This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

July 20, 2023

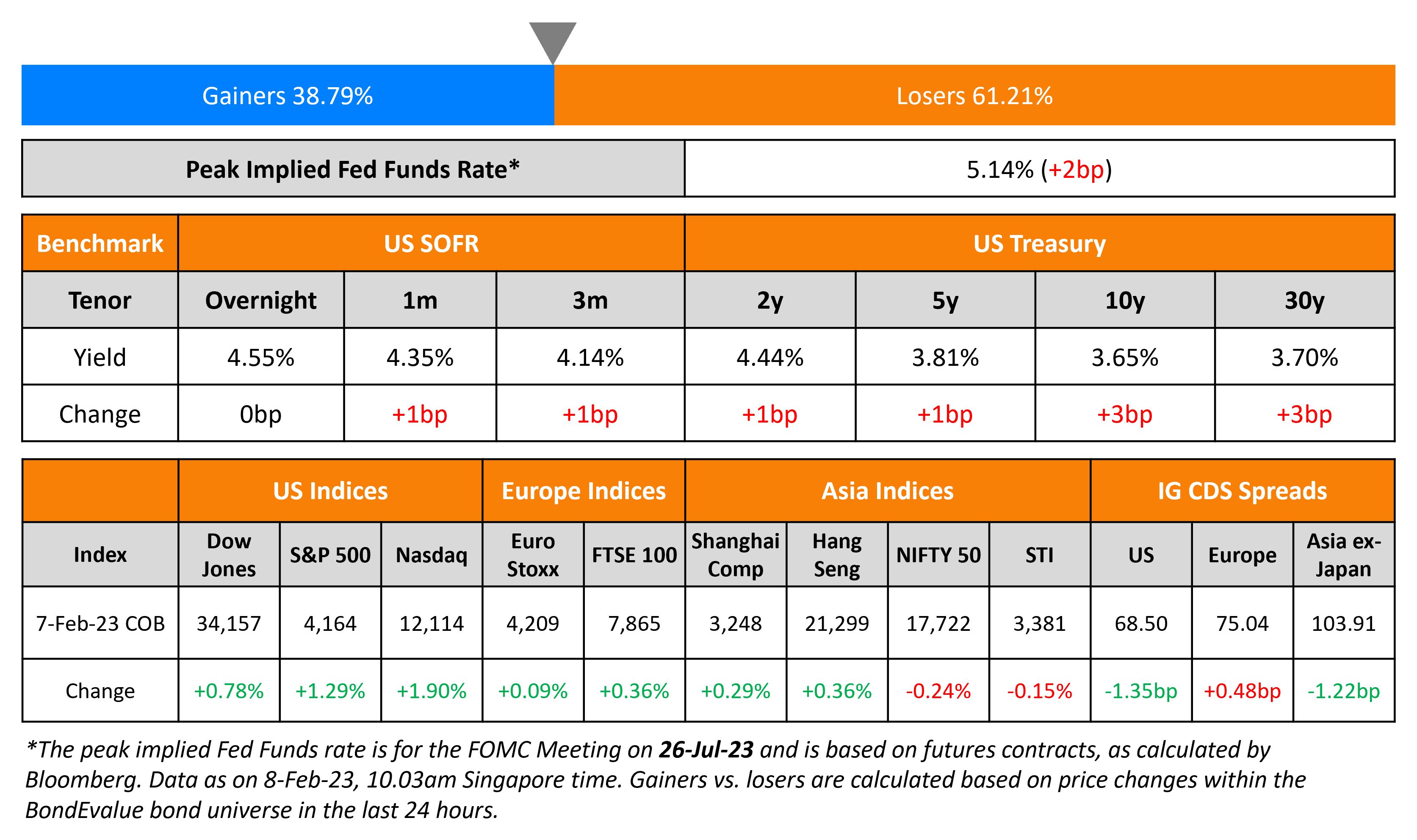

Treasury yields were trading steady on Wednesday. The peak Fed Funds rate was unchanged at 5.40%. The beginning of the US earnings season saw big banks continue to report earnings with Goldman Sachs disappointing expectations as profits fell by ~60%. On the other hand, BofA beat street expectations with net income up 19%. US equity indices ticked slightly higher. Credit spreads widened slightly with US IG and HY CDS spreads wider by 0.5bp and 0.2bp respectively.

European equity indices were flat too with European main CDS spreads 0.2bp tighter and Crossover CDS were tighter by 0.5bp. Asia ex-Japan CDS spreads widened 0.3bp and Asian equity markets have opened mixed today. Turkey’s Erdogan signed $50bn in deals during his UAE visit, including signing an MoU with ADQ (Abu Dhabi sovereign wealth fund) to finance up to $8.5bn of Turkey earthquake relief bonds.

