This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

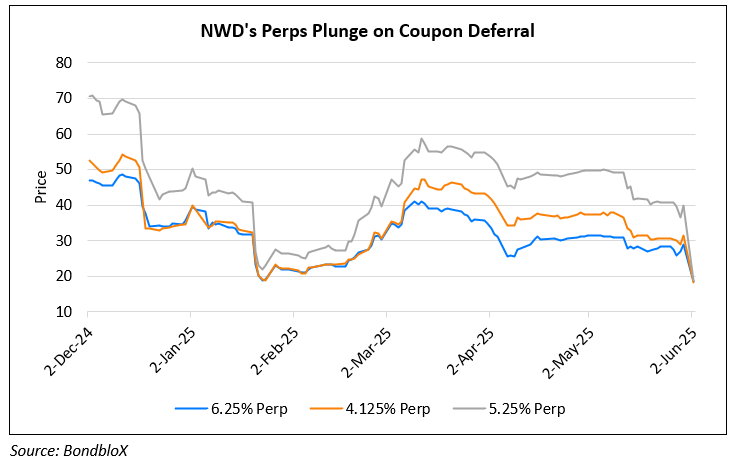

NWD Perps Nosedive After Coupon Deferral

June 2, 2025

New World Development (NWD) announced the deferral of interest payments on four of its perpetual bonds late on Friday. The developer’s spokesperson said that it continues to “manage its overall financial indebtedness whilst taking into account the current market volatility and continues to comply with its existing financial obligations”. It plans to postpone coupon payments worth $77.2mn due next month, as per Bloomberg. Residential property development in Hong Kong and mainland China account for 50% of NWD’s revenue with home values dropping 28% from their all-time high in 2021. The developer reported its first annual loss in 20 years and currently has liabilities amounting to $26.9bn. NWD is reported to have finalised a $11.16bn refinancing plan by end-June and has secured 40% of the commitment. Bloomberg reported that NWD is looking for more banks to join in an ~HKD15.6bn ($1.99bn) loan backed by its key asset, Victoria Dockside.

NWD’s Perp are down by 20 points, led by its 6.15% Perp that has more than halved in value since Friday. It currently trades at 18 cents to the dollar. Track all NWD Bonds here.

The following chart exhibits the bond price movement for NWD Perps over the last six months.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

HK Airlines Plans $6.2bn Debt Restructuring

September 29, 2022

NWD Warns of Potential Loss of Up to $871mn

February 24, 2025