This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

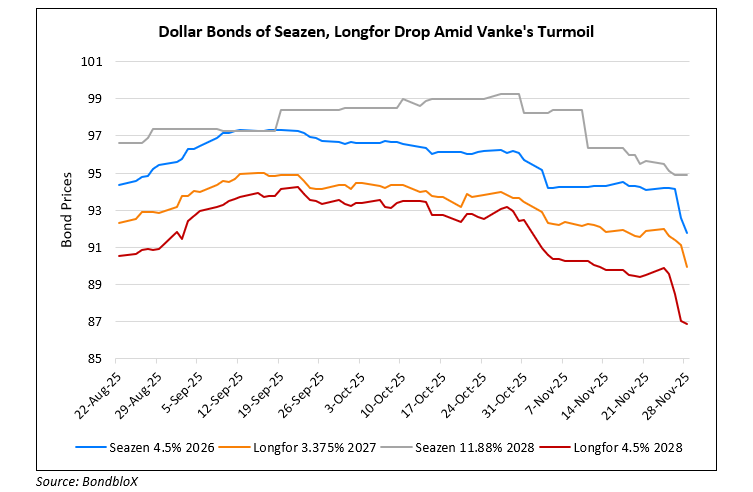

China Vanke’s Loan Request Rejected by Chinese Banks; Dollar Bonds of Seazen, Longfor Drop

November 28, 2025

China Vanke’s short-term loan request was rejected by at least two big local banks as it tried to sought to repay two local bonds worth a combined RMB 5.7bn ($805mn) due next month, as per sources. The talks happened ahead of a Wednesday announcement that the company was seeking bondholders’ approval to extend the maturity of one of the bonds. One of the banks declined the request before Vanke sought to extend its bond while the other rebuffed the attempt. Two other banks were reluctant to proceed, sources said. The loan talks were being led by Vanke’s largest shareholder, Shenzhen Metro Group Co, as per reports. The waning support for Vanke is said to indicate China’s reluctance to support the real estate sector, some analysts noted.

Vanke’s dollar bonds have plunged to deeply distressed levels this week. Vanke’s 3.975% 2027s note remains around 23 cents on the dollar this morning. The impact on Vanke is likely to have translated to other property developers’ bonds including the likes of Seazen and Longfor, whose dollar bonds have also dropped. For instance, Seazen’s 4.5% 2026s and Longfor’s 3.375% 2027s have fallen in tandem by 1.5-2 points, as seen in the chart below.

For more details, click here.

Go back to Latest bond Market News

Related Posts: