This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

October 2020: Mixed Bag With 53% of Dollar Bonds Higher Led by HY

November 2, 2020

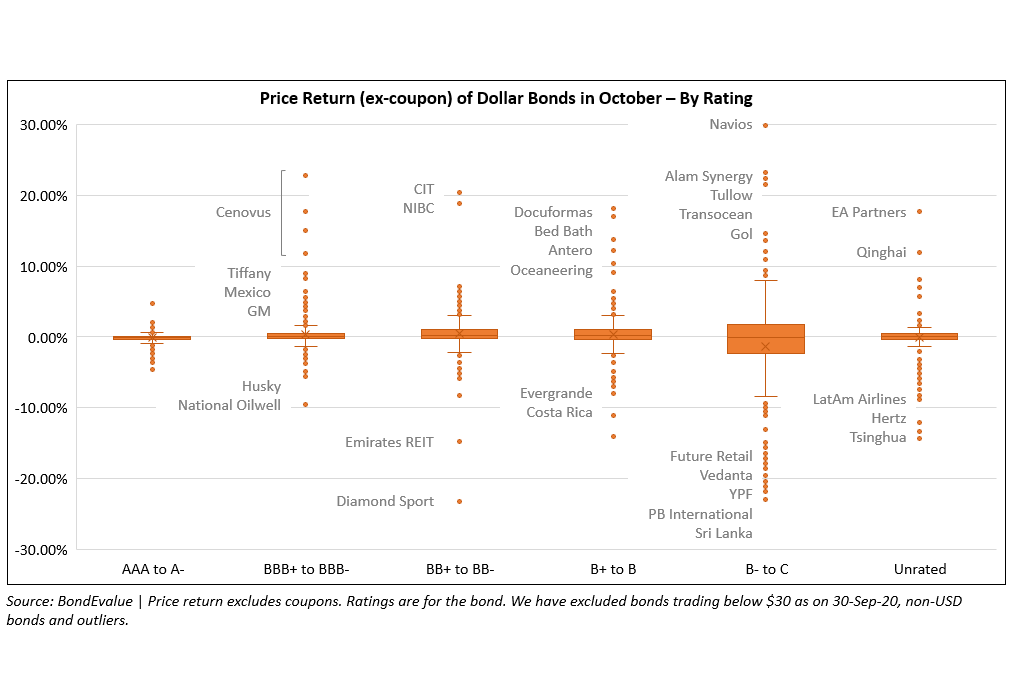

The month of October was mixed given the overall volatility across markets, particularly the last week. Overall, 53% of the dollar bonds in our universe delivered a positive price return (ex-coupon). This translated to a mark-to-market gain of ~$2.9bn calculated by taking a product of the amount outstanding and the month’s price change for each bond. The box and whisker plot above shows how bonds moved in price terms (ex-coupon) in October – by credit rating. The horizontal line inside each of the six boxes indicates the median price return, while the box area above and below it represents the upper and lower quartile respectively. The dots that fall above and below the bounds are outliers with each dot representing a bond.

We can observe that Cenovus was the biggest dollar bond gainer last month in the investment grade (IG) space – the bonds saw major gains after news of its acquisition of Husky in a $7.8bn deal. A successful exchange offer of Alam Sutera’s bonds saw their bonds go up over 20% in the HY space. Sri Lanka, Vedanta and Future Retail’s dollar bonds made some of the biggest losses in the junk grade space.

Investment grade bonds underperformed the overall dollar bond segment while High Yield (HY) fared better with 60% of the HY bonds in our universe delivering positive price returns in October vs. 46% for investment grade bonds.

Issuance Volume & Largest Deals

Global corporate dollar issuance volume stood at $114.5bn, down 32% vs. September and up 140% vs. last October’s issuance of $47.7bn.

Asia ex-Japan G3 currency issuance stood at $54bn, slightly lower than September’s issuance of $54.3bn and 40% higher vs. last October’s issuance of $38.7bn. Investment grade bonds dominated with new deals worth $38.4bn while high yield bond issuance stood at ~7bn, over double of September’s junk bond issuance of $3.4bn.

Below are the largest deals in October sorted by issue size. The largest issuances globally was topped by United Airlines which raised $3bn via 7Y bonds at a yield of 5.875%, with the issuance backed by a fleet of 352 aircrafts, 99 spare engines and other spare parts.

The largest issuances across the APAC and Middle East were led by Turkey while China’s jumbo issuance of $6bn across four tranches was among the highlights as it drew orders over $27.2bn, 4.5x issue size.

Top Gainers & Losers

The Sri Lankan sovereign got hammered over the month of October on several fronts – political uncertainty where the President clinched a majority vote to amend the constitution, US’s pressure on the nation due to its ties with China and economic uncertainty on repayments of bonds over the next few years. Most Sri Lankan dollar bonds dropped ~20%. Another big loser was Future Retail who’s bonds dropped ~19% with Amazon’s legal filing regarding Future Retail’s acquisition by Reliance. Mining company Vedanta Resources Limited also saw its bonds drop given a failed delisting of its Indian subsidiary Vedanta Ltd.

Go back to Latest bond Market News

Related Posts:

The Record-Setting ‘Bubka’ Bond Market of 2020

October 14, 2020

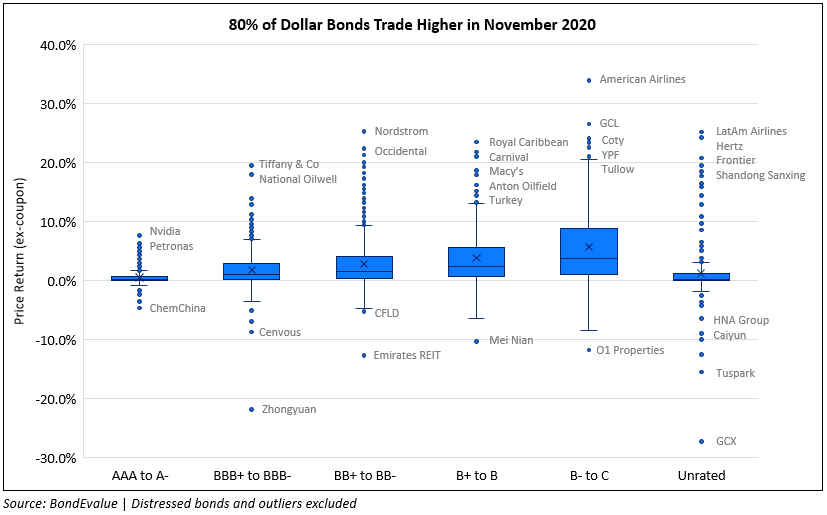

November 2020: 80% of Dollar Bonds In The Green on Vaccine Hopes

December 1, 2020