This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

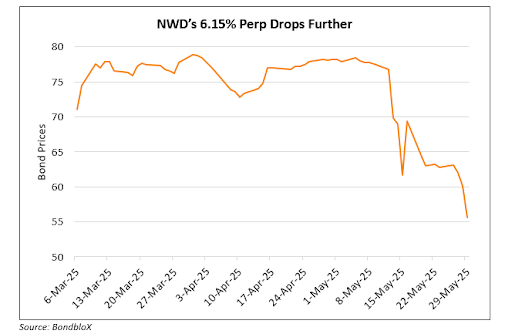

NWD’s 6.15% Perp Drops by 4.5 Points Amid Upcoming Payments

May 29, 2025

Hong Kong developer New World Development (NWD’s) 6.15% Perp fell by over 4.5 cents to 55.6 cents on the dollar. This comes on the back of concerns surrounding the lack of a call notice for its $345mn 6.15% Perp callable on June 16, which would lead to extension risk and the coupon being reset. At current levels, this would imply a new adjusted coupon of ~10.20% (i.e., US 3Y Treasury yield plus the reset spread of 620.1bp). NWD faces $116.6mn in coupon payments due across multiple bonds in June, including four perpetual notes (the first of which falls on June 9). The company is required to give investors 5-10 business days’ advance notice in case of deference of any payments. It should be noted that deferring coupon payments on NWD’s perps does not constitute an event of default. NWD is also trying to finalize a HKD 87.5bn ($11.2bn) loan refinancing agreement with over 50 banks by end-June. Bankers in Hong Kong are closely monitoring the situation as a covenant waiver on New World’s existing loans is set to expire next month. As per Bloomberg, a failure to secure this refinancing before the covenants expire could trigger demands for immediate repayment of the loan. NWD’s is among as one of Hong Kong’s most leveraged developers. This is set against a property market backdrop where Hong Kong home values have fallen 28% from their 2021 peak, and commercial office vacancies remain near historical highs.

Go back to Latest bond Market News

Related Posts: