This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Why Did NWD’s Bonds Crash? Key Events, Asset Sales, Refinancing Moves and More

July 17, 2025

New World Development (NWD), one of Hong Kong’s largest property developers, is facing mounting financial pressure amid a prolonged real estate downturn and tightening credit conditions. Over the past year, the company has been urgently working to manage its debt load, undertaking a series of asset sales, refinancing efforts, and cost-cutting measures.

With liquidity stress intensifying, NWD is relying on the sale of several properties, high-profile refinancing packages, and key project launches in Hong Kong to stabilize its financial footing. This timeline outlines the company’s ongoing efforts to navigate a critical period marked by bond payment risks, falling revenues, and shifting investor confidence.

Timeline of Events

July 10, 2025: It seeks to sell real estate assets in mainland China. It plans piecemeal divestments, including prominent K11 buildings in Hangzhou, Shenzhen and Shanghai, to ease ongoing liquidity stress. It was also in talks earlier with Chinese state-owned firms about a potential sale.

July 4, 2025: It plans to raise up to $2bn via a new 3Y secured loan, backed by its flagship asset, Victoria Dockside. The loan’s minimum target size is of HKD 4bn ($510mn) and could be scaled up to HKD $15.6bn ($2bn), with proceeds to be used to repay debt.

June 30, 2025: It is said to have achieved its 2025 property sales target of HKD 26bn ($3.3bn) helped by its Deep Water Pavilia project in southern Hong Kong. Separately, as per a report, bankers who worked on NWD’s refinancing deal are said to have pitched the deal to their credit committees highlighting that the stakes were high and a failure to secure a deal could have caused a larger crisis in the Hong Kong property sector.

June 27, 2025: NWD secures full written commitments from banks for a HKD 87.5bn ($11.1bn) loan refinancing package. This makes it one of the largest in Hong Kong and comes just days before key debt deadlines, including HKD 9.2mn ($1.2mn) in bond interest payments due in the next few days.

June 18, 2025: It made a $5.05mn coupon payment on its USD 5.875% 2027s. The coupon is coming due and a missed payment could have triggered an event of default if not settled within 14 days. This gives NWD some time as it works toward finalizing its pursuit in the much needed $11.1bn loan refinancing.

June 13, 2025: It received over 87% backing from banks in the form of written commitments for its planned $11.2bn loan refinancing. This is a significant increase from the 60% support it had received as of end-May.

June 6, 2025: NWD has priced the first batch of 101 apartments in its co-developed Deep Water Pavilia project at HKD 20,932 ($2,668) per square foot. This is the lowest rate for any residential project in the city’s posh Southern district.

June 3, 2025: The developer’s $2.6bn mega-mall project, 11 SKIES, is said to be experiencing slow progress with only about 40% of the mall’s space being leased. The key issues include delayed tenant move-ins, a perceived reluctance from airlines to shift flights to the airport terminal adjacent to the project, and a subdued economic outlook hurting tourist spending.

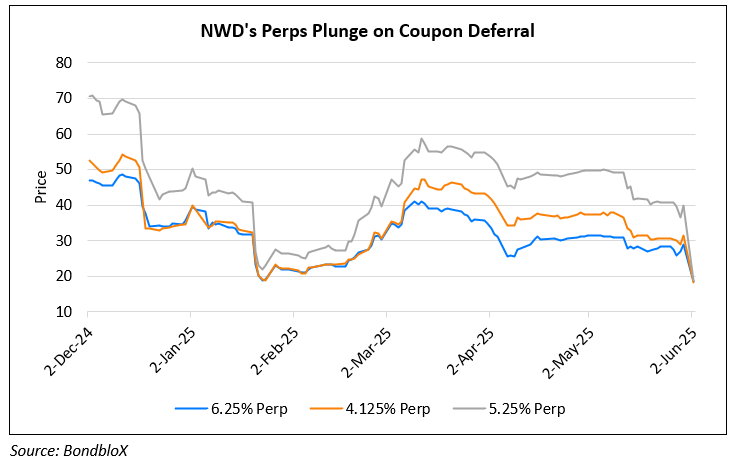

June 2: NWD announced the deferral of interest payments on four of its perpetual bonds. A spokesperson said that it continues to “manage its overall financial indebtedness whilst taking into account the current market volatility and continues to comply with its existing financial obligations”. It plans to postpone coupon payments worth $77.2mn due next month, as per Bloomberg.

May 29, 2025: NWD’s 6.15% Perp fell by over 4.5 cents to 55.6 cents on the dollar. This comes on the back of concerns surrounding the lack of a call notice for its $345mn 6.15% Perp callable on June 16, which would lead to extension risk and the coupon being reset. At current levels, this would imply a new adjusted coupon of ~10.20% (i.e., US 3Y Treasury yield plus the reset spread of 620.1bp).

May 23, 2025: NWD secured commitments from about 10 banks for a HKD 87.5bn ($11.2bn) loan refinancing initiative, as per Bloomberg. Major lenders including Bank of China, HSBC, Standard Chartered have reportedly completed internal approvals, adding upto HKD 20bn ($2.6bn) in commitments.

May 21, 2025: It has reportedly asked banks to complete the approval of two new loans totalling HKD 87.5bn ($11.2bn) for refinancing by end-June. This was partly driven by the upcoming expiration of a covenant waiver on NWD’s existing loans next month, they noted. Also, has not issued a call notice for its outstanding 6.15% Perp within the 30-day notice period prior to the first call date on 16 June 2025.

April 2, 2025: NWD is revising the terms of two loans totaling HKD 87.5bn ($11.2bn) to attract lender support. The company plans to offer Victoria Dockside, a flagship commercial complex, as secondary collateral, though it is already pledged for a new HKD 15.6bn ($2bn) loan led by Deutsche Bank.

March 13, 2025: Ares Management Corp is said to have recently approached at least two banks to acquire debts from NWD at a discount, as per sources. The specific discount or amount thereof were not available. The potential move is considered part of Ares’ strategy to participate in NWD’s ongoing refinancing efforts. However, sources noted that the two banks did not show interest in engaging with Ares, and the current status of these discussions remains unclear.

March 3, 2025: NWD posted a loss of HKD 6.63bn ($852mn) for 1H2024, a sharp decline from a profit of HKD 502mn ($65mn) last year, driven by writedowns on residential and commercial properties. CEO Echo Huang emphasized the company’s focus on reducing debt and plans to sell HKD 26bn ($3.3bn) in assets, including residential and commercial properties, within the current financial year.

February 19, 2025: NWD proposed using $3.8bn of additional properties as collateral to refinance bank loans maturing in 2027 and beyond, as it looks to ease liquidity pressure. It has allegedly sent revised preliminary terms of the three-year refinancing deal to banks.

February 14, 2025: The developer is in discussions to arrange a loan with three banks to refinance HKD 58.1bn ($7.46bn) in bank borrowings, maturing in 2025 and 2026. Bank of China, DBS Bank and HSBC are likely to arrange the loan, the details of which could be released to other prospective lenders soon.

February 12, 2025: The company has raised the prices for a new batch of units at its State Pavilla luxury residential project in Hong Kong. This comes as a result of the prospective buyers outnumbering the project’s supply of flats by more than 28 times. More than 4,800 buyers had written cheques for a chance to buy one of the 168 listed units. The 39 units in the third price list, unveiled on Tuesday, are priced between HKD 6.35mn ($815k) and HKD 20.39mn ($2.6mn) after discounts.

February 7: NWD’s dollar bonds rose by over 3 points across the curve, after reports suggested that the developer was set to release its first price list for 88 units at its State Pavilia luxury residential project.

January 24, 2025: As per an HKEX filing, NWD announced that it has successfully refinanced ~HKD 17.8bn ($2.3bn) of its bank loans. The developer added that it will continue to “carry out its businesses as usual” and will continue to engage with its stakeholders, including its lenders and bondholders. This comes after recent rumors and speculations with regard to debt restructuring talks.

January 21, 2025: NWD denied rumors that it has started debt restructuring talks, that included its dollar bonds. This comes after NWD asked banks to postpone the due dates of some bilateral loans in late-2024, and asked for waivers on loan conditions, causing concerns over its ability to service its large debt load.

January 6, 2025: NWD’s infrastructure arm CTF Services Ltd., formerly (NWS Holdings) is said to be in early discussions with Yuexiu Group regarding a $2bn sale of a bundle of roads in mainland China, as per sources. They noted that discussions have also taken place with other buyers and been communicated that the package of roads could be split into smaller chunks for sale.

December 18, 2024: NWD is said to have sent out a letter to its bank lenders, seeking a waiver on loan conditions, as per Debtwire. It said that the developer was seeking forbearance, after its net debt-to-assets ratio breached the 100% threshold, allowing its lenders the ability to recall their loans.

December 17, 2024: Dollar bonds of NWD dropped by over 1.5 points across the curve. Local media reported that there was a further delay in the completion of NWD’s Pavilia Farm III project in the Tai Wai district of Hong Kong. The housing project is now expected to be completed by March 2026, a year later than the original date.

December 11, 2024: NWD’s dollar bonds continued to rise by over 1 point. The company sold an industrial building, Artisan Lab in Hong Kong’s Kowloon area for HKD 620mn ($79.8mn), as per Sing Tao Daily. NWD may still need to sell more assets in 2025 even after its above disposal, as per Bloomberg Intelligence. They added that the recent asset sale could lower the developer’s net debt-to-shareholders’ equity ratio by 0.3%.

December 2, 2024: NWD appointed Echo Huang Shaomei as CEO, replacing Eric Ma Siu-cheung after just two months. Ma resigned on November 29 to pursue personal commitments, and the leadership change comes amid NWD’s ongoing debt crisis and family succession issues. Its debt-to-equity ratio of 55% is among the highest in the sector and has raised concerns among investors. Separately, the developer has agreed to sell its 75% stake in the Kai Tak Sports Park to Chow Tai Fook Enterprises (CTFE) for HKD 416.7mn ($53.5mn). CTFE, the private holding firm of NWD’s controlling Cheng family, will also assume a HKD 679.9mn ($87.4mn) loan.

September 2, 2024: NWD warned of reporting its first annual loss in 20 years due to a write-down of assets after an extended property market slump. It expects a loss of HKD19-20bn ($2.4-2.6bn) for the year, and cited asset impairments, investment losses and higher interest rates for the expected loss.

Go back to Latest bond Market News

Related Posts:

NWD Warns of Potential Loss of Up to $871mn

February 24, 2025

NWD Posts $852mn Loss; Vanke to Repay Local Bond

March 3, 2025