This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 9, 2023

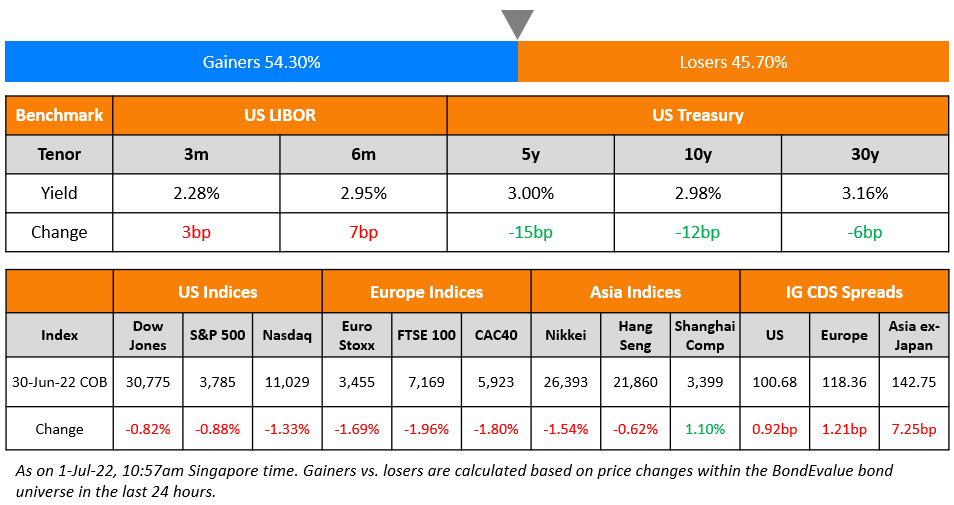

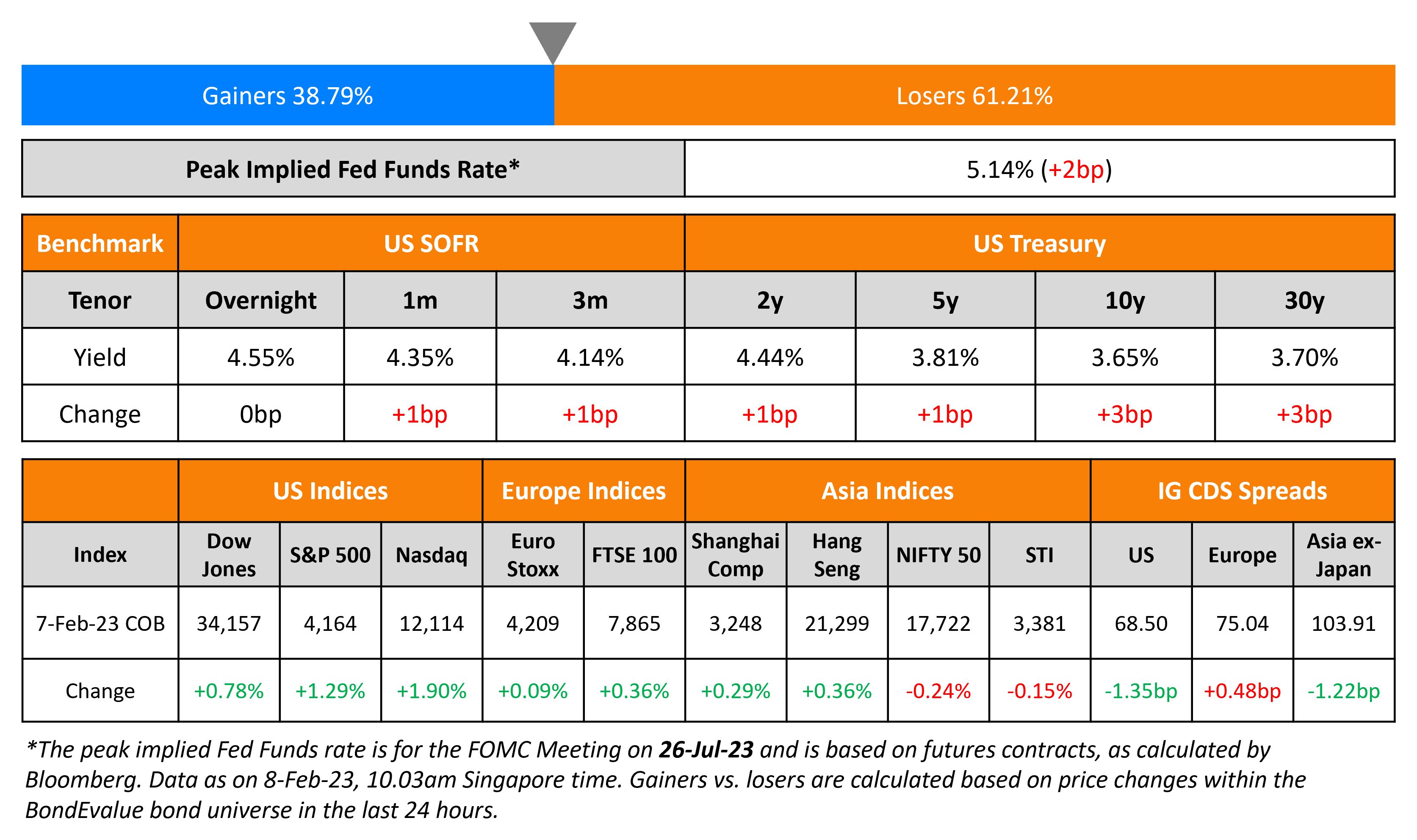

US Treasuries yields were flat broadly across the curve. The peak Fed funds rate rose 2bp to 5.14% for the July 2023 meeting. Currently, the probability of a 25bp hike at the FOMC’s March meeting stands at 91%. Markets await the CPI inflation report next week on February 14 with estimates of a 6.2% print. US IG CDS spreads widened by 1.2bp while HY spreads were 8.8bp wider. Equity indices were higher with the S&P and Nasdaq down 1.1% and 1.7% respectively.

European equity markets ended marginally higher. The European main CDS spread widened 0.7bp while crossover CDS spreads widened 2.3bp. Asian equity markets have opened higher today. Asia ex-Japan CDS spreads were 1.1bp wider.

New Bond Issues

-

Westpac NZ $ 5Y at T+130bp area

Temasek raised €1.5bn via a two-tranche deal. It raised

- €750mn via a 4Y bond at a yield of 3.26%, 30bp inside initial guidance of MS+55bp area. The bonds received orders over €2.4bn, 3.2x issue size. The new bonds are priced 7bp wider to its existing 1.5% 2028s that yield 3.19%.

- €750mn via a 10Y bond at a yield of 3.542%, 35bp inside initial guidance of MS+100bp area. The bonds received orders over €3bn, 4x issue size.

The senior unsecured bonds have expected ratings of Aaa/AAA, are issued by Temasek Financial I Ltd, and guaranteed by Temasek Holdings Pte Ltd. Net proceeds will be provided by the Issuer to the Guarantor and its Investment Holding Companies to fund their ordinary course of business.

American Airlines raised $750mn via a 5NC2 bond at a yield of 7.25%, 25bp inside initial guidance of 7.5% area. The senior secured first lien bonds have expected ratings of Ba3/B-. Proceeds will be used to partially refinance the company’s $1.75mn term loan due June 2025.

ING Bank raised €4bn via a two-tranche deal. It raised

- €2bn via a 3Y covered bond at a yield of 3.129%, 6bp inside initial guidance of MS+4bp area. The bonds received orders over €4.8bn, 2.4x issue size. The new bonds are priced inline with its ultimate parent’s existing 2.75% 2025s that yield 3.13%.

- €2bn via a 10Y covered bond at a yield of 3.098%, 4bp inside initial guidance of MS+23bp area. The bonds received orders over €3.2bn, 1.6x issue size.

The bonds have expected ratings of Aaa/AAA/AAA, are issued by ING Bank NV, and guaranteed by ING Covered Bond Co BV.

Royal Caribbean raised $700mn via a 7NC3 bond at a yield of 7.25%, 25bp inside initial guidance of 7.5% area. The senior unsecured bonds have expected ratings of B2/B+. Proceeds will be used to repay principal payments on debt maturing in 2023 and/or 2024.

UniCredit Bank raised €500mn via a 3Y covered bond at a yield of 3.736%, 15bp inside initial guidance of MS+75bp area. The bonds have expected ratings of Aa2, and received orders over €2.4bn, 4.8x issue size. The new bonds were priced in-line with its existing 1.2% 2026s that yield 3.71%

New Bonds Pipeline

- Khazanah Nasional Bhd hires for $ bond

- SMBC hires for € 3Y Covered bond

Rating Changes

Term of the Day

Margin Call

In leveraged trades, a trader essentially borrows money from the brokerage firm to upsize the position. Due to the leverage given by a broker, the trader is required to put up a certain sum of money up to a threshold in a margin account so that the broker has some collateral. The threshold is known as ‘maintenance margin’. If the leveraged securities rise in value, the trader is at an advantage since the gains get added to the margin account. Here, the broker does not reap any reward, but is more certain about being paid back in full. However, if the securities fall in value and go below the threshold, the broker triggers a margin call. The margin call is the amount that the trader has to add back to top-up their margin account since the margin account’s value has gone below the threshold/maintenance margin requirement.

FT sources reported that Adani’s Chairman faced a margin call of more than $500mn before it repaid a $1.1bn share-backed loan. However, Adani Group said it did not receive a formal request for a margin call.

Talking Heads

On no sign of ‘quick’ decline in inflation – Fed’s Waller

“There are signs that food, energy, and shelter prices will moderate this year”… rapid increases in interest rates had begun “to pay off.”… “But I’m not seeing signals of … quick decline in the economic data, and I am prepared for a longer fight”

On U.S. recession still likely despite resilient economic data – PIMCO

“Recent data on net haven’t caused us to change our outlook for a mild U.S. recession – we’re only pushing the timing back a little bit… Although market-based measures of financial conditions have eased somewhat recently, financial conditions are still tight by historical standards”

On it being too early to declare victory against inflation – JPMorgan CEO, Jamie Dimon

“It’s perfectly reasonable for the Fed to go to 5% and wait a while… you may have to go higher than 5% and that could affect short rates, longer rates”

On ECB Rates Must Hit Significantly Restrictive Levels – ECB GC Member, Kazaks

“We’ll raise rates significantly into restrictive territory and we’ll keep them there for quite some time. It’s natural to expect rate increases will slow to smaller increments, but we’re not there yet. I’m very aligned with the 50 basis-point increase in March and after March I don’t see a reason to take a pause or stop rate increases.”

Top Gainers & Losers – 09-February-23*

Go back to Latest bond Market News

Related Posts:.png)