This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

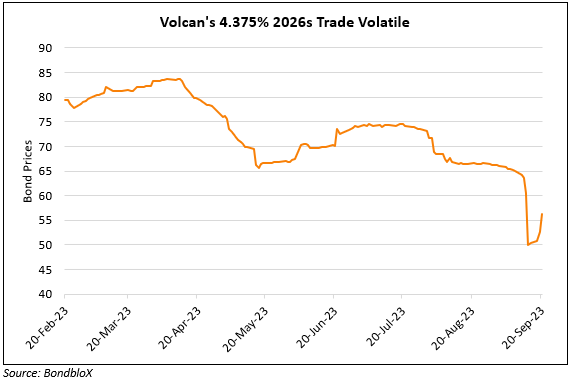

Volcan’s Bonds Drop As Glencore Sells Stake

May 8, 2024

Volcan’s dollar bonds dropped by 6-7 points after Glencore sold its stake in the company. The stake was sold for $20mn to Transition Metals AG, a subsidiary of Integra Capital. According to the statement released, Glencore also has agreed to provide a secured facility of $40mn to fund certain mandatory tender obligations. Earlier, there were reports of Glencore initiating a process to sell its stake, however the news came as a surprise as Volcan is also in advanced talks with creditors to refinance all its debt. According to BancTrust, with new incoming shareholders, the risk for bondholders is to the downside.

Volcan’s 4.375% 2026s dropped 6.4 points to trade at 62.1 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: