This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

April 2024: Solid Data, Repricing of Rate Cuts Sees 87% of Dollar Bonds End Lower

May 1, 2024

April 2024 was a poor month for bond investors with 87% of dollar bonds ending lower (price returns ex-coupons). Both, Investment Grade (IG) bonds and High Yield dollar bonds performed poorly as markets further repriced rate cut expectations by the Fed amid the consistently solid data out of the US. 88% of IG bonds and 83% of HY bonds closed in the red during the month.

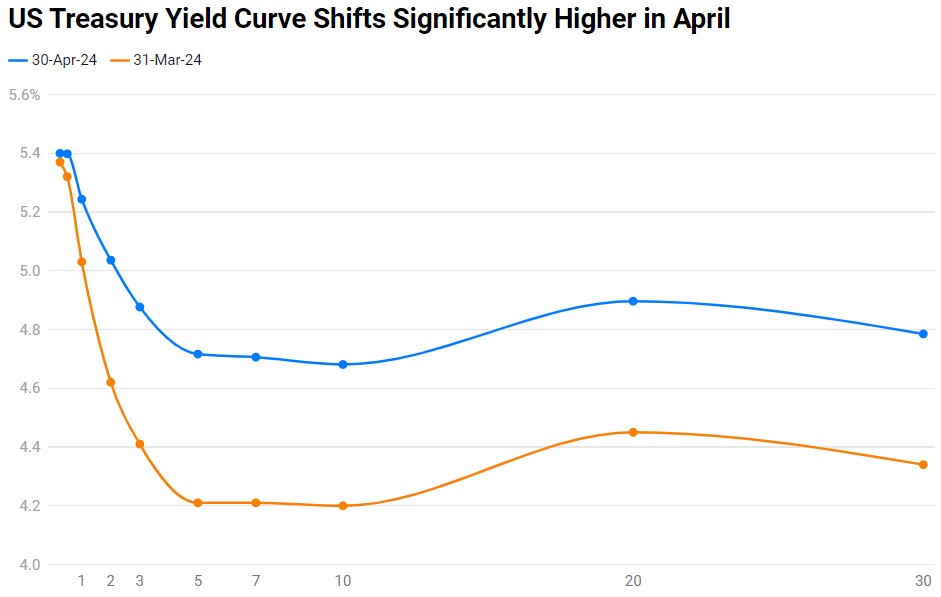

April saw the Treasury yield curve shift even higher, with short-term and long-term rates rising over 40-50bp as markets repriced their expectations of Fed rate cuts in 2024. The 2Y yield closed over 40bp higher to 5.02% and the 10Y yield was up 48bp to 4.68% to end the month. The US economy continued to show resilience and growth, starting with the Non-Farm Payrolls (NFP) showing a massive pick-up of 303k, much higher than the surveyed 214k and the 270k pick-up seen in February. Average Hourly Earnings (AHE) YoY rose 4.1%, in-line with expectations and lower than February's 4.3% print. The Unemployment rate dropped to 3.8% from 3.9%, in-line with expectations. Besides, US inflation also continued to show a lower pace of deceleration, with March CPI up 3.5% YoY, higher than the expected 3.4% and much higher than February's 3.2% reading. Core CPI came at 3.8%, higher than the expected 3.7% and in-line with the prior 3.8% reading. Meanwhile, manufacturing activity continued to show improvement, with the ISM Manufacturing Index coming at 50.3, its first expansionary print in 18 months. Following the continued upbeat data, the FOMC's January meeting minutes and several Fed speakers hinting at a delay in rate cuts, the market also repriced its expectations of Fed rate cuts in 2024. Whilst beginning the month expecting just over 50bp in rate cuts, markets are now pricing-in one rate cut in September and are doubtful of whether a second cut would happen after that.

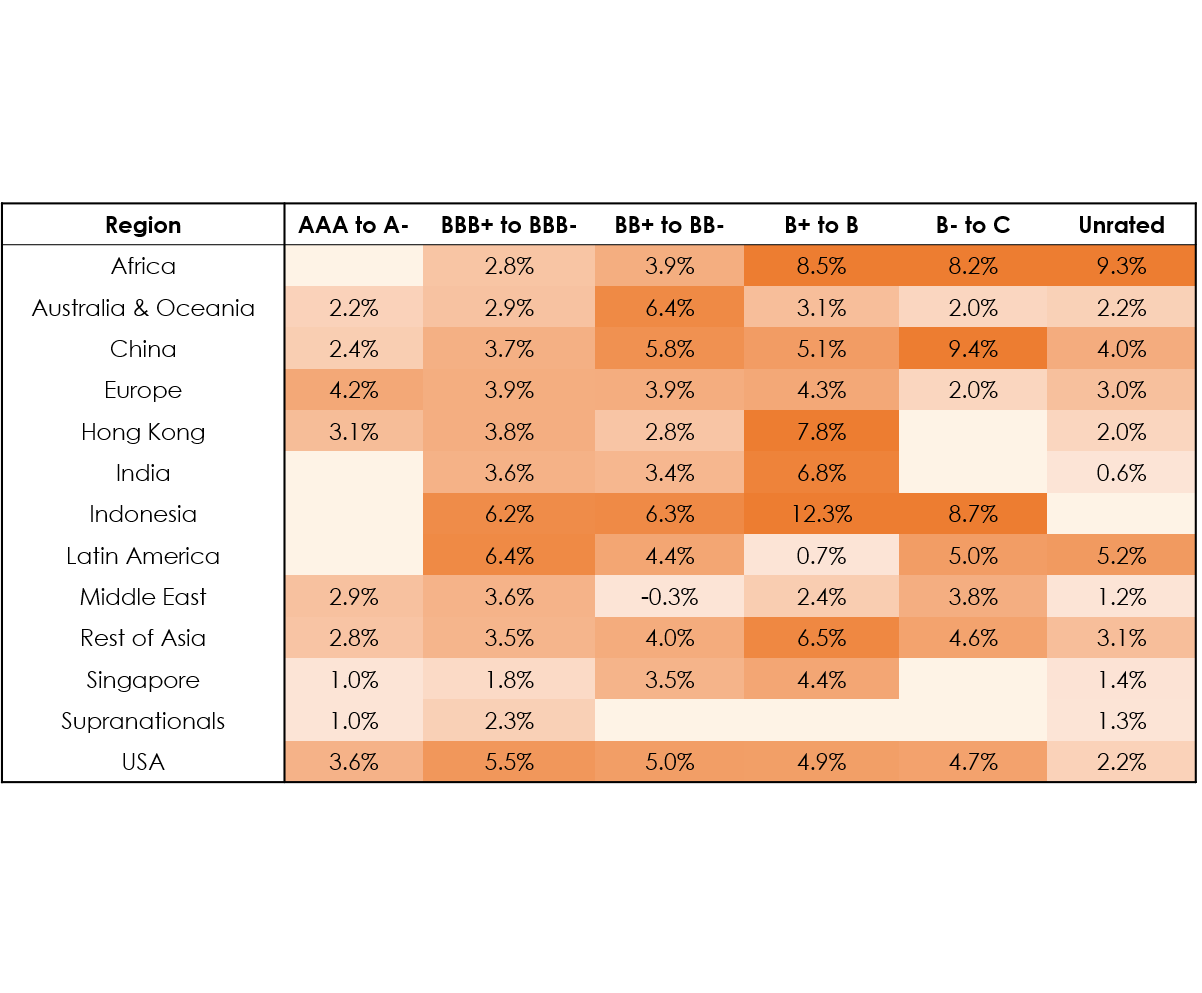

In the top-rated AAA to A- bucket, longer dated bonds of most issuers dropped by 6-10% led by the rise in benchmark rates where the 10Y and 30Y Treasury yield rose 30bp each. In this bucket, Israel's dollar bonds were among the top losers following elevated geopolitical risk upon the confrontation with Iran and a rating downgrade to A+ by S&P. A similar trend was seen even in the BBB+ to BBB- bucket.

Under the HY segment, in the BB+ to B- bucket, Chinese developers Longfor and Vanke saw their dollar bonds top the gainers and losers lists respectively. Longfor's bonds rallied after the company said that it has set aside sufficient funds to repay an RMB 1.5bn ($208mn) note maturing in May. Vanke's notes dropped upon rumors of its executives being banned from travelling overseas and its absence in an event organized by Chinese authorities regarding signing-off loans to 12 developers. In the B- to C bucket, Mexican telecommunication company Total Play's bonds jumped over 19% after it proposed a swap offer to bondholders, stemming refinancing doubts surrounding its 2025s. American telecommunications firm Embarq's bonds sank nearly 30% after investors claimed that debt issued to fund its leveraged buyout by Apollo Global triggered an event of default. The company has since, won a legal dispute against the bondholders' claims. Another notable loser was Lumen, whose bonds fell over 20% following rating downgrades across agencies. Egypt's bonds trended higher amid several positive updates, continuing its rise from the previous quarter.

Issuance Volumes

Global corporate dollar bond issuances stood at $279bn in April, ~7% higher than March. As compared to April 2023, issuance volumes were up 60%. 73% of the issuance volumes came from IG issuers with HY comprising 14% and unrated issuers taking the remaining 13%.

Asia ex-Japan & Middle East G3 issuance stood at $23.7bn, down 33% MoM whilst being higher by 39% YoY. 63% of the volumes came from IG issuers with HY issuing 34% and unrated issuers taking the rest.

Largest Deals

The largest deals globally were led by US issuers with Boeing's $10bn six-trancher topping the tables. This was followed by the big US banks following the release of their quarterly earnings. JPMorgan and Morgan Stanley raised $9bn and $8bn via four-tranchers each, followed by Goldman Sachs and Wells Fargo’s $5bn and $4.25bn two-tranchers each.

In the APAC and Middle East region, deal volumes were led by Abu Dhabi's $5bn three-tranche deal, Westpac's €1.5bn deal, followed by CDB's ~$1.43bn two-tranche multicurrency issuance and Sydney Airport's €1bn two-trancher.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019