This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

October 2022: High Yield Bonds Outperform Investment Grade Peers Again

November 1, 2022

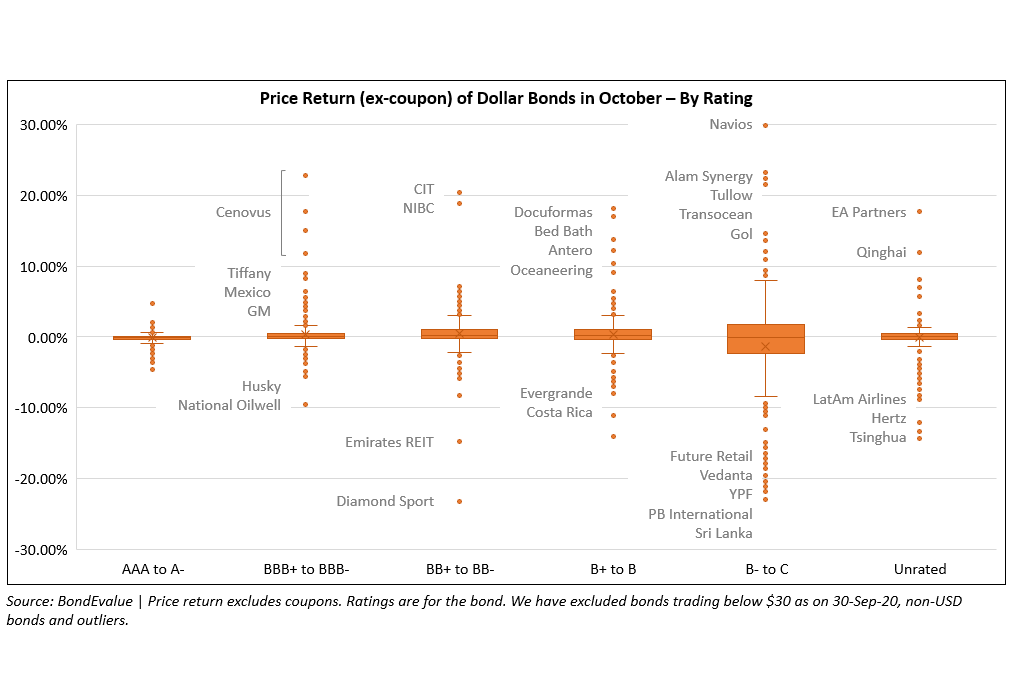

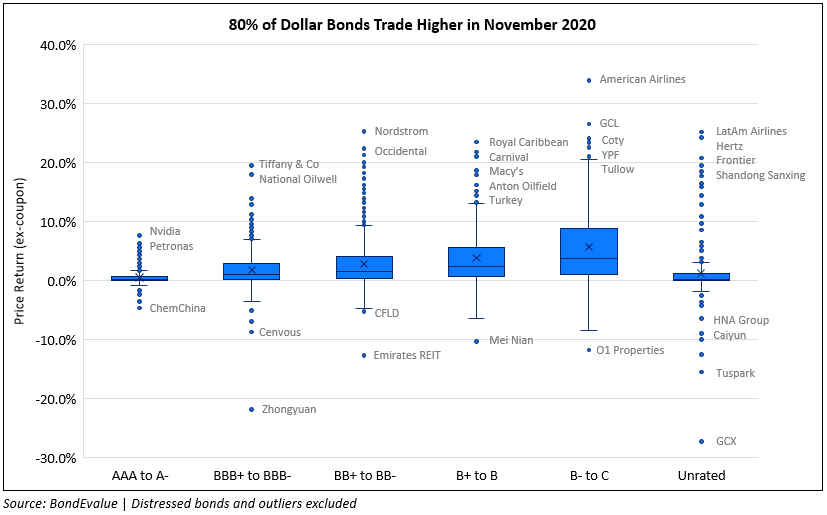

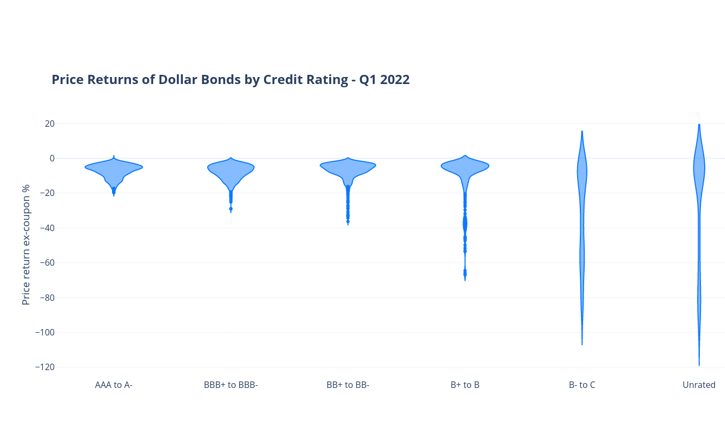

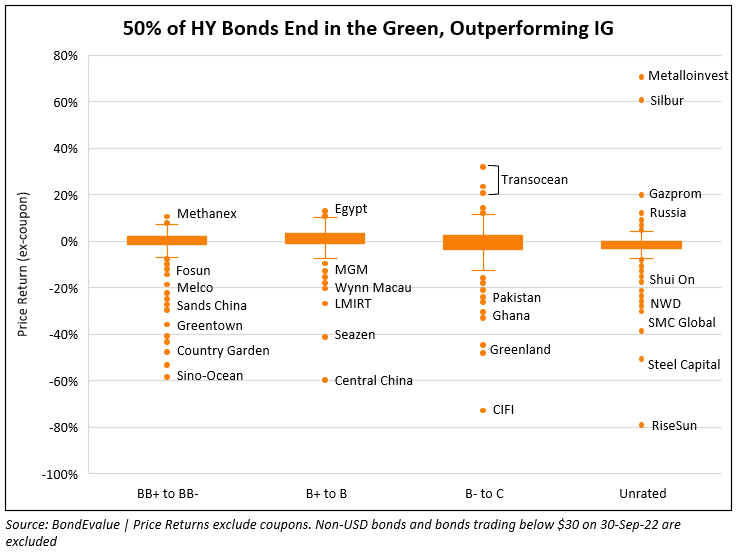

The month of October saw 73% of dollar bonds in our universe delivering a negative price return (ex-coupon). 86% of all Investment Grade (IG) dollar bonds in our universe ended the month in the red, while High Yield (HY) outperformed with 50% in the green. Benchmark yields shifted higher across the board as inflation surprised on the upside leading to a steeper rate hiking path by the Fed. US CPI YoY for September came in at 8.2%, higher than expectations of an 8.1% print. Core CPI was at a 40Y high of 6.6%, above expectations of 6.5%. With this backdrop, the peak fed funds rate crossed 5% for the May 2023 meeting during mid-October (for context, the Fed Funds rate was last seen above 5% just before the GFC in 2007-08). The probability of the Fed hiking rates by 75bp in both its November and December meetings stood at 95% and 65% mid-month. However, as high frequency soft data like the Markit PMIs showed a contraction in activity, markets are now evenly split between a 50bp and 75bp hike in December, while a 75bp November hike remains intact. Overall, looking at the yield curve, yields rose by 15-20bp across the 2Y to the 10Y segment, while 30Y yields were up 40bp during the month.

Besides the impact of the rise in 30Y yields on very long-dated bonds of high grade issuers, the losers list in the IG universe included dollar bonds of Tencent and Alibaba falling by over 15%. Besides the broader impact of rising rates, Beijings tightening government controls also weighed on their bonds. In the BBB+ to BBB- segment, gains were observed in Delta Air and Nordstrom's dollar bonds. Among the losers in this bracket were dollar bonds of Chinese property developer Longfor that fell by over ~60%, Jinmao's falling by over 40% and Vanke dropping over 25%. Their bonds were impacted severely by the broad sell-off in higher rated names after news that its peer CIFI Holdings did not make payments on certain debts. Besides, asset manager Huarong's bonds fell over 10% with the company witnessing a downgrade to BBB- from BBB by S&P.

In the rated high yield space, the biggest gainers were bonds of Egypt and Transocean - Egypt's dollar bonds rallied over 10% across its curve as it reached a $3bn IMF staff agreement loan. Transocean's bonds rallied over 20% upon the completion of its distressed debt exchanges post which it was upgraded by S&P to CCC. Among the losers were dollar bonds of casino operators like Wynn Macau, Sands China, MGM and Melco as reports noted that Xi Jinping's third term as leader may put further pressure on casino operators, with a possible reversal of its stance to ease Covid-related restrictions affecting tourism to Macau. Besides, other Chinese property developers like Country Garden, Sino-Ocean, Greentown etc. got impacted by the setback from CIFI Holdings. In the unrated segment, Russian companies like Metalloinvest, Gazprom, the sovereign etc. saw their bonds top the gainers list. Among the losers were perpetual bonds of NWD and SMC Global - the former's bonds dropped amid concerns that Hong Kong’s mass-residential prices could drop 10-15% before end-2023 while the latter's bonds dropped on reports of a possible funding shortfall of ~$1bn by June 2023. Most recently, Greenland Holdings' dollar bond due November 3, dropped over 80% after the company warned of a default on the note.

Issuance Volumes

Global corporate dollar bond issuances stood at $141.9bn, almost flat from September's $143bn in issuances, but down 42% YoY. Given the volatile market conditions, persistent inflation and the path of the Fed's aggressive rate hikes, only 5% of the issuances came from the high yield space while 92% of the issuances came from the investment grade space. The balance 3% were from unrated deals.

APAC ex-Japan & Middle East G3 issuance stood at $19.89bn, up 77% MoM, but down 48% YoY. Investment grade issuances almost doubled on a monthly basis to $15.7bn while high yield issuances were near flat at $3.1bn. The issuance volume from the region was the highest in six months, since April 2022 which saw $22.1bn in deals.

Largest Deals

The largest deals in October 2022 were led by UnitedHealth's jumbo $9bn seven-trancher followed by banking majors Morgan Stanley, HSBC and Barclays' raising $6.5bn, $6.25bn and $5bn via three-tranchers each. Other Large deals included Lockheed Martin's $4bn five-trancher, CADES's $4bn deal and Goldman Sachs' $2bn deals.

In the APAC & Middle East region, the largest deals were led by Saudi Arabia's $5bn dual-trancher that involved a $2.5bn sukuk issuance. This was followed by Saudi PIF (GACI) raising $3bn via a green three-trancher, Turkey's $2.5bn sukuk issuance and Philippines' $2bn three-tranche deal.

Top Gainers & Losers

The biggest gainer in the month were once again Russian entities like Metalloinvest, Sibur, Tinkoff Bank, the sovereign and their like as investment banks warmed up to the trading of Russian debt again outside the grip of Western sanctions ever since late July. Russian sovereign and corporate bond prices have been trending upwards ever since the update. Other gainers included Transocean's bonds upon the completion of its distressed debt exchanges post which it was upgraded by S&P to CCC. Iamgold, the Burkina Faso based gold miner saw its bonds rally over 30% as it sold its 95% interest in Rosebel Gold Mines for cash a consideration of $360mn and saw a release of its equipment lease liabilities worth ~$41mn. Egypt's dollar bonds witnessed a rally of over 10% across its curve as it reached a $3bn IMF staff agreement loan. Chinese conglomerate Fosun International saw a volatile with a downgrade by Moody's to B2 post which it announced its plans of a $7-11bn asset sale. Most recently, the company was said to be seeking strategic options including selling either a majority or minority stake in reinsurer Peak Re with a valuation of $500mn-$1bn.

On the losers list, sell-offs were witnessed in popular names like Hong Kong property company New World Development's (NWD's) Perps that fell over 30% amid concerns that Hong Kong’s mass-residential prices could drop 10-15% before end-2023. Sovereigns like Ecuador and Ghana also saw some of their bonds drop over 30%. Ecuador's bonds initially witnessed some gains after rumors of a bond buyback program. However, there was no confirmation regarding the above. Ghana on the other hand has been under pressure, witnessing downgrades since September - the latest being its downgrade to Caa2 from Caa1 by Moody’s due to deteriorating macroeconomic conditions, difficulties in the government’s liquidity and debt sustainability, and increasing risk of default. SMC Global Power's dollar perps also witnessed a sudden and sharp sell-off after a report said that the company “risks a funding shortfall as high as $1 billion by next June”. The company's CEO however, denied any funding crunch in an interview later.

Looking at the China real estate sector, there were barely any gainers. The biggest losers in this pack were medium/longer dated bonds of relatively higher rated developers like Country Garden, CIFI, Sino-Ocean, Longfor etc. that had witnessed a rally over a month ago on news that they could issue state-backed local bonds. However, this month, their bonds dropped over 50% across the board. This began with worries concerning CIFI Holdings. News broke out that CIFI Holdings did not make payments on “certain nonstandard debt under a project company”. After witnessing downgrades across rating agencies the company most recently defaulted on a HK$ 2.5bn ($318mn) convertible bond due in 2025. Sino-Ocean recently followed on with the negative sentiment by extending a dollar bond repayment.

Go back to Latest bond Market News

Related Posts: