This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Asks Banks to Complete ~$11.2bn of Loan Approvals; No Call Notice Issued yet on 6.15% Perp

May 21, 2025

New World Development (NWD) has reportedly asked banks to complete the approval of two new loans totalling HKD 87.5bn ($11.2bn) for refinancing by end-June, as per Bloomberg. This was partly driven by the upcoming expiration of a covenant waiver on NWD’s existing loans next month, they noted. Separately, NWD has not issued a call notice for its outstanding 6.15% Perp within the 30-day notice period prior to the first call date on 16 June 2025. As per the bond documents, the coupon will reset to the US 3Y Treasury yield plus a spread of 620.1bp, if not called. Going by prevailing market data, this would imply a new adjusted coupon of ~10.15%. NWD company retains the right to redeem the perps in whole or in part at any time provided that at least $250 mn remains outstanding if NWD chooses to carry out a partial redemption.

Go back to Latest bond Market News

Related Posts:

NWD Completes $4.5bn in Loans, Repayments YTD

June 25, 2024

NWD Warns of First Annual Loss in Two Decades

September 2, 2024

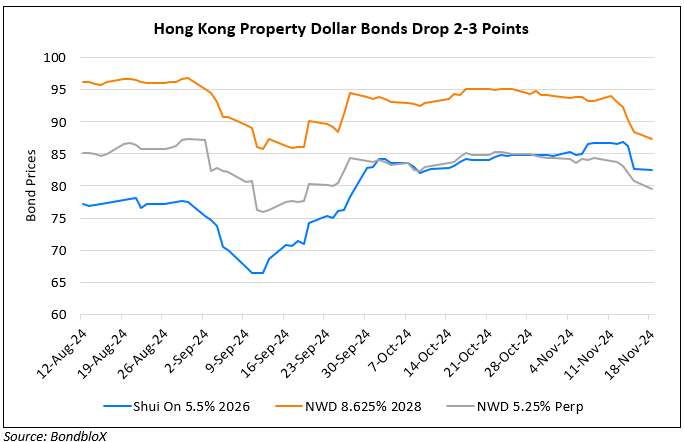

Dollar Bonds of NWD, Shui On Drop Sharply

November 18, 2024