This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vanke’s Bonds Drop; Longfor Downgraded to HY Status of BB+

April 15, 2024

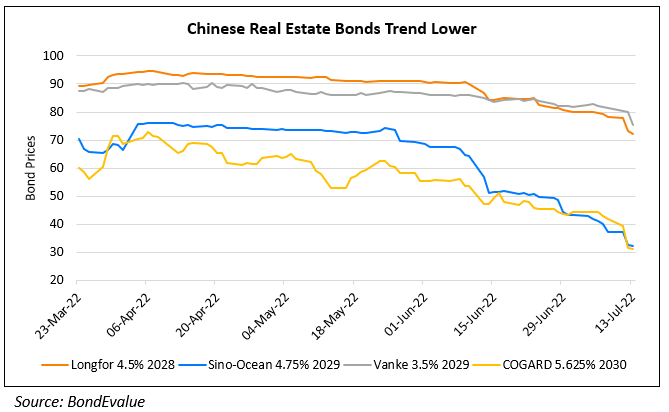

China Vanke’s dollar bonds dropped on rumors of its executives being banned from travelling overseas, with the 3.15% May 2025s dropping by almost 4.8 points to 62. The company in its Sunday meeting denied the speculation and said that it was making plans to address liquidity pressure and operational difficulties. In addition, Vanke’s absence in an event organized by Chinese central bank and the financial regulator, where RMB 14.6bn ($2bn) of loans were signed to 12 developers, further fueled questions on Vanke’s access to funding. Once IG-rated, Vanke has been hit by a series of downgrades and is now rated at HY-status of Ba1/BB+/BB+ at all the three rating agencies.

In related news, its peer, Longfor Group was downgraded to HY-status of BB+ from BBB- by S&P. The downgrade follows S&P’s expectation of Longfor’s leverage remaining high over the next 1-2 years due to weak sales and margin compression amid the property sector downturn. However, S&P believes the company has adequate liquidity and funding access to cover its debt repayment obligations over the next one year.

Longfor’s 4.5% 2028s dropped by almost 2.1 points to 61.6 cents on the dollar.

Go back to Latest bond Market News

Related Posts: