This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

Hong Kong’s New World Development (NWD) has warned of reporting its first annual loss in 20 years due to a write-down of assets after an extended property market slump. It expects a loss of HKD19-20bn ($2.4-2.6bn) for the year, and cited asset impairments, investment losses and higher interest rates for the expected loss. Bloomberg notes that home prices in Hong Kong are at its lowest in eight years adding to the record-high vacancy rates in the office market that has kept rental incomes low. Besides, NWD also faces succession planning issues. NWD is trying to raise capital and is banking on property sales for it, whilst also trying to sell non-core investment properties.

NWD’s dollar bonds were trading weaker with its 6.15% Perp down 0.2 points to 97.9, yielding 10.2%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

NWD Completes $4.5bn in Loans, Repayments YTD

June 25, 2024

Sun Hung Kai Becomes HK’s Largest Home Seller Overtaking NWD

January 6, 2022

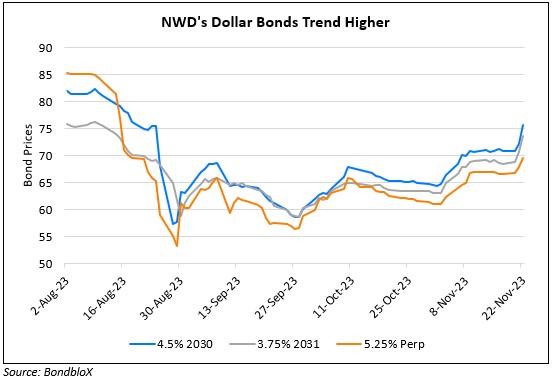

NWD’s Dollar Bonds Move Higher

November 22, 2023