.png)

New Bond Issues

- Hanhwa Q Cells $ 5Y Green at T+140bp area

Morgan Stanley raised $6.75bn via a four-part deal as detailed in the table above.

If the 6NC5s and 11NC10s are uncalled, the coupons will reset at the overnight SOFR plus 163bps and 188bps respectively, and be paid quarterly thereafter. While all the bonds are senior bank notes, the 2Y fixed rate and floating notes are both issued at the Opco level, by its North American branch while the other longer tenor notes are issued by the Holdco, explaining the difference in issue rating between the notes. All the tranches except for the 2Y floater have make-whole calls, while all the tranches have 1-month par calls except the 11NC10s which has a 3-month par call. Proceeds will be used for general corporate purposes.

Mirae Asset raised $400mn via a 3Y bond at a yield of 7.055%, 20bp inside initial guidance of T+295bp area. The senior unsecured bonds have expected ratings of Baa2/BBB, and received orders over $1.3bn, 3.3x issue size. Asset and fund managers were allocated the bulk of the deal at 71%, while the remainder were taken up by other financial institutions including private banks, central banks and pension funds. APAC accounted for 75% and EMEA 25%. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- KEPCO hires for $ 3Y and/or 5Y Sustainability bond

Rating Actions

- Fitch Upgrades American Airlines’ IDR to ‘B+’; Outlook Stable

- Fitch Downgrades Digicel International Finance Limited to ‘RD’

- Fitch Downgrades AZUL to ‘RD’; Upgrades to ‘B-‘

- Carvana Co. Downgraded To ‘CC’ From ‘CCC’ On Announced Transaction Support Agreement; Outlook Negative

Term of the Day

Fiber-Backed Bond

Fiber-backed bonds are considered as a type of green bond that are backed by a network company’s fiber assets and associated customer contracts. Frontier Communications said that it is planning to offer a $1.05bn bond deal that will repackage revenue from its secured fiber network, the latest in a string of companies trying to capitalize on fiber.

Talking Heads

On UK Inflation Dropping to the Lowest in 15 Months

Samuel Tombs, chief UK economist at Pantheon Macroeconomics

“We continue to think that the worst is over for UK households and that the MPC will not need to raise Bank Rate all the way to 6.25%, as markets priced-in yesterday.”

Hussain Mehdi, macro investment strategist at HSBC

“(The figures are) tentative evidence that UK inflationary pressures might finally be turning a corner.”

Martin Beck, chief economic adviser to the EY ITEM Club

“Although inflation remains well above the 2% target, the direction of travel is now looking more favorable, following a period when UK inflation appeared to be very sticky in comparison with other economies.”

Valentin Marinov, head of G-10 currency research at Credit Agricole

“You could almost hear the sigh of relief at the BOE…As a minimum, the UK rates investors could reconsider their expectations of a 50bps hike in August and may even reassess the expectation of 6% terminal rate.”

Yael Selfin, chief economist at KPMG UK

“(The BoE is) unlikely to substantially change its hawkish policy stance…Inflation is unlikely to return to target before early 2025…We expect inflation to average 7.5% this year before falling to 3% in 2024.”

On the ECB’s Interest Rate Decision – ECB Governing Council member Yannis Stournaras

“We might have one further move next week of 25 basis points, but I’m not sure that we’re going to go further than that…We’ll stop there. I think that’s my opinion…The argument that inflation is falling and we have found out that we are at the optimal point that further increases of interest rates might damage the economy”

“(A stronger currency and strengthened reserves) are all definitely very encouraging signs, which suggests that the forthcoming review should go through…Sri Lanka is closely following the guardrails that have been laid for the program.”

Shamaila Khan, head of fixed income for EM and APAC at UBS

“(El Salvador President Nayib Bukele) has one of the highest approval rates and he has managed that successfully, and there’s also an understanding that you have to make sure that the country continues to have access to the market…it’s a dollarized economy.”

Nathalie Marshik, managing director for LatAm fixed income at BNP Paribas

“El Salvador is somewhat uniquely positioned as one of the highest yielding ‘performing’ distressed credits…it would take a “significant” fiscal deterioration or a change in the political tone towards the market for bonds to stage another selloff.”

On the Impact of US Dollar Appreciation on EM Economies

“Emerging market and developing economies with pre-existing vulnerabilities such as high inflation and misaligned external positions experienced greater depreciation pressures, while commodity-exporting economies benefited from the increase in commodity prices…Many emerging market economies suffered worsening credit availability, diminished capital inflows, tighter monetary policy, and bigger stock market declines. In advanced economies, more flexible exchange rates were able to absorb some of the impact through depreciation, while more accommodative monetary policy also helped – provided that there were firmly anchored inflation expectations.”

Top Gainers & Losers – 20-July-23*

Go back to Latest bond Market News

Related Posts: