This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

IMF-Senegal Discusions to Continue Despite No Immediate Deal

November 7, 2025

Senegal continues to be in discussions with the IMF for a new financial program, despite the multilateral lender not striking any immediate financing program. The IMF mission chief Edward Gemayel said that the lender is committed to moving quickly, with the program potentially reaching the IMF board by December or early next year. The IMF had suspended Senegal’s previous $1.8bn program, triggered by the discovery of misreported debt figures under the former administration, and approval of a new arrangement will depend on the government’s credible plan to restore debt sustainability. Senegal’s total liabilities, including state-owned enterprises, were estimated at 132% of GDP at end-2024, a figure both sides now agree on. The government aims to manage debt risks through conventional refinancing and restructuring measures. Before providing new funding, the IMF board must first decide whether to waive $700mn already disbursed under the suspended program. While the IMF supports Senegal’s reform plans, it cautioned that the 2026 budget is overly ambitious, particularly its projection of a 5%-of-GDP increase in tax revenue.

Senegal’s bonds traded marginally weaker with its 6.25% 2033s down 0.4 points to 71.4, yielding 12.9%

For more details, click here

Go back to Latest bond Market News

Related Posts:

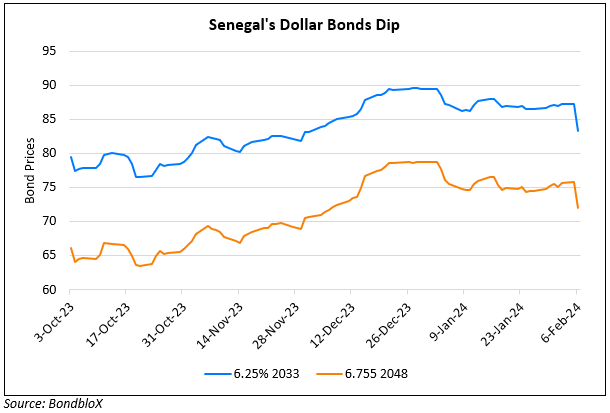

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024