This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Maldives, CDB Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 2, 2021

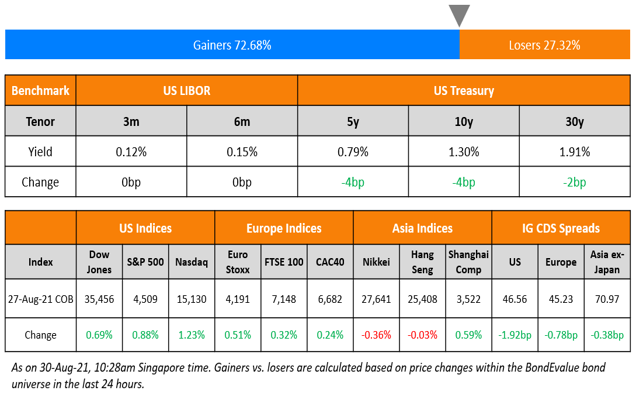

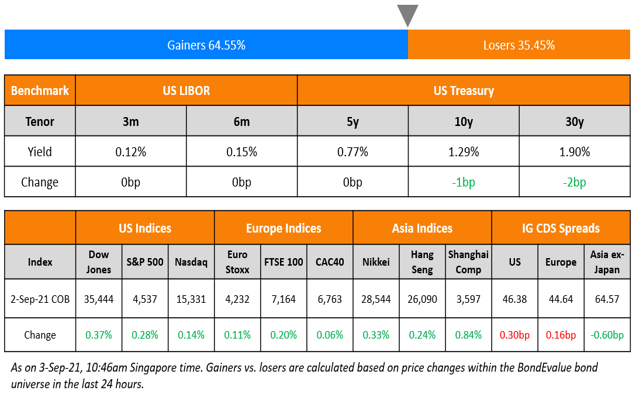

US markets kicked off September with a small gain – Nasdaq gained 0.3% hitting an all time high, while the S&P was 0.1% higher. Real Estate added another 1.7% while Utilities added 1.3%. Energy and Financials, down 1.5% and 0.6%, were a drag on the markets. European markets were mixed – CAC and FTSE closed 1.2% and 0.4% up while DAX ended 0.1% down. UAE’s ADX and Saudi’s TASI were down 0.5% and 0.1% respectively. Brazil’s Bovespa was also up 0.5%. Asian markets took a cue from the US and opened in the green – HSI, started off with gains of 0.8% before cooling down. Shanghai, up more than 0.5% is leading the Asian markets. HSI and Nikkei are up 0.1-0.2%. Singapore’s STI is down ~0.3% after starting in the green. US 10Y Treasury yields fell 3bp to 1.30%. US IG CDS spreads were broadly stable while HY spread tightened by 1.2bp. EU Main CDS and Crossover CDS spreads tightened by 0.3bp and 2bp respectively. Asia ex-Japan CDS spreads tightened 1.2bp.

According to payroll services firm ADP, US private payrolls rose 374k in August vs. July’s 326k, but much lower than Dow Jones’ expectations of 600k. All eyes now will be on Friday’s non-farm payrolls report for August, which is expected at 720k new jobs. US ISM manufacturing PMI for August was 59.9, 0.4 points up MoM and 0.5 points above expectations. Eurozone manufacturing PMI for August came in at 61.4, lower than last month’s 62.8 and expectations of 61.5. German manufacturing PMI recorded 62.6 in August, vs. 65.9 in July and inline with expectation of 62.7. UK’s manufacturing PMI came in at 60.3, 0.2 points higher than expectations but lower than 0.1 MoM. Spanish PMI at 59.5 beat last months 59 and the expectations of 58.9.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

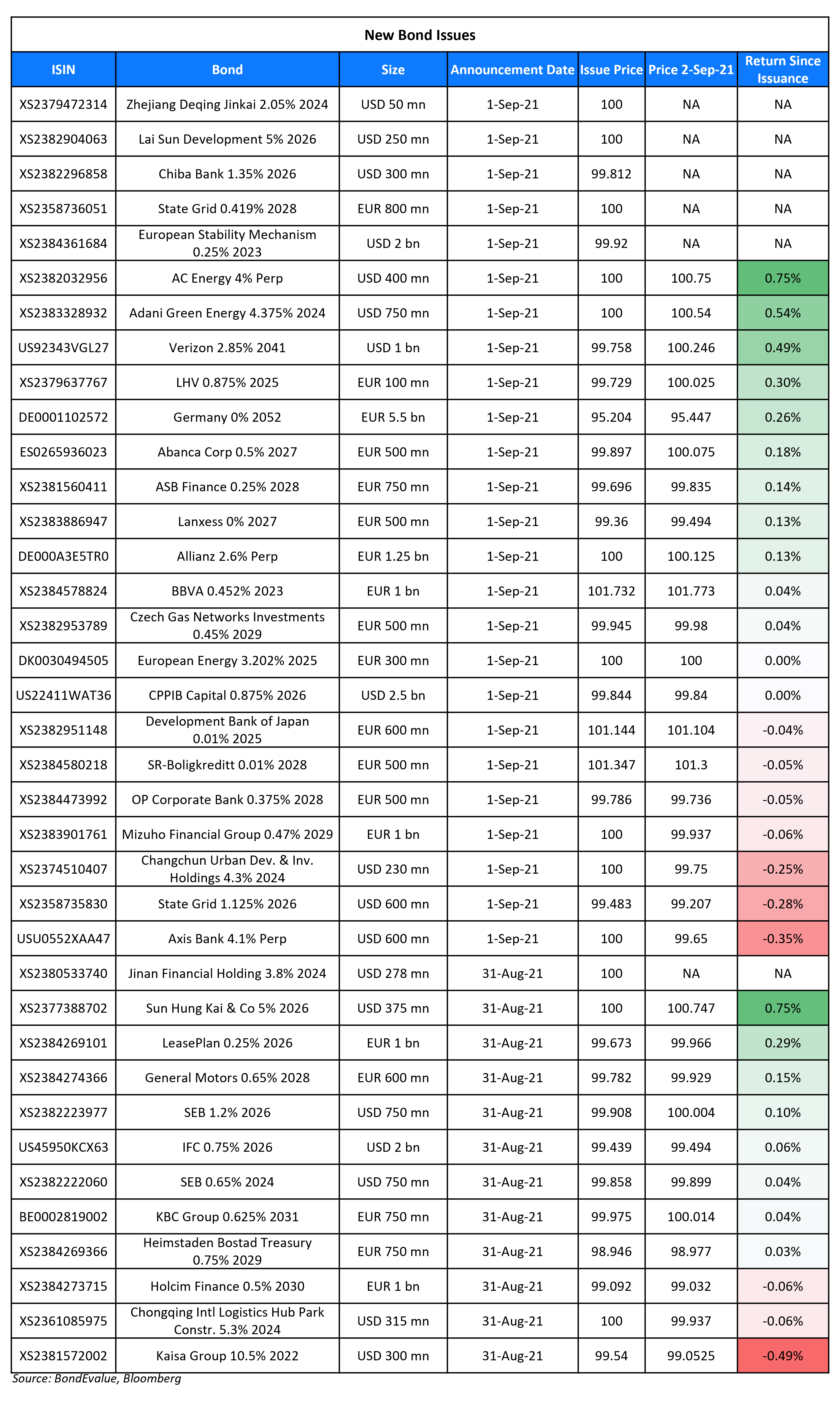

New Bond Issues

- Maldives $ tap of 9.875% 2026 sukuk, FPG at 10.5%

- China Development Bank HK branch $ 3Y green bonds at T+60bp area

- Aozora Bank $ 3Y bond at T+105bp area

- Japan Tobacco $ 10Y/30Y Formosa at T+130bp/3.7% area

- Contemporary Amperex Technology (CATL) $ 5Y bond at T+125bp area

Axis Bank raised $600mn via a perpNC5 AT1 sustainable bond at a yield of 4.1%, 30bp inside initial guidance of 4.4% area. The bonds have expected ratings of B1 and received orders over $1.8bn, 3x issue size. Proceeds will be allocated to eligible green and social projects under the issuer’s sustainable financing framework, which has been reviewed by Sustainalytics. The notes will be written down if the Reserve Bank of India deems the bank would fail without a write down or an injection of public funds, or if the bank’s CET1 ratio drops to 5.5%. The CET1 trigger ratio applies until the end of September, before rising to 6.125% from October 1, when the RBI will implement an additional capital conservation buffer. If not called on September 8, 2026, the coupon will reset on March 8, 2027 and every 5Y thereafter to the Treasury yield plus a margin of 331.5bp. The bonds are set to be the first ever sustainable issuance from an Indian bank and are priced 43bp wider than HDFC Bank’s 3.7% AT1s, priced on August 19, that currently yield 3.67%. “We see the fair value for Axis Bank at around 4%, representing 35–40bp premium over HDFC Bank AT1 bonds in the secondaries,” said Yustina Quek, analyst at CreditSights. Asian investors were allocated 58%, European investors 20% US 16% and Middle East 6%. Fund managers received 72%, sovereign wealth funds, provident funds and insurers 11%, private banks 9%, banks 7% and others 1%.

Adani Green Energy raised $750mn via a 3Y bond at a yield of 4.375%, 32.5bp inside initial guidance of 4.7% area. The bonds have expected ratings of Ba3 and received orders over $3.7bn, 4.9x issue size. Proceeds will be used for onward lending to the issuer’s subsidiaries and for capital expenditure to fund renewable projects under the eligible green project criteria covered in its green financing framework. ASIA, EMEA and US took 48%, 28% and 24% respectively. Fund/Asset Managers were allocated 93%, Private Banks 5%, and Banks, Financial Institutions 2%. The new bonds, issued at the holdco level, are priced 114.5bp wider to its older 6.25% 2024s, issued at the opco level and rated BB- that currently yield 3.23%.

China’s State Grid Overseas Investment (BVI) Limited raised $600mn via a 5Y bond at a yield of 1.232%, 45bp inside the initial guidance of T+90bp area. The bonds have expected ratings of A1/A+ and received orders over $6.3bn, 10.5x issue size. The new bonds priced ~13bp tighter vs. its older 2.875% bonds due 2026 that currently yield 1.36%. The issuer also raised €800m via 7Y bonds at a yield of 0.419%, 62.5bp over Mid Swaps and 27.5bp inside initial guidance of MS+90bp area.

Lai Sun Development raised $250mn via a tap of its existing $250mn 5% 2026s at a yield of 4.999%. The unrated bonds received orders over $1.1bn, 4.4x issue size. The new notes will be fungible with the outstanding bonds after a 40-day compliance period. With the new issuance, the total outstanding amount of the 5% 2026s is $500mn. Proceeds will be used for general corporate purposes. The bonds will be issued by wholly owned subsidiary Lai Sun MTN and guaranteed by the parent. Asia Pacific investors took 99% with the rest going to EMEA. Fund/ asset/ pension managers received 54%, private banks 45% and others 1%. The existing 5% 2026s currently yield 4.88%.

AC Energy raised $400mn via a fixed-for-life green perp non-call 3.5Y at a yield of 4%, 45bp inside initial guidance of 4.45% area. The unrated bonds received orders of $1.88bn, 4.7x issue size. Proceeds will be used to finance or refinance eligible green projects under the guarantor’s green bond framework. The notes will be issued by wholly owned subsidiary ACEN Finance and guaranteed by the parent. There is a change of control put option at 101. Asset/fund managers took 59%, banks 28% and private banks 13%. Asia ex-Philippines took 70%, the Philippines 25% and Europe 5%. The new bonds are priced 72bp wider to its existing 5.1% perps that yield 3.73%.

Japanese lender Chiba Bank Ltd raised $300mn via a 5Y bond at a yield of T+62.5bp, 37.5bp inside the initial guidance of T+100bp area. The bonds have expected ratings of A1 and received orders over $3.5bn, 11.7x issue size. Proceeds will be used for general corporate purposes.

Changchun Urban Development & Investment Holdings raised $230mn via a 3Y bond at a yield of 4.3%, 30bp inside the initial guidance of 4.6% area. The bonds have expected ratings of Baa1/BBB+ and received orders over $770mn, 3.3x issue size. Proceeds will be used for debt refinancing. The bonds will be issued by subsidiary Chang Development International and guaranteed by the parent. Banks and financial institutions got 90% with the rest allocated to fund managers, sovereign wealth funds and private banks. Changchun Urban Development & Investment Holdings is an investment and financing vehicle in Changchun city, Jilin province, and is wholly owned by the Changchun SASAC. Its businesses include urban drainage pipelines, engineering construction, water treatment and financial services.

Zhejiang Deqing Jinkai raised $50mn via a 3Y SBLC-backed bond at a yield of 2.05%, 15bp inside the initial guidance of 2.2% area. The bonds are backed by a standby letter of credit from Bank of Hangzhou, Huzhou branch. Proceeds will be used for project construction, general corporate purposes and working capital. The issuer is wholly owned and controlled by the Deqing SASAC and it’s businesses include urban infrastructure construction, land development, water supply and sewage treatment in Deqing city, Zhejiang province.

Development Bank of Japan Inc raised €600mn via a 4Y sustainable bond at a yield of MS+11bp, 3bp inside the initial guidance of MS+14bp area. The bonds have expected ratings of A1/A and received orders over €2.2bn, 3.7x issue size.

ASB Finance Ltd raised €750mn via a 7Y bond at a yield of MS+50bp, 20bp inside the initial guidance of MS+70bp area. The bonds have expected ratings of A1/AA- and received orders over €1.1bn, 1.5x issue size.

Mizuho Financial Group Inc raised €1bn via a 8NC7 bond at a yield of MS+68bp, 2bp inside the initial guidance of MS+70bp area. The bonds have expected ratings of A1/A- and received orders over €1.4bn, 1.4x issue size.

New Bonds Pipeline

- ICBC $6bn AT1 perp

Rating Changes

- Southwestern Energy Co. Upgraded To ‘BB’ From ‘BB-‘ By S&P On Close Of Acquisition; Outlook Positive

- Moody’s downgrades Peru’s rating to Baa1; changes outlook to stable

- SK HoldCo LLC Downgraded To ‘CCC’ By S&P On Rising Liquidity Risk And Elevated Likelihood Of A Restructuring, Outlook Negative

- Moody’s downgrades Talen Energy Supply to B3; outlook negative

- Moody’s affirms Tenet Healthcare Corporation’s CFR at B2; changes outlook to positive

- Distressed Debt Purchaser Intrum Outlook Revised To Stable By S&P On Deleveraging And Manageable Pandemic Impact; Affirmed At ‘BB/B’

- Power Construction Corp. Of China Outlook Revised To Stable By S&P On Improving Financial Prospects; ‘BBB+’ Rating Affirmed

- Fitch Revises Outlook on Haidilao to Negative; Affirms at ‘BBB’

Term of the Day:

Restricted Tier 1 Bonds

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual with a minimum 10-year non-call, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events: 1. Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months 2. Drop of solvency ratio below 75% of the SCR 3. Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene Allianz EU raised EUR 1.25bn of Perp NC10.6 RT1s on Wednesday.

Talking Heads

“We have to watch the risks to the outlook for prices. In my view, upside risks predominate.” “Accommodative monetary remains appropriate. But we shouldn’t disregard the risk to too-fast inflation.”

“Cash has been trash for a long time, but there are now new contenders,” said Gross. “Intermediate to long-term bond funds are in that trash receptacle for sure, but will stocks follow? Earnings growth had better be double-digit-plus or else they could join the garbage truck.”

“How willing, therefore, will private markets be to absorb this future 60% in mid-2022 and beyond?” Gross wrote. “Perhaps if inflation comes back to the 2%+ target by then, a ‘tantrum’ can be avoided, but how many more fiscal spending programs can we afford without paying for it with higher interest rates?”

Eugene Leow, a fixed-income strategist at DBS Group Holdings Ltd

“Investors are getting pushed into higher-yielding EM government bonds.” “Developed-market yields stayed persistently low even as Powell guided that the taper is set to start later this year.”

Gabriel Chan, head of investment services for Hong Kong at BNP Paribas Wealth Management

“It is particularly true for countries with higher rates like South Africa, Turkey and Indonesia,” he said.

Sabrina Corujo at consultancy Portfolio Personal Inversiones.

“The post-restructuring payment outlook looks clear in years ahead, the economy is recovering, the central bank seems to have stabilized the exchange rate and slowly recover reserves.” “We are clearly not in the best of scenarios – or close to it – but we’re not under the shadow of default.”

Gustavo Ber from Estudio Ber

“The result will be crucial to forcing consensus that will allow post-election strategies to address fiscal and monetary issues, as well as stabilizing divergent currency exchange rates.” “It’s also key to an agreement with the IMF to refinance payments.”

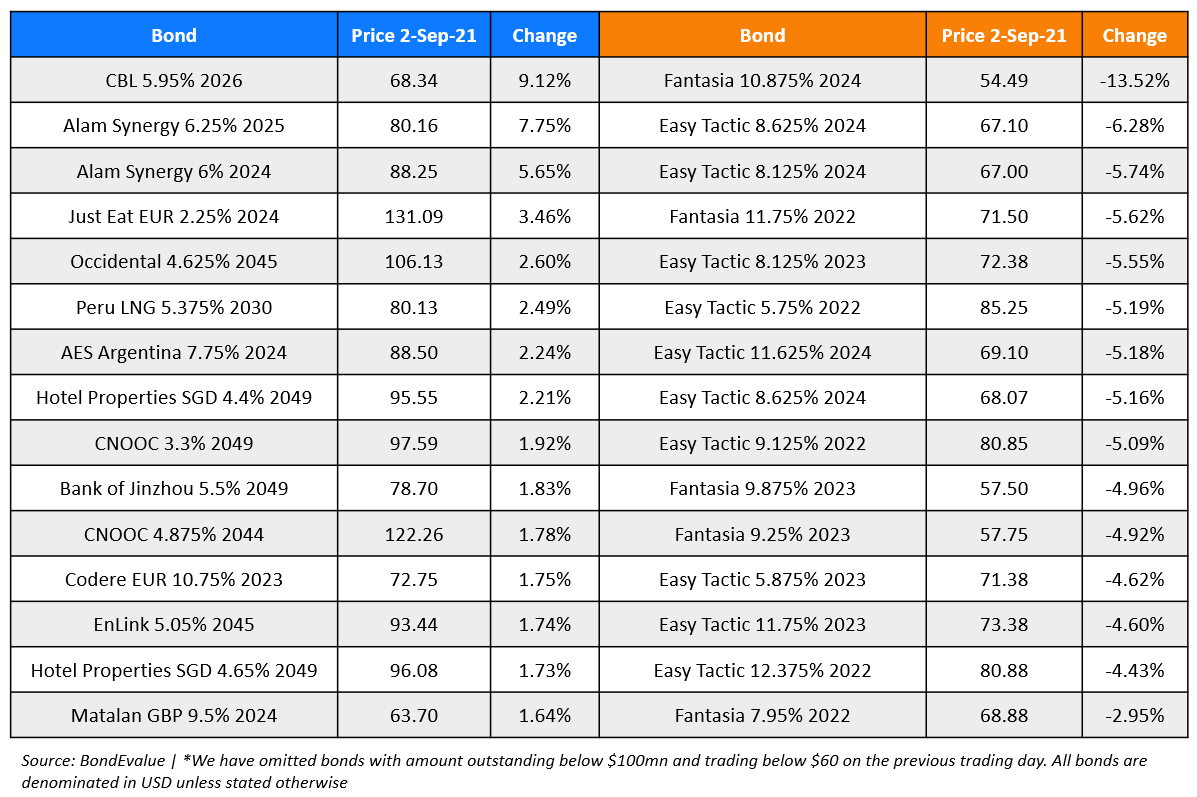

Top Gainers & Losers – 02-Sep-21*

Go back to Latest bond Market News

Related Posts:%20(1).jpg)