This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China’s Higher-Rated Property Dollar Bonds Sell-off Led by Country Garden

July 13, 2022

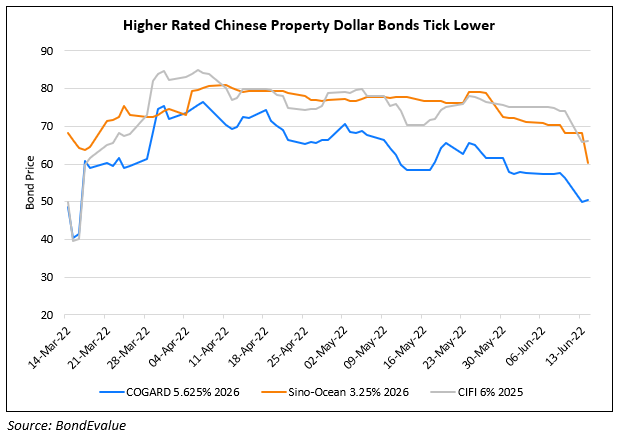

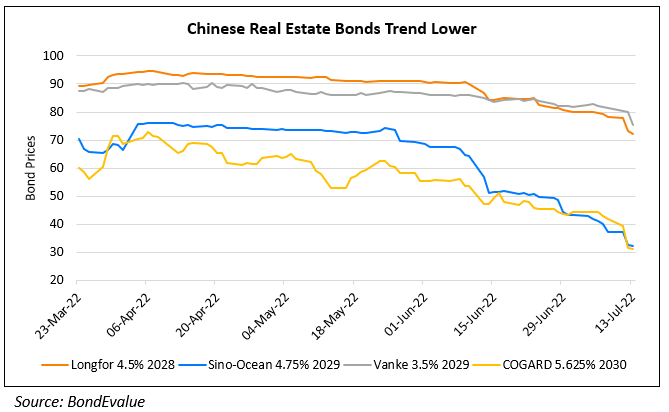

Chinese developers’ dollar bonds have sold-off across the board led by Country Garden, China’s largest developer, with several of their notes falling significantly, by over 8%. Even investment grade (IG) rated industry peers such as Longfor, Sino-Ocean and Vanke were not spared from the selloff. Bloomberg notes that the sell off was driven by a spike in Covid cases in several parts of China, stoking fears that the authorities would tighten pandemic measures that would further impair the already struggling Chinese economy. Such news would significantly hurt the real estate sector which has already suffered heavily from a slump in sales in H1 2022 due to lockdowns. Another factor accelerating the selloff is thin market liquidity, Bloomberg notes. Iris Chen, a credit desk analyst with Nomura Hong Kong said, “There is one-way selling but no buying interest on the back of weak market confidence in the property sector, and there seems to be no specific near-term upside catalyst that people are expecting.” Country Garden, Vanke, Longfor, Sino-Ocean are all rated in the BBB by Fitch.

For the full story, click here

Go back to Latest bond Market News

Related Posts: