This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Completes $4.5bn in Loans, Repayments YTD

June 25, 2024

New World Development (NWD) said that it has completed HKD 35bn ($4.5bn) in low cost, long-term loans since January. The loans would help fill its liquidity needs, whilst also increasing the proportion of yuan loans to reduce overall financing costs. For instance, SCMP notes that the average interest rate for its offshore loans was about Hibor plus 110bp while selected onshore yuan loans were set at fixed rates of 2.9-3.0%. The developer has also refinanced a hotel loan for a JV with Abu Dhabi Investment Authority (ADIA) for a total amount of HKD 9.5bn ($1.2bn). The company said that it will continue to “optimise its loan portfolio and seek low-cost onshore loans” to control financing costs.

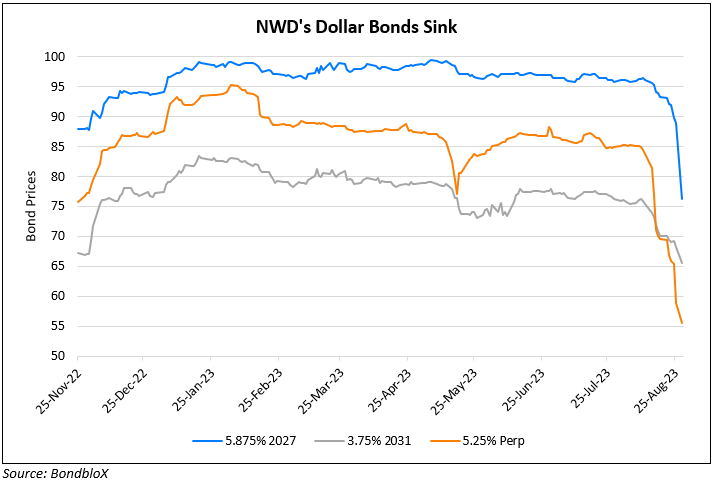

NWD’s dollar bonds traded stable with its 6.15% Perp at 93.9, yielding 15.4% to its first call date in March 2025.

For more details, click here

Go back to Latest bond Market News

Related Posts: