This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

November 2025: IG Bonds Lead Modest November Gains as Fed Doves Reignite Rate-Cut Odds

December 1, 2025

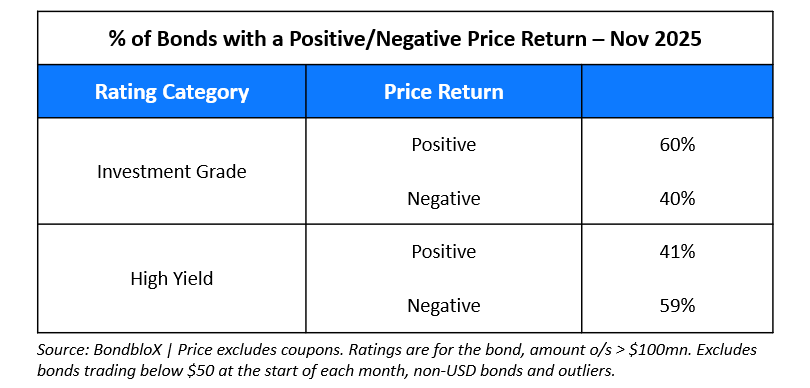

November 2025 was a modest month for bond investors, with 55% of dollar bonds ending higher (price returns ex-coupons). 60% of Investment Grade (IG) bonds ended in the green, outperforming High Yield (HY) bonds where 59% ended in the red. US Treasury yields ticked higher during the beginning of the month as markets began to price out the possibility of a December Fed rate cut. However, yields quickly came down after dovish comments by Fed speakers led by John Wiiliams in late-November. This saw markets reprice the December rate cut, with the probability of a cut at nearly 90% currently.

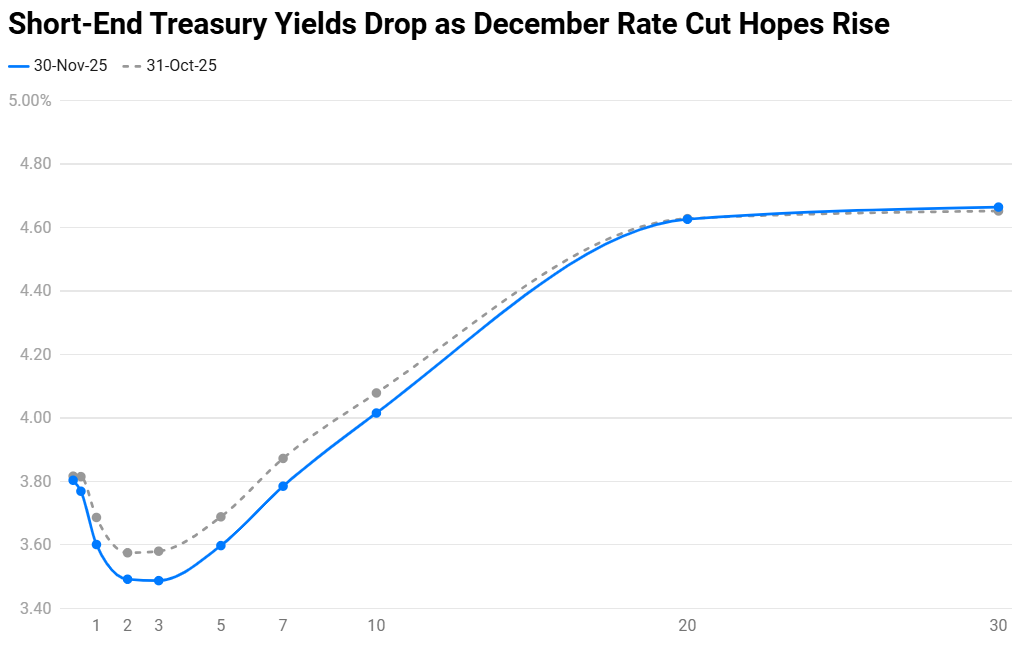

The month of November saw the Treasury yield curve shift lower, led by the near-term yields – the 1Y, 2Y and 3Y yield fell by 9bp while the 10Y ended 5bp lower. The delayed US Non-Farm Payrolls (NFP) reading for September came-in at 119k, better than expectations of 53k. The Unemployment Rate rose to 4.4% from 4.3%, alongside an increase in labour force participation. The ISM Manufacturing Index fell to 48.7, worse than expectations, marking its eighth consecutive reading in contractionary territory. However, the ISM Services reading came in at 52.4, much better than expectations of 50.8 and the prior reading of just 50.0. The headline and core CPI readings did not get published due to the government shutdown at the time. With the government reopening mid-month and the broad data indicating a modest state of the economy, New York Fed President John Williams reignited rate cut chances. He said that there was room to lower rates again in the near-term as the labor market softens. Besides, other known doves including Christopher Waller, Stephen Miran and Michelle Bowman echoed a similar stance. Following this, markets are now pricing-in an 88% chance of a 25bp rate cut in December as compared to 44% a couple of weeks ago.

In the AAA to A- rated IG space, ultra long-dated bonds (maturing beyond 2060) of top tech companies like Amazon, Meta and Apple ticked lower by 2-3%. In the BBB+ to BBB- space, Oracle’s longer-dated notes in particular, were the most prominent losers, down by 3-5%. This came on the back of the jump in its CDS spreads to its highest level in 3 years, on the back of concerns over the company’s AI-based spending and potential overvaluation.

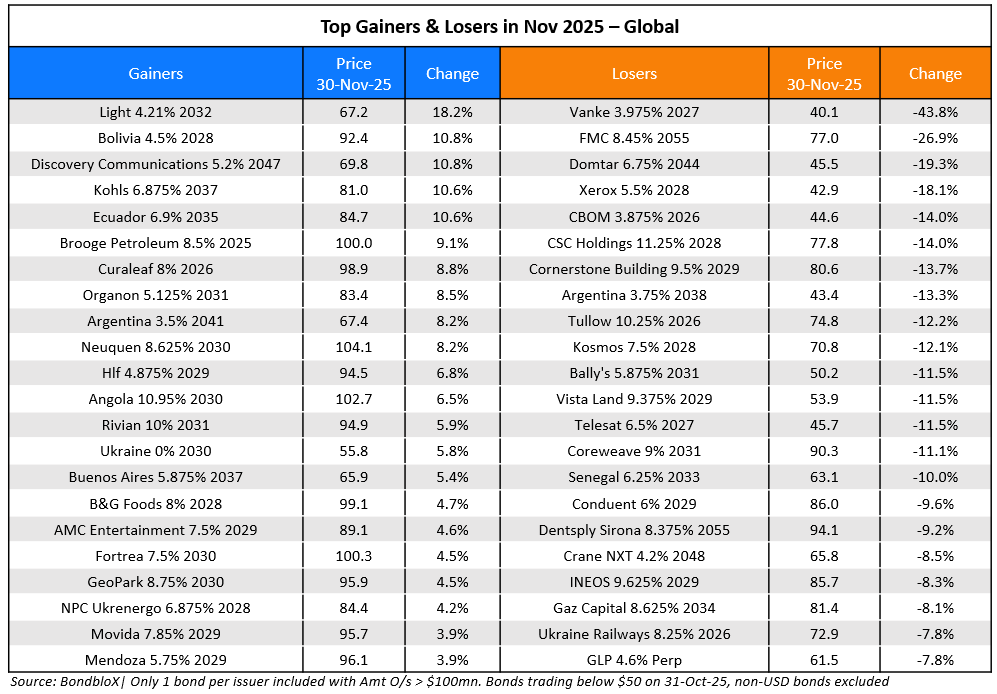

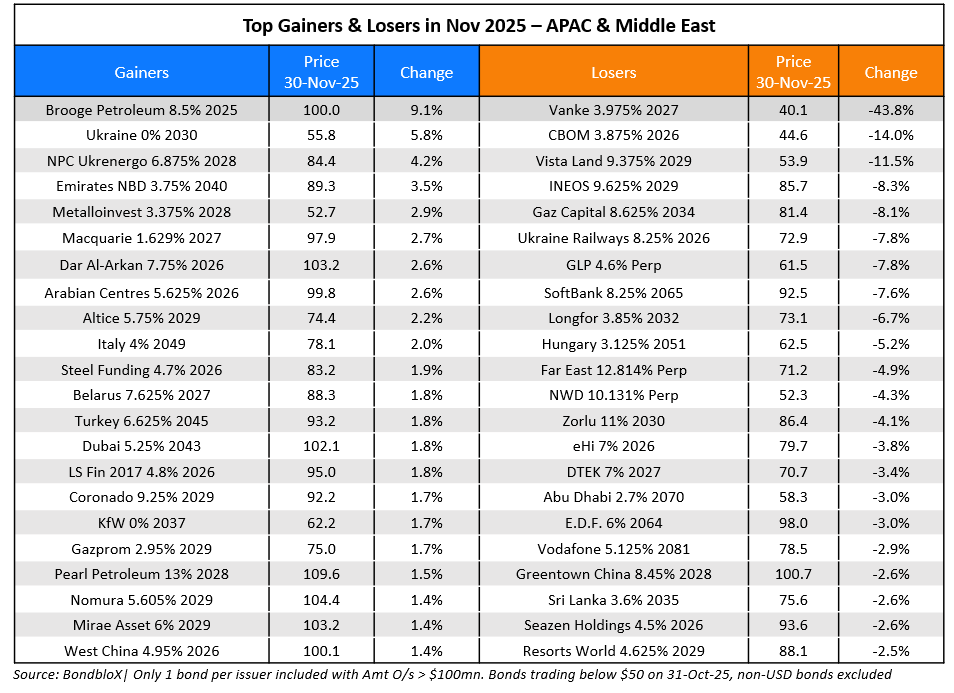

Bolivia’s dollar bonds were the top gainers in the HY category, marching higher by 9-11% during the month. As per Reuters, Bolivian bonds have risen close to 60% YTD, among the best performers in JPMorgan’s EM bond index. Kohl’s bonds followed, gaining by 8-10%, after the company raised its annual forecast for second time this year, signaling early success chances of a turnaround. Ukraine’s dollar bonds gained by 4-6% on the back of renewed hopes of a truce with Russia. Discovery Communications’ long dated bonds also gained by over 4% after the reports of the company wanting Paramount to sweeten its acquisition offer.

Among the losers, Vanke’s dollar bonds lost almost 40% of their value after the company sought extension of local bond payments due in December. This impacted bonds of other real estate companies like Longfor and Seazen, whose bonds saw a drop of over 4%. FMC’s dollar bonds were the second worst performer, dropping by 20-27%, due to weak Q3 results, and its subsequent downgrade to HY status of BB+ by S&P. Domtar’s bonds dropped by 16-19% in the HY space, followed by CSC Holdings’ dollar bonds which dropped by 7-14% across the curve. Senegal’s dollar bonds dropped by 7-10% during the month after it could not secure a funding program deal with the IMF.

Issuance Volumes

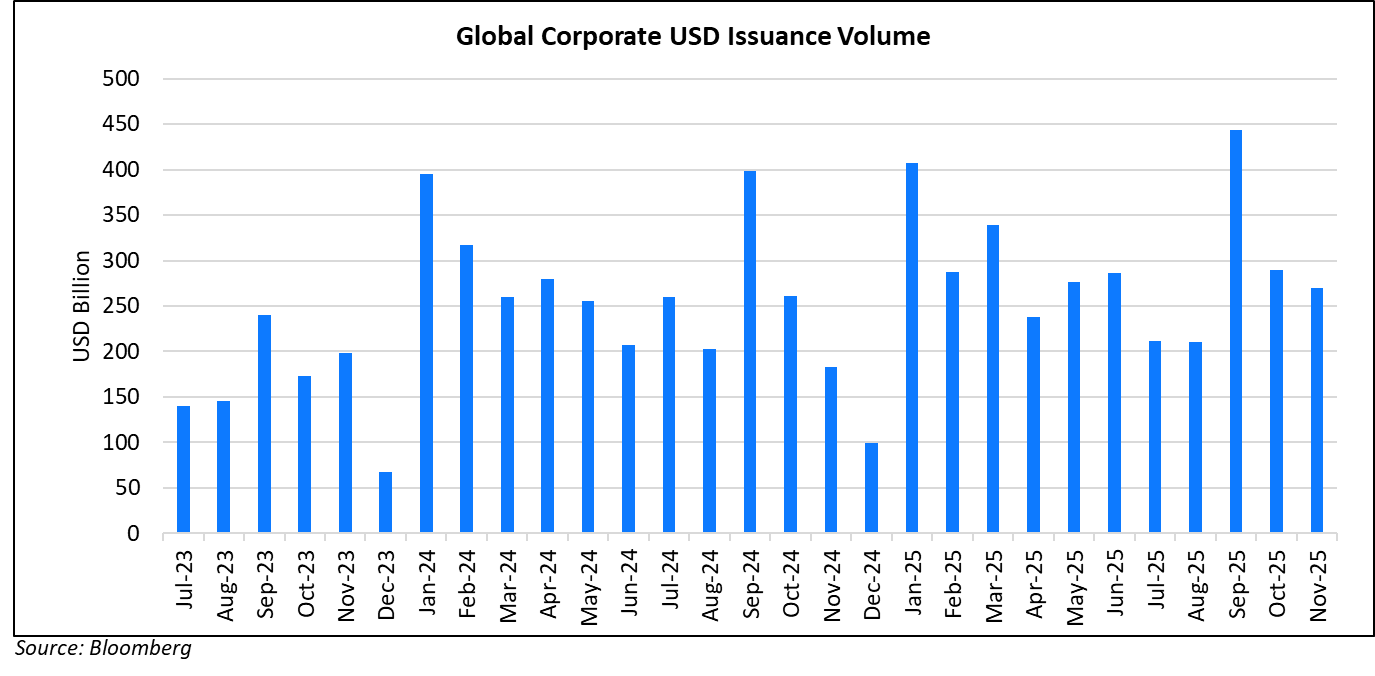

Global corporate dollar bond issuances stood at $270bn in November, 7% lower MoM. As compared to November 2024, issuance volumes were up 47%. 78% of the issuance volumes came from IG issuers with HY comprising 20% and unrated issuers taking the remaining 2%.

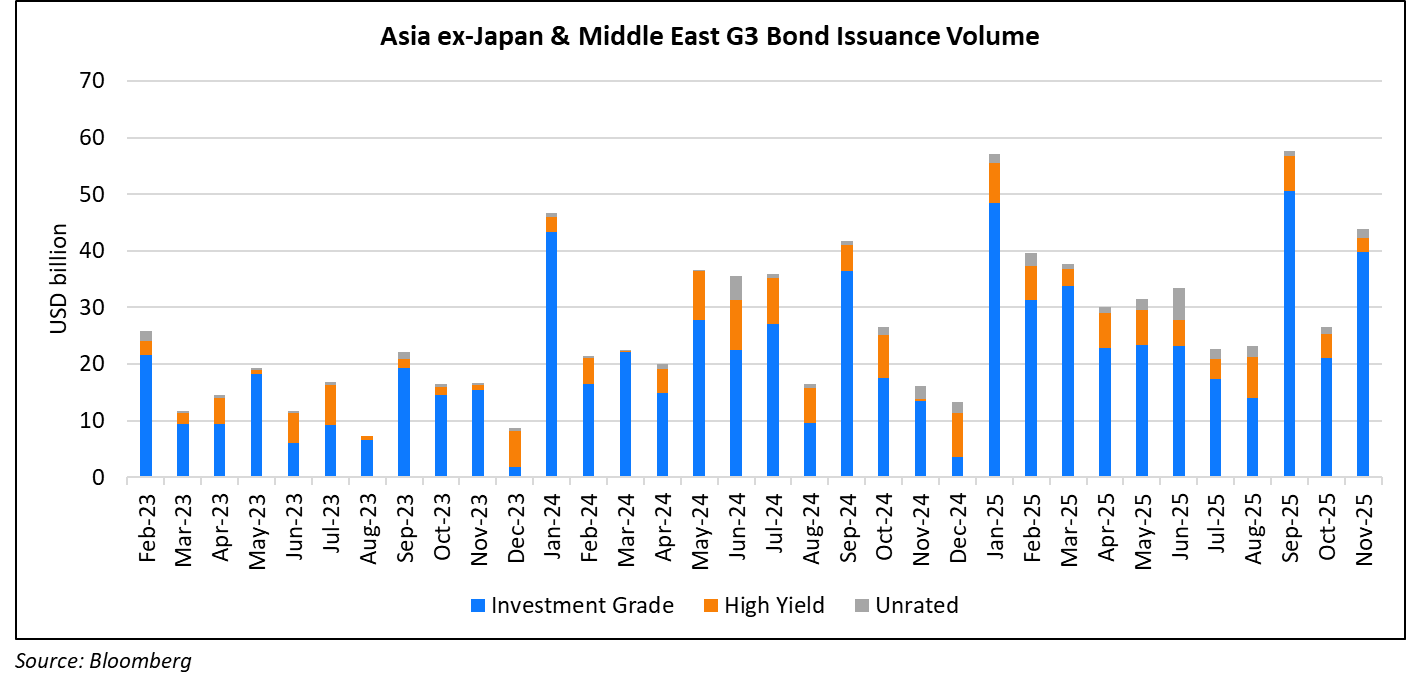

Asia ex-Japan & Middle East G3 issuance stood at $45bn, up 25% MoM and more than doubled YoY. 89% of the volumes came from IG issuers with HY issuing 9% and unrated issuers taking the rest.

Largest Deals

The largest deal globally was led by large American tech companies led by Alphabet’s $17.5bn eight-part deal, Amazon’s $15bn six-part deal, Verizon’s $11bn five-part deal. Some of the other large deals included Global Payments’ $6.2bn four-part issuance, Novartis’ $6bn seven-trancher, Pfizer’s and Morgan Stanley’s $6bn multi-tranche deals each.

In the APAC and Middle East region, deal volumes were led by China raising over $8bn via USD and EUR-denominated issuances, followed by Qatar’s $4bn two-part issuance, Amcor’s €1.5bn two-part deal, Santos’ $2bn two-trancher and Indonesia’s $2bn two-part sukuk issuance.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024