This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NWD Secures Support from 10 Banks for $11.2bn Loan Refinancing

May 23, 2025

New World Development (NWD) has secured commitments from about 10 banks for a HKD 87.5bn ($11.2bn) loan refinancing initiative, as per Bloomberg. Major lenders including Bank of China, HSBC, Standard Chartered have reportedly completed internal approvals, adding upto HKD 20bn ($2.6bn) in commitments.

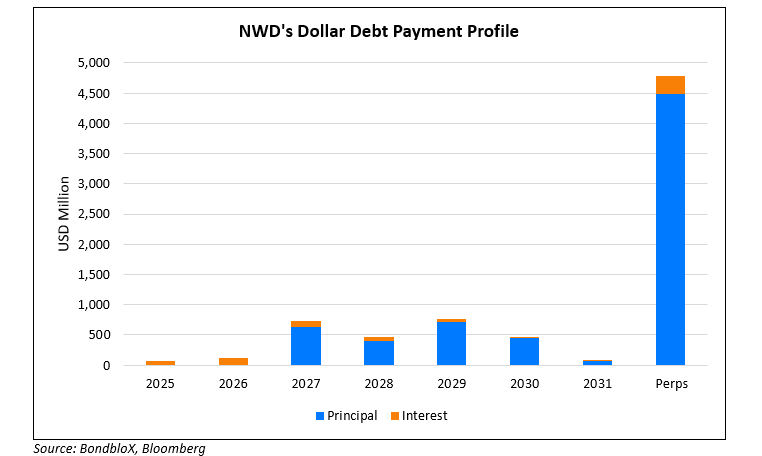

NWD is said to be under pressure to complete the refinancing initiative by the end of June as a covenant waiver on its existing facilities is set to expire. The company also has coupon payments of about $116.6mn due in June for multiple bonds, including four perpetual notes. Recently, NWD had failed to issue a call notice for its outstanding 6.15% Perp. As per the bond’s terms, it had to provide notice at least 30 days prior to first call date on 16 June 2025. At current levels, this would imply a new adjusted coupon of ~10.20% (i.e., US 3Y Treasury yield plus the reset spread of 620.1bp). NWD has a total of $13.4bn in debt payments due across all currencies inclduing its bonds, loans and interest payments. Of this, $7.5bn remains outstanding in dollar denominated payments.

In the chart above, we have provided a summary of NWD’s outstanding principal and interest payments due on dollar denominated debt.

For more details, click here

Go back to Latest bond Market News

Related Posts: