This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta, Sunac, Fantasia Launch $ Bonds; Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

February 25, 2021

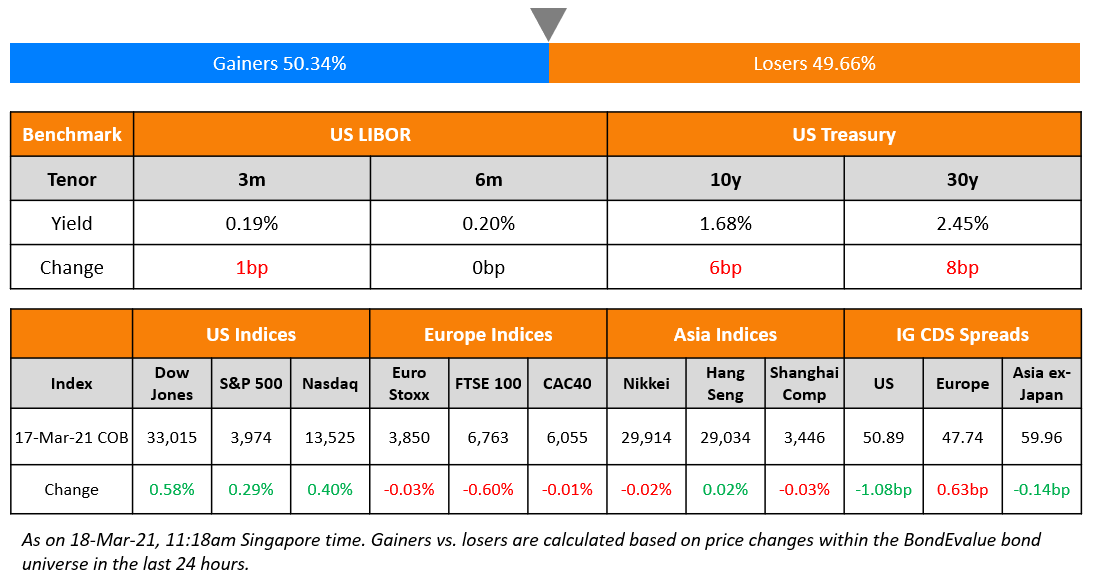

S&P ended 1.1% higher while Nasdaq was 1% higher. Tesla rallied 6% with a mixed session for big tech – Facebook, Amazon and Apple were lower by 0.6%, 1% and 0.4% while Google and Netflix were up 1.2% and 1.3%. Fed Chair Powell reiterated the primary goal of full employment and said it may take over three years for inflation to exceed the 2% target. US 10Y Treasury yields eased some of its 9bp sell-off to 1.43% to close at 1.40%. European equities were also higher by over 0.5%. German GDP growth in Q4 2020 was revised upward to 0.3% from 0.1%. US IG CDS spreads were 1.1bp tighter and HY was 6.7bp tighter. EU main CDS spreads tightened 0.9bp and crossover spreads tightened 3.2bp. Asian equity markets have opened ~1% higher today while Asia ex-Japan CDS spreads are 0.5bp tighter. Momentum in the Asian primary markets continue with six new dollar deals launched today dominated by Chinese issuers.

Bond Traders’ Masterclass | Last Few Days to Get a 25% + 10% Discount on The Bundle

Register before the end of the month for the Bond Traders’ Masterclasses scheduled for late-March and early-April to get a 25% + 10% discount on the bundle package of five modules. Click on the image below to register.

The modules are specially curated for private bond investors and wealth managers to develop a strong fundamental and practical understanding of bonds. Given the ultra-low interest rate environment, flurry of new bond deals particularly from junk-rated issuers and tightening credit spreads, it is now more important than ever for investors to understand bond valuation, portfolio construction and new bond issues to help them get better return for risk.

The sessions will be conducted by debt capital market bankers who have previously worked at premier global banks such as Credit Suisse, Citi and Standard Chartered.

New Bond Issues

- Vedanta Resources $ 4NC3 at 9.375% area

- Sunac China tap of $ 5.95% 2024s/6.50% 2025s at 6.35%/6.75% areas

- Fantasia Holdings $ 3NC2 at 11.6% area

- Qingdao China Prosperity State-owned Capital $ 3Y at 3.35% area; books over $1.8bn

- CDB Financial Leasing $ 3Y/5Y at T+155bp/T+165bp area

- Jiazuo Investment Group 363-day at 5.8% area

Guangzhou R&F Properties raised $325mn via a 3.5Y non-call 2.5Y bond (3.5NC2.5) at a yield of 11.625%, 37.5bp inside initial guidance of 12% area. The bonds have expected ratings of B+ and received orders of over $1.6bn, 4.9x issue size. Proceeds will be used for debt refinancing. Easy Tactic is the issuer and R&F Properties (HK) is the guarantor, while Guangzhou R&F is the keepwell and equity interest purchase undertaking provider. The bonds were priced at a new issue premium of 72.5bp over their older 8.125%% bonds due July 2024, which are currently yielding 10.9% on the secondary markets.

Commercial Bank of Qatar (CBQ) raised $500mn via a Perpetual non-call 5Y (PerpNC5) AT1 bond at a yield of 4.5%, 20bp inside initial guidance of 4.7% area. The bonds were unrated and received orders of over $900mn, 1.8x issue size. As per IFR, Commercial Bank is Qatar’s second largest conventional bank and third largest bank overall by assets, net loans and deposits with an issuer rating of A3/BBB+/A. CBQ’s AT1 offers a coupon 50bp higher than peer Ahli Bank QSC’s (A2/A) recent 4% Perp issued last week and 12bp lower than DIB’s (A3/A) 4.625% Perp Sukuk issued in Nov 2020.

Far East Horizon raised $500mn via a 3Y bond at a yield of 2.637%, or T+240bp, 45bp inside initial guidance of T+285bp area. The bonds have expected ratings of BBB-, and received orders over $3.3bn, 6.6x issue size. Asia Pacific bought 93% of the notes and EMEA 7%. Asset managers, fund managers and hedge funds received 70%, banks and financial institutions 20%, sovereign wealth funds and insurers 8%, and private banks and corporates 2%. Proceeds will be used for working capital and general corporate purposes.

Bank of Nova Scotia raised $1.25bn via a two part offering. It raised $950mn via a 5Y bond at a yield of 1.074%, or T+50bp, 15bp inside initial guidance of T+60bp area. It also raised $950mn via a 5Y Floating Rate Note (FRN) at 0.555% or SOFR+54.5bp against initial guidance of SOFR equivalent. The SEC registered bonds have expected ratings of A2/A-/AA-.

Guotai Junan International raised $400mn via a 5Y bond at a yield of 2.004%, or T+142.5bp, a strong 47.5bp inside initial guidance of T+190bp area. The bonds have expected ratings of BBB+ and received orders over $2.7bn, 6.75x issue size, revised from $3.8bn after the tightening. Asian investors took 97% of the notes and EMEA 3%. Banks received 49%, fund managers, asset managers and hedge funds 41%, and the public sector and insurers 10%. Proceeds will be used for refinancing and general corporate purposes.

Castle Peak Power raised $300mn via a 10Y energy transition bond at a yield of 2.268%, or T+87.5bp, 47.5bp inside initial guidance of T+125bp area. The bonds, expected ratings of A1/AA- received orders of $1.4bn, over 4x issue size. Proceeds will be used to finance or refinance construction of a second additional gas-fired power generation unit using a combined cycle gas turbine within the guarantor’s Black Point Power Station in Hong Kong. Castle Peak Power is 70%-owned by CLP Power Hong Kong and 30% by China Southern Power Grid International (HK).

Bank of New Zealand raised $750mn via a 5Y bond at a yield of 1.124%, or T+52bp, 18bp inside initial guidance of T+70bp area. BNZ is a fully owned subsidiary of National Australia Bank. The bonds are expected to be rated A1/AA-.

New Bond Pipeline

- HCL Tech $ bond

- Microsoft $ bond alongside exchange offer

- JSW Steel $ bond

Rating Changes

- Ezdan Holding Downgraded To ‘CCC’ From ‘B-‘ By S&P On Higher Risk Of Default; Issue Rating Lowered To ‘CCC-‘; Outlook Negative

- Moody’s downgrades TechnipFMC and assigns Ba1 CFR

- Exelon Generation Co. LLC Downgraded To ‘BBB-‘ From ‘BBB’ By S&P On Spin-Off From Parent Exelon Corp., Outlook Stable

- Fitch Places Exelon Corp. and Exelon Generation on Negative Watch; Affirms Utilities’ Ratings

- Ireland-Based Packaging Producer Smurfit Kappa Group Upgraded To ‘BBB-‘ By S&P On Tighter Financial Policy; Outlook Stable

- Moody’s changes Taiwan’s outlook to positive from stable, affirms Aa3 rating

Term of the Day

Spin-Off

Spin-offs are a corporate re-organization strategy used by a company to create a new subsidiary from its parent company. The parent separates (spins-out) part of its business into a second publicly-traded entity and distributes shares of the new entity to its current shareholders. Spin-offs come in different types like pure play spin-offs, equity carve outs etc. Reliance Industries is spinning off its new oil-to-chemicals operation into an independent unit.

Talking Heads

Clarida said that he’s “bullish” on the outlook for the U.S. economy and sees inflation at the Fed’s 2% goal by year’s end, after what he expects to be a temporary rise above that level before then due to “base effects.” He added that the Fed’s current monetary policy settings are appropriate now and “for the rest of the year”.

“The market is nervous about additional stimulus, worried about the risks of higher inflation, and concerned about QE tapering,” said Goldberg. “The selloff is likely being exacerbated by convexity hedging and positioning stop-outs.”

On one of the biggest Treasury ETFs bleeding after breakneck selloff in the bond market

Subadra Rajappa, head of U.S. rates strategy at Societe Generale SA

“It certainly feels like a tantrum is underway. Despite the Fed’s repeated reassurances that they see no clear risks to higher inflation investors are not convinced,” said . “Any hints of change in Fed asset purchases could put the brakes on the back-end selloff. Barring that, there could be more room for yields to rise.”

Peter Boockvar, Bleakley Advisory Group

“Bonds are getting oversold, though in the short term and I wouldn’t be surprised if the rise tooka breather,” Boockvar wrote.

Priya Misra, head of global rates strategy for TD Securities

“We need the Fed to sound concerned about the rise in real rates and suggest that they are not about to taper anytime soon. That can scare away some shorts in the Treasury market,” Misra said. “He said that the rise in rates reflects confidence in the economy. I think the rise in rates also reflects nervousness about Fed support.”

“Technically, the 10-year U.S. yield is looking attractive and we are shifting part of our investment in Australia into Treasuries,” Takei said. “Japanese investors may think back later and say it was good they bought Treasuries now.” “U.S. yields have been lower compared to many other developed nations and have underperformed those in Australia, but they are catching up now,” Takei said.

On corporate bonds with the highest credit grades most exposed to yield surge – in a note by Bank of America Corp. strategists led by Hans Mikkelsen

Spread widening shows “credit investors uncomfortable with interest rate uncertainty,” they wrote. “The right time for much more rates risk — including for a rates shock — is over the summer with the U.S. back to normal and potentially clear signs of improvement in Europe,” the strategists wrote.

Top Gainers & Losers – 25-Feb-21*

Go back to Latest bond Market News

Related Posts: