This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

April 2023: Dollar Bonds Witness Another Positive Month With 81% of Dollar Bonds In The Green

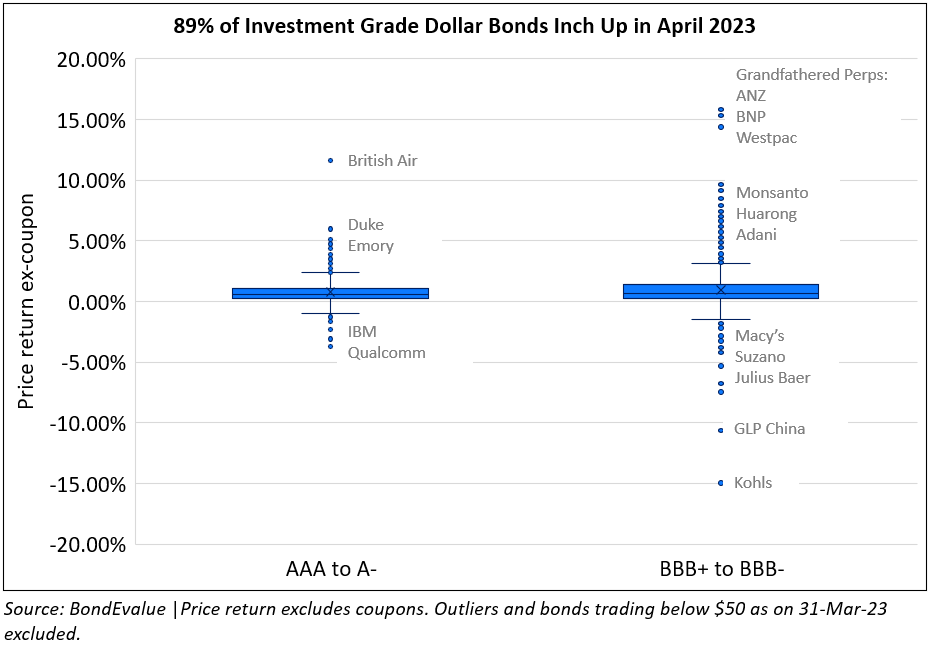

The month of April was yet another positive one for bond markets as 81% of the dollar bonds in our universe ended in the green (ex-coupon). 89% of all Investment Grade (IG) dollar bonds in our universe ended April in the green, outperforming the High Yield (HY) segment that saw 64% of dollar bonds in the green.

The month initially saw a sharp fall in benchmark yields as US economic data showed a slowing down in the economy alongside banking sector worries. First, US JOLTS Job Openings dropped by 623k to 9.9mn in February, the lowest since May 2021, suggesting a cooling labor market. ISM Manufacturing fell from 47.7 to 46.3, the lowest reading since June 2020. At the same time, Jamie Dimon, the CEO of JPMorgan Chase said that the banking crisis was “not yet over” and that its impact will be felt for years. He also remarked that the “market’s odds of a recession have increased”. This caused sentiment to drop at the time. However, following the jobs report and the inflation print later in the month, yields went back higher. US Non-Farm Payrolls came at 236k for March, higher than the surveyed 230k and the unemployment was lower than the prior month’s 3.6% to come at 3.5%. Core CPI came at 5.6%, in-line with the surveyed 5.6% and higher than the prior month’s 5.5% print. While economic data points did not indicate any strong case for a slowdown or a status quo in economic growth, overall volatility in stock and bond markets reduced. Risk sentiment was broadly stable through the month. The CBOE VIX Index measuring US stock market volatility is near its 2021 lows of 16.5 and the MOVE Index measuring Treasury bond volatility is currently where it began the year, at 122 and significantly lower from its peak of 198 in March.

The biggest gainers in the IG-space were the grandfathered Perps of ANZ, BNP and Westpac and HSBC’s legacy disco Perps that they decided to redeem. Other gainers included China Huarong whose dollar bonds jumped over 8% following the downgrade of its senior unsecured notes to Ba1. This occurred because the ratings action was considered to be a move that would fuel demand from high-yield funds given Huarong’s bonds will now enter HY indices from IG-category. Also, Adani Group’s dollar bonds saw an uptick after it chose to buyback a portion of its bond and also conveyed a “comfortable liquidity” position. The losers were led by Kohl’s bonds that continued to fall after it posted losses a month ago alongside warning of a profit shortfall. Also, GLP China’s Perp fell over 10% following the broad negative sentiment on the Chinese property sector.

In the High Yield space, the most prominent gainers were AT1 bonds of popular banks including Deutsche Bank, Commerzbank, SocGen, ING, BNP and others. El Salvador’s dollar bonds were up over 15% after markets considered the nation’s appointment of former IMF official Alejandro Werner as the adviser to be a strong positive. Vedanta’s dollar bonds were also higher by up to 10% as the company tried to reinstate confidence in markets about its repayment ability – it redeemed its dollar bond due last month and reduced its debt by $1bn. Among the losers were Chinese property developers like Wanda Properties, COGARD, Road King and Sino-Ocean. Wanda’s bonds fell upon the extension of its trust loans that then spilled over to peers, sparking new fears about the real estate sector.

For a detailed list of the top gainers and losers in April, scroll below.

Looking at the returns among bank AT1 bonds, most of these notes ended the month in the green (as seen in the table below). These subordinated bonds recouped some of the losses they saw in March as worries about the ability of the banking sector to call back AT1s reduced. However, looking at it on a two-month horizon, AT1s are still lower than the levels they were at end-February. In the table below, we have published a list of AT1s across the banking sector and sorted by their price returns in April.

Issuance Volumes

During the entire month, global corporate dollar bond issuances stood at $175.1bn almost flat as compared to March’s $176bn in deals. As compared to April 2022 also, issuance volumes were only 6% lower YoY. 82% of the issuance volumes came from IG issuers with HY and unrated issuers taking the remainder.

Asia ex-Japan & Middle East G3 issuances stood at $17bn, up 14% MoM, but down 23% YoY. 55% of the volumes came from IG issuers and HY issuers comprised 41%, with unrated issuers taking the remainder.

Largest Deals

The largest deals globally during the month were led by US banks – BofA raised $8.5bn via a two-part deal, Morgan Stanley $7.5bn via a three-tranche deal and Wells Fargo with a single issuance worth $3.75bn. Besides, European banks also filled the list of the largest deals where ABN AMRO and Credit Agricole raised €2.75bn and €1.5bn via dual-tranchers each. Among non-financials, Walmart raised $5bn via a five-tranche issuance, followed BPCE’s €3bn dual-trancher and Enterprise Holdings’ $3bn three-trancher that topped the tables.

In the APAC and Middle East region, deal volumes were led by Saudi Electricity’s $2bn dual-trancher, TAQA’s $1.5bn two-trancher and Sydney Airport’s €1bn issuance. Other deals included SBI’s $700mn issuance, TransUrban’s €700mn deal, Hana Bank’s €650mn issuance alongside Kookmin Bank and BOC Aviation’s $500mn deals each.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts: