This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Tata Motors Downgraded; BoE Ramps Up Purchases by £100bn; ECB Offers Loans to Banks at -1%

June 19, 2020

Market sentiment is mixed at the end of the week after the US jobless claims report stayed above one million and reduced the hope for a V-shaped recovery. Investors see economic damage as an unavoidable consequence of rising coronavirus cases despite the Trump administration indicating that they will not reimpose lockdown restrictions. US markets ended a tad lower but European markets were lower by 0.5%-0.75%. Pace of borrowing has relaxed a bit but issuers continue to issue new deals sustaining primary bond market momentum. Treasury yields were lower on safe haven bid while IG CDS spreads widened across the board. Asian markets are having a mixed opening this morning.

Learn more about the masterclass

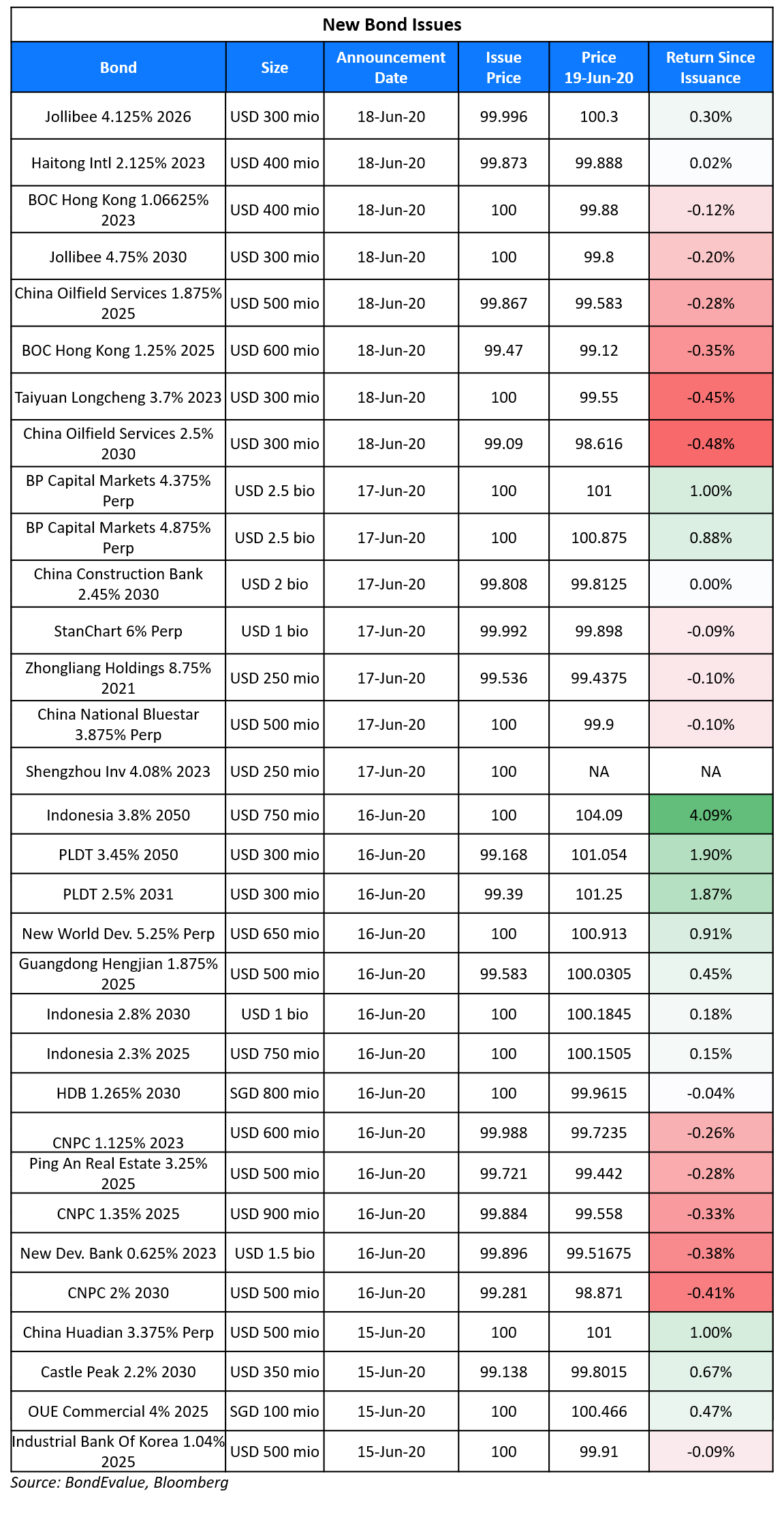

New Bond Issues

- Jiayuan International $ 364-day, final @ 12%

Bank of China Hong Kong branch raised $1bn via a two-tranche deal. It raised $400mn via a 3Y floater at a yield of 1.06625%, 75bp over 3-month Libor and 35bp inside initial guidance of 3mL+110bp area. It also raised $600mn via 5Y bonds at a yield of 1.36%, 103bp over Treasuries and 37bp inside initial guidance of T+140bp area. The bonds are expected to be rated A/A1.

Haitong International Securities Group raised $400mn via 3Y bonds at a yield of 2.169%, 195bp over Treasuries and 40bp inside initial guidance of T+235bp area. The bonds, expected to be rated BBB/Baa2, received orders worth $1.3bn, 3.25x issue size.

China Oilfield Services raised $500mn via 5Y bonds at a yield of 1.903%, 158bp over Treasuries and 67bp inside initial guidance of T+225bp area and $300mn via 10Y bonds at a yield of 2.6039%, 190bp over Treasuries and 60bp inside initial guidance of T+250bp area.

Jollibbee raised $600mn via a two-tranche deal on Thursday. It raised $300mn via long 5Y bonds at a yield of 4.125%, 25bp inside initial guidance of 4.375% area and a $300mn 10Y bond at a yield of 4.75%, also 25bp inside initial guidance of 5% area. The unrated bonds received orders worth $1.6bn, 2.67x issue size.

Rating Changes

Moody’s downgrades Tata Motors to B1; changes outlook to negative

Moody’s downgrades Kraft Heinz Finance UK’s GBP notes to Baa3 on collateral release

Moody’s downgrades Adler Pelzer to B3, from B2; outlook negative

Moody’s changes Digicel’s outlook to stable; assigns Caa2 CFR to DGL0.5 following debt exchanges

Fitch Downgrades Intralot to ‘CC’; Senior Unsecured to ‘C’

Bank of England Increases Asset Purchases by £100 Billion

In its recently concluded policy meeting, the Bank of England announced the following:

- Maintain the Bank Rate at 0.1%

- Continue its existing programme of £200bn of UK government bond and sterling non-financial investment-grade corporate bond purchases

- Increase the size of UK government bond purchases by £100bn

- Total size of asset purchases stands at £745bn

The additional £100bn of asset purchases will be funded issuance of central bank reserves and aimed at boosting economic activity and inflation from 0.5% currently towards its target of 2%.

Andrew Bailey, the Bank’s governor, said: “As partial lifting of the measures takes place, we see signs of some activity returning. We don’t want to get too carried away by this. Let’s be clear, we’re still living in very unusual times.”

For the full story, click here

ECB Offers Loans to Banks at Negative 1% as Part of New Financing Scheme

For the first time ever, the European Central Bank (ECB) is offering loans to banks at a rate that is below its main deposit rate. The ECB announced on Thursday that 742 banks have applied to borrow €1.3tn under its main refinancing scheme at interest rates as low as -1%, subject to certain conditions. Since the ECB’s deposit rate stands at -0.5%, the new refinancing scheme is essentially a subsidy for the banks. This comes just days after the ECB announced easing on reporting of mark-to-market losses related to government bond holdings for the banks. According to the FT, banks are likely to use €760bn of the new refinancing scheme to repay existing ECB debt and the balance €549bn to buy its government’s bonds, thereby earning an instant profit on the carry trade. The increase in the ECB’s lending program will increase the size of its balance sheet to over €6tn, over half of the EU bloc’s GDP. The condition imposed on banks to avail of the -1% rate is that they need to maintain their lending to businesses and households (ex residential mortgages) at the same levels as last year. If the lending falls below last year’s level, the rate will push up to -0.5%.

For the full story, click here

Moody’s Downgrades Tata Motors into Deeper Junk with Rating B1, Negative Outlook

Moody’s downgrades Tata Motors Limited (TML) to B1 from Ba3 pushing the company’s rating deeper into junk territory. The outlook for the company was under review and has now been revised to negative. Tata Group holds ~46.4% in TML, which includes commercial vehicles (CV) and private vehicles (PV) in India and also its wholly owned UK based premium car manufacturers JLR. The company had been witnessing reduced sales due to falling demand even before the ongoing pandemic. The effects of the pandemic have only accentuated the problem. Moody’s forecasts the adjusted EBITDA margin to remain negative and Adjusted Debt / EBITDA at 10.0x for the ongoing year.

TML’s has cash of $700mn as of March 31 and an $200mn undrawn revolver maturing in 2022. The company is likely to have an equity injection of $300mn by Tata Sons and an INR bond issuance of ~$130mn in the current quarter and a long term loan of $400mn. This is only marginally short of the obligations worth $2.1bn over the next 18 months. TML’s cash flow from operations will also help in reducing the deficit. The association with Tata Group also allows the auto major to have a strong access to the capital markets. The company’s bonds have been stable since the announcement.

For the full story, click here

Fitch Cuts India’s Outlook to Negative; Maintains Investment Grade Rating

Fitch Ratings joined Moody’s and has revised India’s outlook to Negative. The LT Foreign Currency IDR outlook was changed to Negative while affirming the rating at BBB. As per the rating agency, the sovereign’s growth outlook has weakened due to the pandemic and economic activity could contract by 5% in the fiscal ending March 2021. Although the rating agency predicts a rebound to 9.5% in FY2022, the risks due to the increase in the number of fresh coronavirus cases remains a concern. The government spared only 1% of GDP towards relief spending as most of the bailout package of 10% of GDP was non-fiscal in nature. India’s government debt is expected to rise to 84.5% of GDP in FY21 from an estimated 71% in FY20. This is much higher than the median of other median BBB category sovereigns which stood at 42.2% for 2019 and 52.6% for 2020. The factors which affect the medium-term GDP growth outlook include the following.

- Asset-quality challenges in banks and liquidity issues in non-banking financial companies (NBFC)

- Limited inflows from foreign investors

- Structural reforms announced by the government

- Geopolitical risks due to longstanding border issues with China and Pakistan

.png?upscale=true&width=800&upscale=true&name=image%20(6).png)

For the full story, click here

In a related story, Economic Times reported that the foreign-currency bonds of Reliance Industries Limited (RIL) outperformed those of sovereign backed bonds in the first half of the on current year on the back of its fundraising spree in a bid to cut debt. RIL is India’s most valuable company and has become net debt free after raising $23 billion from sales stakes in Jio and a rights issue, reported by the ET.

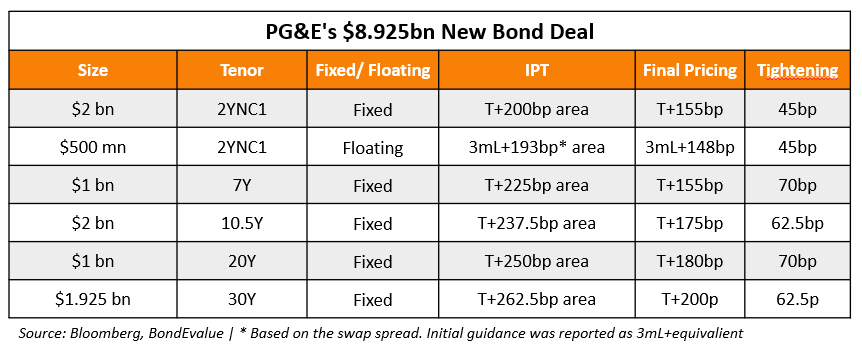

PG&E Raises a Massive $8.925 Billion in Bonds While in Bankruptcy

Pacific Gas and Electric Co. raised a massive $8.925bn via a new six-tranche bond deal on Thursday. The new bonds are part of a $59bn restructuring plan for the California utility company, which is set to leave Chapter 11 (Term of the day, explained below) with more debt than it entered with. PG&E’s new bond details are listed in the table below:

There seems to have been strong demand for the new bonds, expected to be rated Baa3 by Moody’s, based on the 45-70bp tightening of pricing from initial price guidance to final pricing. The increased debt pile of the utility is to help it pay for the billions in fire-related claims. S&P this week said that PG&E is expected to emerge from bankruptcy with about $38bn of debt, most of which will be backed by a first mortgage, but that it also owes $25.5bn in wildfire settlements.

For the full story, click here

EU Clearing The Way for Thyssenkrupp’s Elevator Division Sale

Thyssenkrupp is in talks to launch a multi-billion euro high-yield debt package to help finance their acquisition by a private equity consortium. German conglomerate Thyssenkrupp is selling off its elevator division, which is the fourth biggest worldwide, to pay for restructuring their empire of companies and cut their debt. The deal was put off because of the pandemic. But on Thursday, the European Commission cleared the sale, paving the way for the deal’s closing. Advent, Cinven and Germany’s RAG foundation had signed a €17.2bn ($19.3bn) deal to buy Thyssenkrupp’s elevators division in late February. This process is being led by Credit Suisse, Goldman Sachs and UBS.

For the full story, click here

BEV Term of the Day

Chapter 11

There are different types of bankruptcies in the US. Chapter 11 is know as the “reorganization” bankruptcy and is available to individuals, sole proprietorship, partnerships and corporations. Corporations file for chapter 11 so that they can continue to operate while being protected from creditors claims to collection activities and property repossession.

Petitions to file for chapter 11 can be voluntary or involuntary. In the case of a voluntary filing, the debtor must provide a schedule that provides details of its financial position. Upon filing a voluntary petition for relief under chapter 11 or, in an involuntary case, the entry of an order for relief, the debtor automatically assumes an additional identity as the “debtor in possession.” Once the petition is filed, there is an automatic stay order that suspends all judgments, foreclosures, collection activities, and property repossessions by creditors that arose before the petition.

The bankruptcy court requires debtors to propose a restructuring plan with 120 days from the date of filing, which then grants the debtor another 180 days to allow the debtor to obtain confirmation of the restructuring plan. The plan is deemed to have been accepted by courts if it is accepted by creditors with at least two-thirds in amount and at least half of the number of allowed claims.

For more on Chapter 11 by CFI, click here

For more on Chapter 11 by US Courts, click here

Talking Heads

On China gradually withdrawing financial support – Yi Gang, People’s Bank of China Governor & Guo Shuqing, chairman of the banking and insurance regulator

“The financial support during the epidemic response period is (being) phased, we should pay attention to the hangover of the policy,” People’s Bank of China Governor Yi Gang told a financial forum in Shanghai. “We should consider the timely withdrawal of policy tools in advance.”

Yi said new loans are likely to hit a record of nearly 20 trillion yuan ($2.83 trillion) this year, up from 16.81 trillion yuan in 2019, and total social financing could increase by more than 30 trillion yuan. The economy is gradually emerging from a 6.8% economic decline in the first quarter, its first contraction on record.

“There’s no free lunch in the world. How can we allow this many world central banks turn on the money-printing machine and print unlimited money?” Guo Shuqing, chairman of the banking and insurance regulator argued. “There are a price to pay for blank cheques.”

On Argentina’s debt restructuring talks – a person close to the negotiations on the Argentine side

“The government is considering its options,” a person close to the Argentine side said. “We are getting close to legal action, which will bring a lot more intensity on the government.” Another person on the bondholders side mentioned that, “The current [legal] documentation provides too much latitude for behaviour by Argentina that is inconsistent with good practices in sovereign debt restructurings and will undermine creditor rights in the future.”

Top Gainers & Losers – 19-Jun-20*

Go back to Latest bond Market News

Related Posts: