This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

May 2024: Softer Data and Treasury Rally Sees 90% of Dollar Bonds End Higher

June 3, 2024

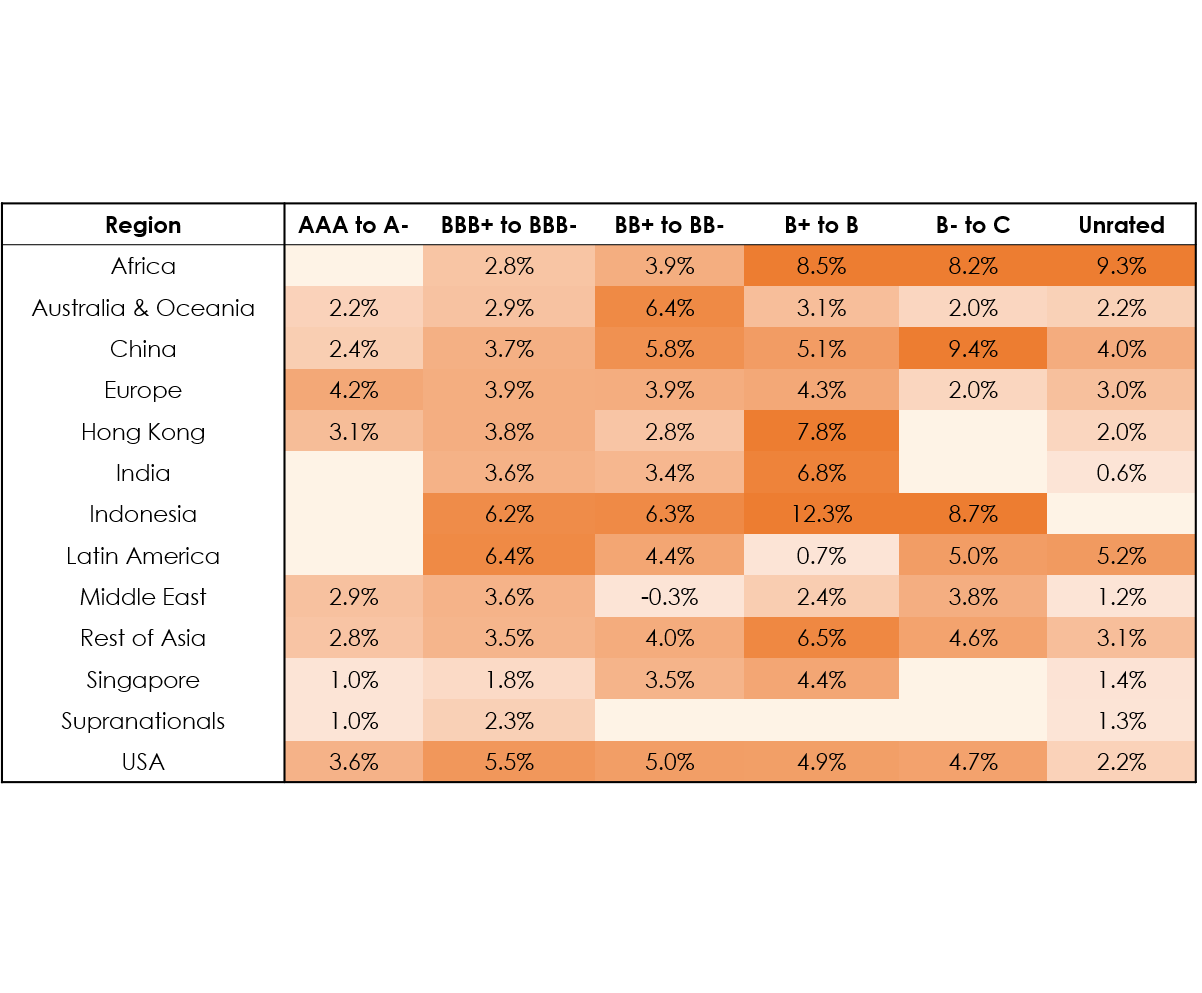

May 2024 was a solid month for corporate bond investors with 90% of dollar bonds ending higher (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds performed well as softening data saw the Treasury curve shift lower. 92% of IG bonds and 75% of HY bonds closed in the green during the month.

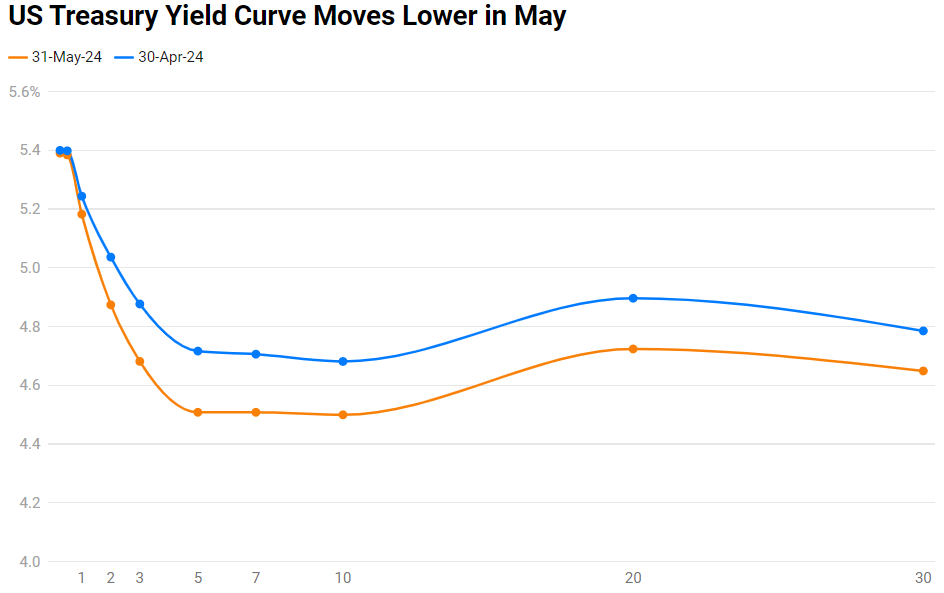

Despite intermittent volatility during the month, May saw a shift lower across the Treasury yield curve. Yields initially dropped across the curve during the first two weeks, followed by a surge higher and later, a dip again towards the end of the month. The 2Y and 10Y yields ended 16bp and 18bp lower during the month, to 4.87% and 4.50% respectively. The US economy continued to remain resilient despite softening economic data. Non-Farm Payrolls (NFP) rose 175k in April, lower than expectations of 240k. Average Hourly Earnings rose 3.9%, lower than the expected 4.0%, while the unemployment rate rose slightly to 3.9% from 3.8%. US Headline and Core CPI came at 3.4% and 3.6%, in-line with expectations, but registering a drop from the prior 3.5% and 3.6% readings respectively. Headline Retail Sales saw no growth in April while March's numbers were revised lower. Similarly, ISM Manufacturing and Services were softer than expected, with the former slipping back into contractionary territory.

As a result, markets began pricing-in 50bp of Fed rate cuts by end-2024. However, while softer than expected, the economic data was not enough to convince most Fed speakers who came out saying that they needed more confidence that inflation was indeed slowing towards their target. Markets have since, repriced their expectations of Fed rate cuts in 2024 to just over 25bp. They are currently pricing-in one 25bp rate cut in September and are unclear about a second cut after that.

Investment Grade (IG) dollar bonds across the spectrum saw a broad rally owing to its longer duration relative to high yield bonds, as the drop in Treasury yields lifted prices. While there were select individual bonds that fell by 5% over the course of the month (Ford 2032s, Hudson Pacific 2029s, JBS 2027s etc), there was no particular news that impacted the issuers' curve.

Under the HY segment, in the BB+ to B- bucket, Chinese developers Longfor and Vanke saw their dollar bonds top the gainers list after the PBOC announced several measures to support the property sector, including a $42bn relending program for select SOEs to buy unsold homes from developers. In the B- to C bucket, Carvana's bonds were among the top gainers, after it forecasted an unexpected bump in current-quarter retail sales and core profits. iHeartMedia's bond was the biggest loser, down over 40% after its revenues missed expectations, whilst also reporting losses. Another notable loser was Lumen, whose bonds fell over 10% continuing its drop from the prior month, following downgrades across rating agencies. Among unrated issuers, Gazprom's dollar bonds fell over 15% after it reported its worst annual loss in over two decades.

Issuance Volumes

Global corporate dollar bond issuances stood at $260.7bn in May, ~7% lower than April. As compared to May 2023, issuance volumes were up 15%. 81% of the issuance volumes came from IG issuers with HY comprising 18% and unrated issuers taking the remaining 1%.

Asia ex-Japan & Middle East G3 issuance stood at $34.5bn, up 46% MoM and a massive 82% YoY. 84% of the volumes came from IG issuers with HY issuing 14% of it and unrated issuers taking the rest.

Largest Deals

The largest deals globally were led by US issuers with CVS Health’s $5bn five-trancher and J&J’s $4bn four-trancher topping the tables. This was followed by large banks including the likes of HSBC, StanChart and Intesa Sanpaolo that raised over $3bn each. Other large issuances included Comcast’s $3.25bn three-trancher and Elevance Heatlh’s $3.2bn four-trancher and Foundry JV Tobacco’s $3.05bn two-trancher amongst others.

In the APAC and Middle East region, deal volumes were led by Saudi Arabia's $5bn three-tranche sukuk deal, Westpac’s $3bn four-trancher and Philippines’ $2bn two-trancher.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019

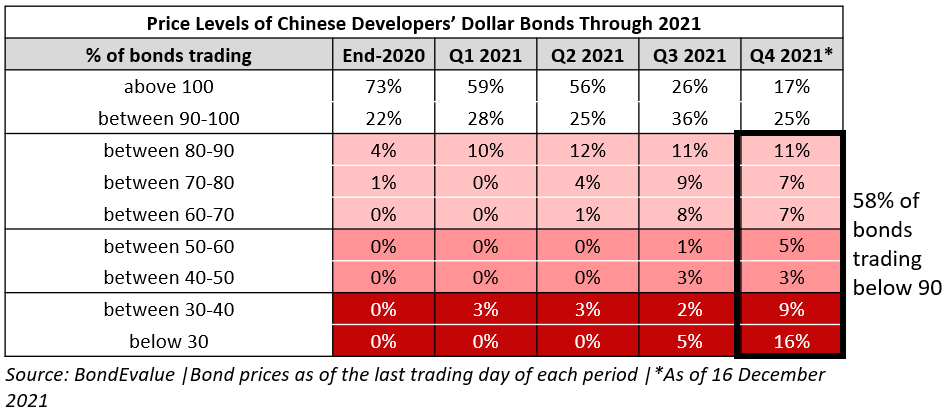

2021 Recap: China Real Estate – When Hope Went Up In Smoke

December 20, 2021