This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

2021 Recap: China Real Estate – When Hope Went Up In Smoke

December 20, 2021

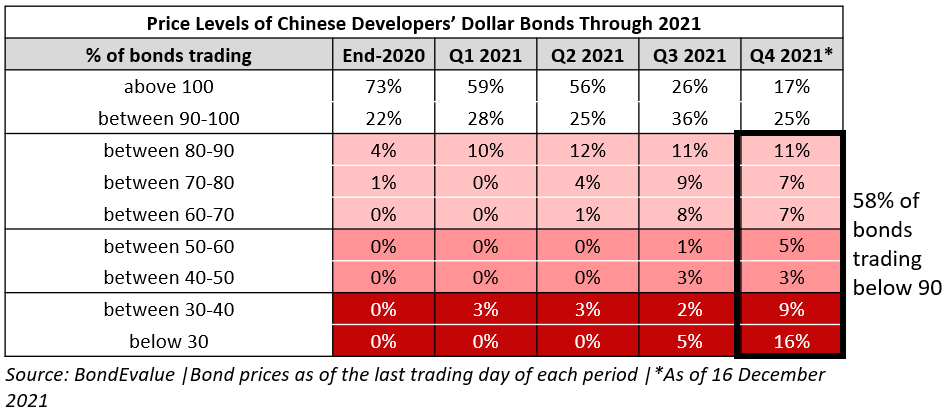

2021 was a year to forget for the Chinese property sector. What started out as a recovery from the pandemic in 2020 turned into a crisis just when the outlook seemed to be stable. The first half of the year was fairly steady – 87% and 81% of developers’ dollar bonds were trading above 90 cents on the dollar at the end of Q1 and Q2 respectively (refer to the table above). The only developer that was under distress then was China Fortune Land Development (CFLD) that defaulted on its $530mn 8.625% dollar bonds due February 28, 2021. CFLD then proposed a debt restructuring plan to deal with RMB 270bn ($41.7bn) of debt.

However the second-half of the year unleashed a wave of volatility and uncertainty in the sector beginning with the world’s most indebted developer China Evergrande. Whilst Evergrande had its share of uncertainty in 2020 after rumors of a liquidity crunch, the situation eased out by year end after reaching an agreement that its strategic investors would not demand repayment of up to RMB 130bn ($19bn) should the company fail to list its subsidiary Hengda on the Shenzhen exchange by January 31, 2021. However, H2 2021 saw the company getting downgraded by rating agencies, looking for options to sell its assets and raising funds as credit markets tightened. Within the span of a quarter, the company’s true financial condition came to light with investors selling its dollar bonds rampantly, culminating with a default on December 7, after its 30-day grace period on two dollar bonds expired.

The animated box & whisker chart below shows the trend of Chinese Developers’ Bond Prices through 2021. As observed below, H1 was fairly stable, but ever since the events at Evergrande began to unfold, several other property developers also saw their bonds collapse (scroll below for details). This is illustrated by the decreasing lower bound, large whiskers and the widening range in each of the quarterly boxes.

Evergrande was not alone and after initial signals of worry, investors and rating agencies took action on the rest of the sector, with its peers both large and small getting impacted. Smaller names like Sichuan Languang that defaulted on its local bond in July 2021 and Sunshine 100 China Holdings that defaulted on its dollar bonds in August 2021 were the first victims of a larger problem in the sector. Larger developers started facing the brunt since August amid (i) a wave of downgrades (ii) regulations on lending to developers (iii) enforcement of the three red-lines policy (iv) tightening credit conditions and (v) almost no issuance in the sector from September through November.

Evergrande’s peer Fantasia Holdings became the first large victim of financial stress post Evergrande’s unfolding of events, ultimately leading to it defaulting on its $205.656mn 7.375% bond due October 4. Modern Land (China) then defaulted by missing the dollar bond coupon and maturity payment on its $250mn 12.85% bonds due October 25. Kaisa Group, which was the first developer to default back in 2015, saw a déjà vu moment when it defaulted on its $400mn bonds due December 7, 2021 with no grace period for the bond repayment.

The interactive table below shows the list of Chinese property developers sorted by revenue (to indicate scale), alongside their three-red lines ratios, their respective issuer ratings and the median returns YTD across their dollar bonds.

2021 saw Chinese property developers get downgraded an alarming 140 times across the three major rating agencies, 3.8x the number of downgrades from the sector in 2020 when the pandemic hit. Needless to say, the crisis beginning with Evergrande led to massive volatility in Chinese property developers' bonds with 96% of dollar bonds ending the year in the red - some names losing as much as 90% of their value.

Looking Ahead To 2022

2022 looks likely to begin with a continuation of the negative sentiment in the real estate sector - more downgrades and defaults are likely. Several other developers have been impacted since the Evergrande saga. Companies to watch out for in 2022 include China Aoyuan which has seen a liquidity crisis and numerous downgrades, Yango Group which has repayments due in 2022 after averting default in November, RiseSun which faces weakening liquidity and increased refinancing risk and fallen angel Shimao which saw its dollar bonds drop 30% in mid-December following liquidity concerns, to name a few.

The year ahead also sees a large amount of dollar and yuan denominated bonds maturing across the sector (see the interactive chart below). About $50bn of USD-denominated bonds mature next year and around $52bn equivalent of yuan-denominated bonds mature next year with a lot hanging on the recovery of the sector and easing policy. Rest assured, 2022 is going to be a nail-biting year!

Go back to Latest bond Market News

Related Posts:

Tus-Holdings’ Bondholders Approve Debt Extension Plan

August 17, 2021

CFLD Bondholders Said to be Seeking More Bargaining Power

November 26, 2021