This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

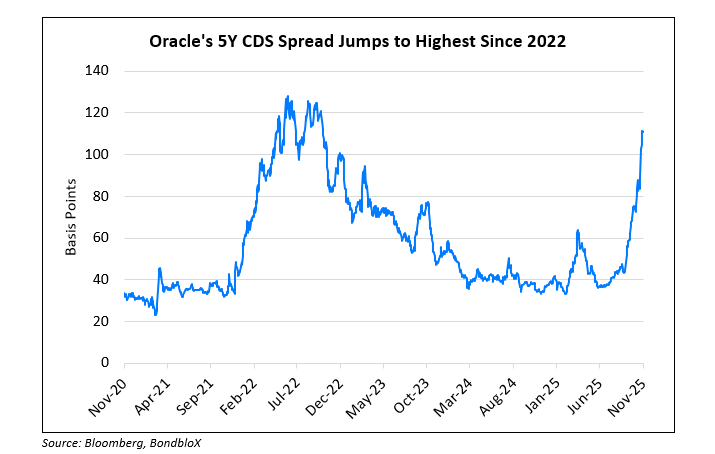

Oracle’s 5Y CDS Spread Jumps to Highest Level in 3 Years

November 21, 2025

Credit Default Swap (CDS) spreads on Oracle’s 5Y debt have more than doubled over the last two months, from 43bp to its current levels of over 110bp, looking at data from Bloomberg (chart below). This comes on the back of its large AI-related spending and debt financing, whilst being rated (Baa2/BBB/BBB) lower than its peers like Microsoft, Broadcom, IBM etc. Oracle is said to have an order backlog of $455bn. OpenAI recently confirmed it had struck a $300bn deal with Oracle to build out data centers in the US. Oracle, in turn, is spending about $40bn on Nvidia chips for those facilities. Oracle’s capital expenditures are projected to exceed $60bn by fiscal 2028 (as per S&P), and some believe that it may consume all operating cash flows for at least three years. Some analysts have raised concerns that Oracle will not make meaningful profits from such large investments. Separately, its cloud business had seen narrower margins than estimated. In September, Oracle raised $18bn via a six-tranche issuance, the third largest deal this year. Its overall debt-to-equity ratio stands at nearly 4.5x, much higher than its peers. While analysts note that Oracle is not expected to default soon, the surge in CDS activity might reflect a position by traders/speculators to generate profits on the back of a potential broader drop in the AI sector.

For more details, click here

Go back to Latest bond Market News

Related Posts: