This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

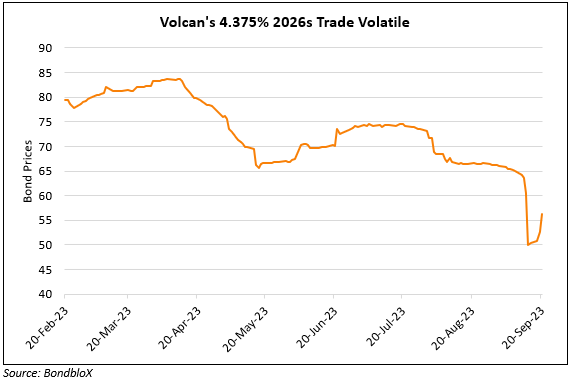

Volcan’s 2026s Jump 3 Points Amid Asset Sale Plans

June 18, 2024

Peruvian mining company Volcan, said that it will continue with its plans to sell non-core assets. As per the CEO, Volcan is in the process of divesting its holding in a Chilean cement maker and also real estate near the new Peruvian port of Chancay. This could see Volcan raise about $200mn in the process. The company has already sold two hydroelectric plants for over $78mn. Volcan is currently also in talks with creditors about refinancing debts due in the coming years. It aims to extend maturities without losses via haircuts, with negotiations currently surrounding the interest rate. As per Bloomberg, Lucror Analytics is recommending the company’s bonds due 2026 after expecting them to make payments due in June and August.

Volcan’s 4.375% 2026s jumped higher by 3 points to 75.53, yielding 23.1%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Volcan’s Dollar Bonds Trade Choppy on Management Changes

September 20, 2023

Volcan’s Bonds Drop As Glencore Sells Stake

May 8, 2024