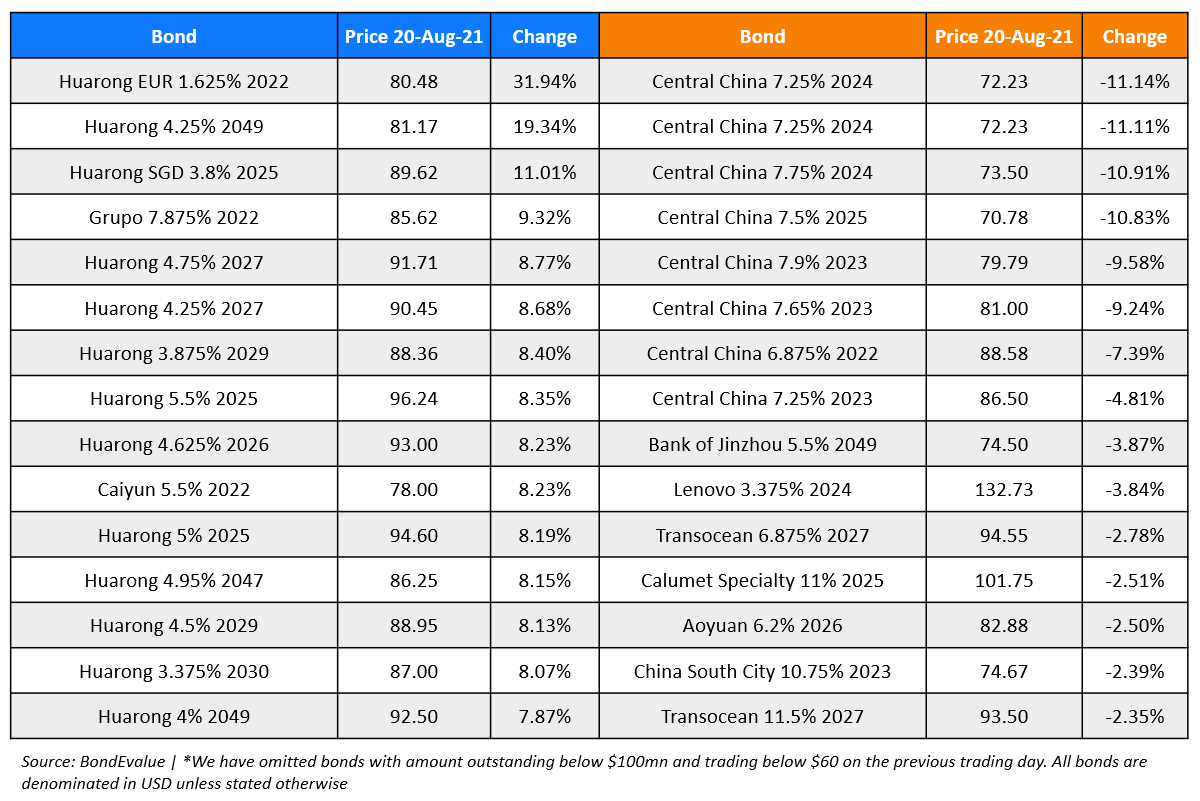

Top Gainers & Losers – 23-Aug-21*

Go back to Latest bond Market News

Related Posts: