This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hong Kong’s NWD, Li & Fung, Hysan, Lifestyle International See Their Dollar Bonds Slip

August 25, 2023

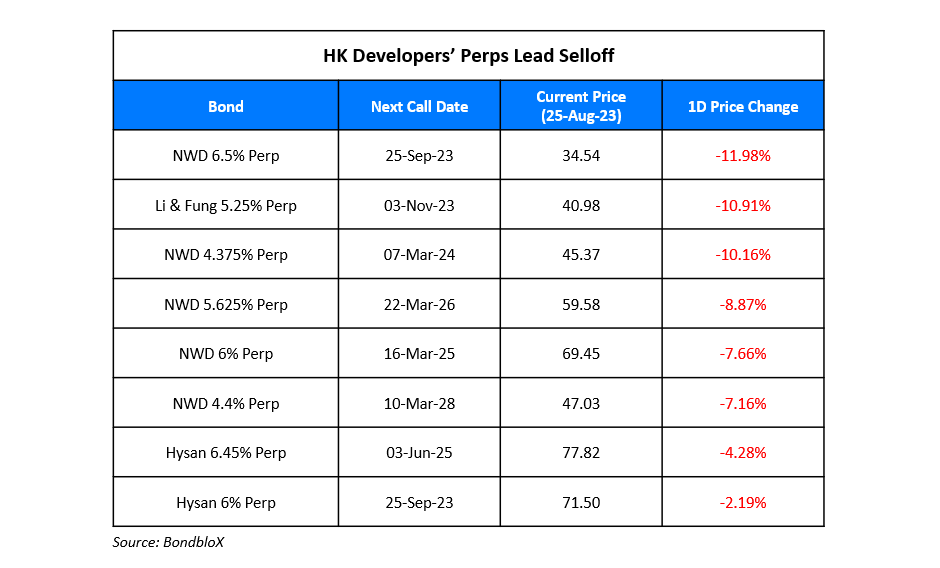

Dollar bonds of several Hong Kong companies dropped sharply by 3-7 points on Thursday. This includes dollar bonds from issuers including NWD, Li & Fung, Hysan and Lifestyle International. Hong Kong property developers reported their lowest sales since 2019 for new residential units completed. They sold only 55% of apartments completed in the H1, compared to the average sell-through rate of 78% in the last five years, as per real estate agency JLL. Norry Lee, a senior director at JLL said that it showed “most buyers have adopted a wait-and-see attitude and are reluctant to buy flats as they anticipate housing prices will drop”.

The move shows a broad weakness in companies tied to the real estate sector in Hong Kong. In the table above, we have listed the top losers among these issuers. Other dollar bonds also traded weaker.

Go back to Latest bond Market News

Related Posts:

Sun Hung Kai Becomes HK’s Largest Home Seller Overtaking NWD

January 6, 2022

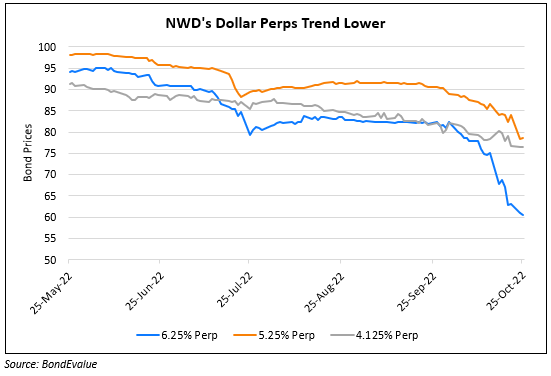

NWD’s Dollar Perps Fall by Over 5 Points

October 25, 2022

New World Development Launches Buyback at Strong Premiums

December 5, 2022