This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

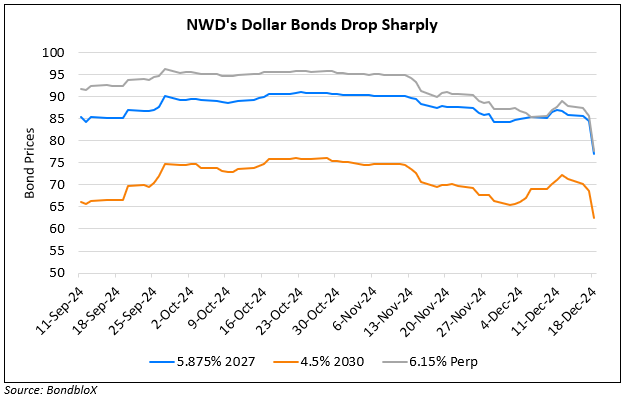

NWD’s Dollar Bonds Plummet on Reports of Seeking Waivers on Loan Conditions

December 18, 2024

NWD is said to have sent out a letter to its bank lenders, seeking a waiver on loan conditions, as per Debtwire. It said that the developer was seeking forbearance, after its net debt-to-assets ratio breached the 100% threshold, allowing its lenders the ability to recall their loans. Jeff Zhang, an analyst at Morningstar said, “Despite the company’s recent CEO change, deleveraging will still be a long process. It’s too early to say it will definitely default”. NWD currently has other financing channels in mainland China. NWD has $16bn in net debt, and a 55% debt-to-equity ratio. While it has refinanced expensive loans in recent times and resorted to asset sales, the company continues to face financial issues.

For more details, click here

Go back to Latest bond Market News

Related Posts:

NWD Completes $4.5bn in Loans, Repayments YTD

June 25, 2024

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

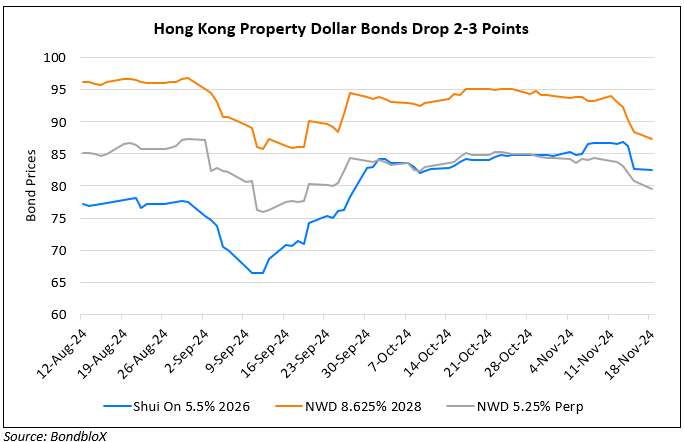

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024