This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

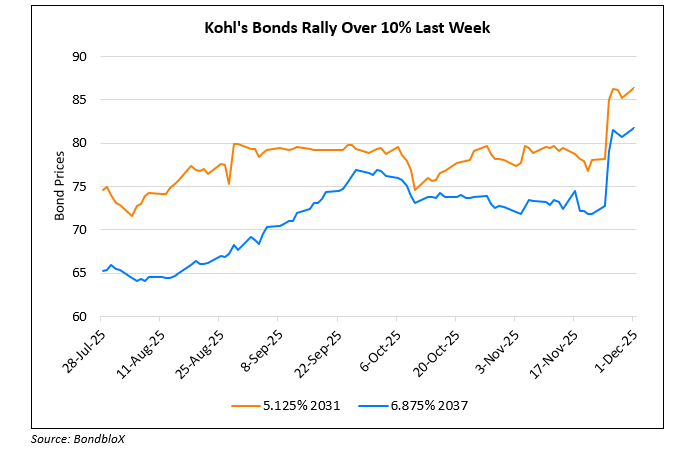

Kohl’s Bonds Rally Amid Improvement in its Forecast

December 1, 2025

Kohl’s bonds and shares and surged by over 10% and 50% respectively last week, after the department store projected a smaller full-year sales decline and a significantly higher annual profit forecast. This marks the second raise in its forecast this year with analysts noting that it signals the early success of its turnaround strategy under Michael Bender, who was recently named CEO. The company now expects adjusted EPS between $1.25-1.45 for the fiscal year 2025, up from a prior range of $0.50-0.80. The annual sales decline is projected to be 3.5-4.0%, a significant improvement from the previously estimated 5-6% decrease. In Q3, Kohl’s posted an adjusted profit of $0.10/share, beating estimates of a $0.20/share loss. Besides, it also reported sales of $3.41bn which topped estimates. The results and stability is said to be driven by cost cuts and strategic moves to attract value shoppers, including adding more coupon-eligible products, investing in proprietary brands, and expanding its Sephora partnership with trendy new brands to appeal to younger customers.

For more details, click here

Go back to Latest bond Market News

Related Posts: