This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

October 2025: 71% of Dollar Bonds Rise as IG Outperforms HY, Continuing the Positive Trend

November 3, 2025

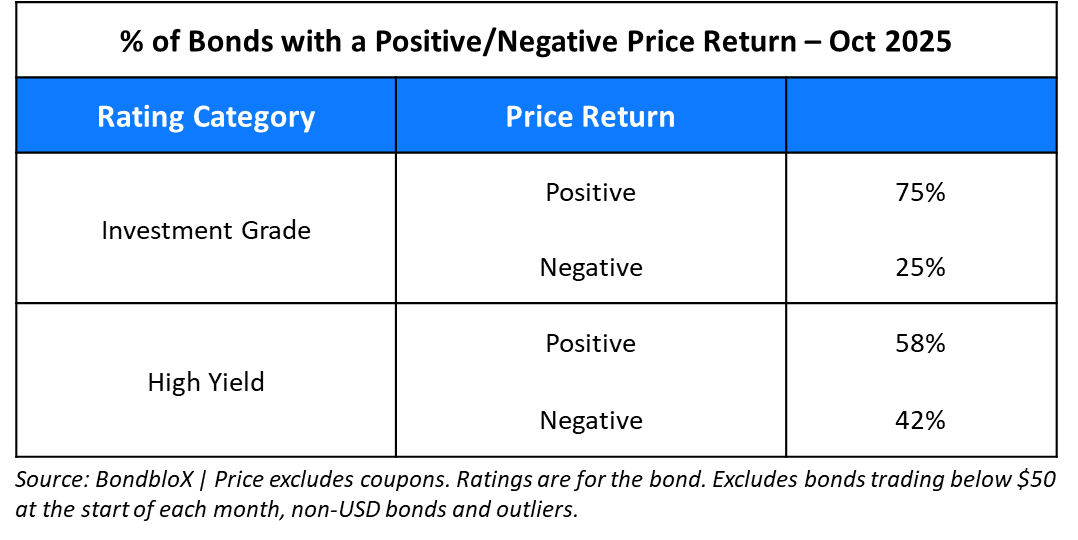

October 2025 was a solid month for bond investors, with 71% of dollar bonds ending higher (price returns ex-coupons). 75% of Investment Grade (IG) bonds ended in the green, outperforming High Yield (HY) bonds where 58% ended in the green. US Treasury yields dipped during the beginning of the month due to soft PMI data, alongside the US government shutdown. However, following a hawkish FOMC meeting late in the month, Treasury yields rebounded and recovered most of the move, thus weighing on bonds.

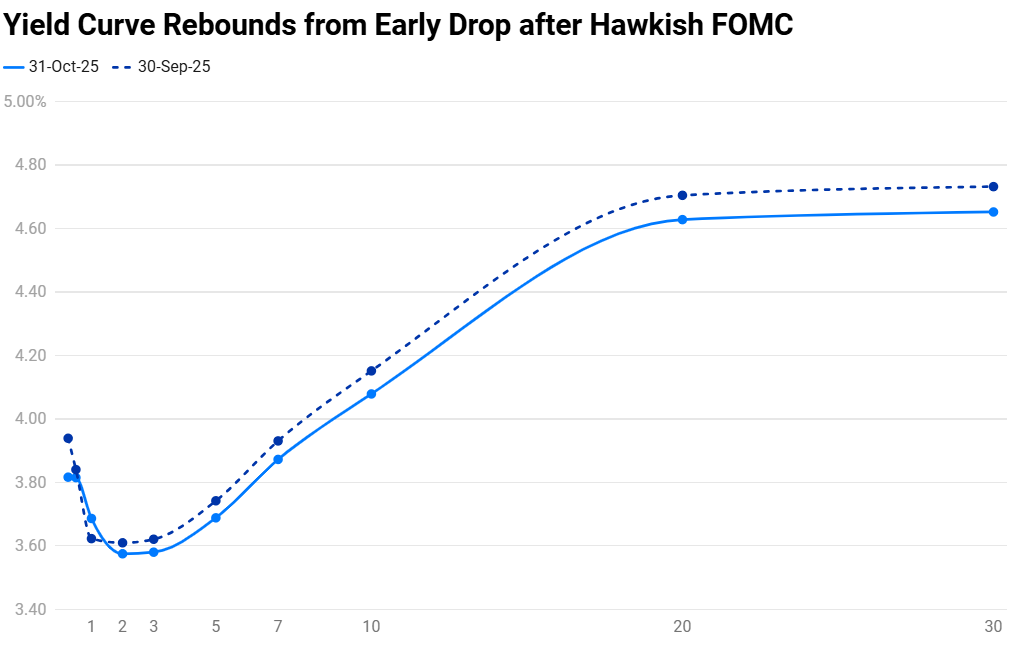

The month of October saw the Treasury yield curve shift marginaly lower from September — the 2Y yield fell by 3bp while the 10Y ended 8bp lower. Due to the US government shutdown, the much awaited jobs report comprising of the NFP, Unemployment Rate and AHE was not published. The ISM Manufacturing PMI contracted for a seventh straight month, coming in at 49.1 vs. expectations of 49.0, underscoring the weakness in the sector. ISM Services PMI for September came in at 50.0, softer than expectations of 51.7 and roughly similar to the prior month’s poor 50.0 reading. The inflation readings were delayed and came in late during the month. The Headline and Core CPI reading showed a moderation in inflation. US CPI YoY rose by 3.0%, softer than expectations of 3.1%. Core CPI came in at 3.0%, lower than expectations and the prior month’s print. The broad softness in the data saw markets expect a 25bp Fed rate cut in both of its October and December meetings. However, while the Fed cut rates by 25bp during the month, Chairman Jerome Powell hinted that a 25bp rate cut in their December meeting was “far from” a foregone conclusion. The probability of a 25bp rate cut for December has fallen from nearly 100% prior to the recently concluded FOMC meeting to about 65% presently.

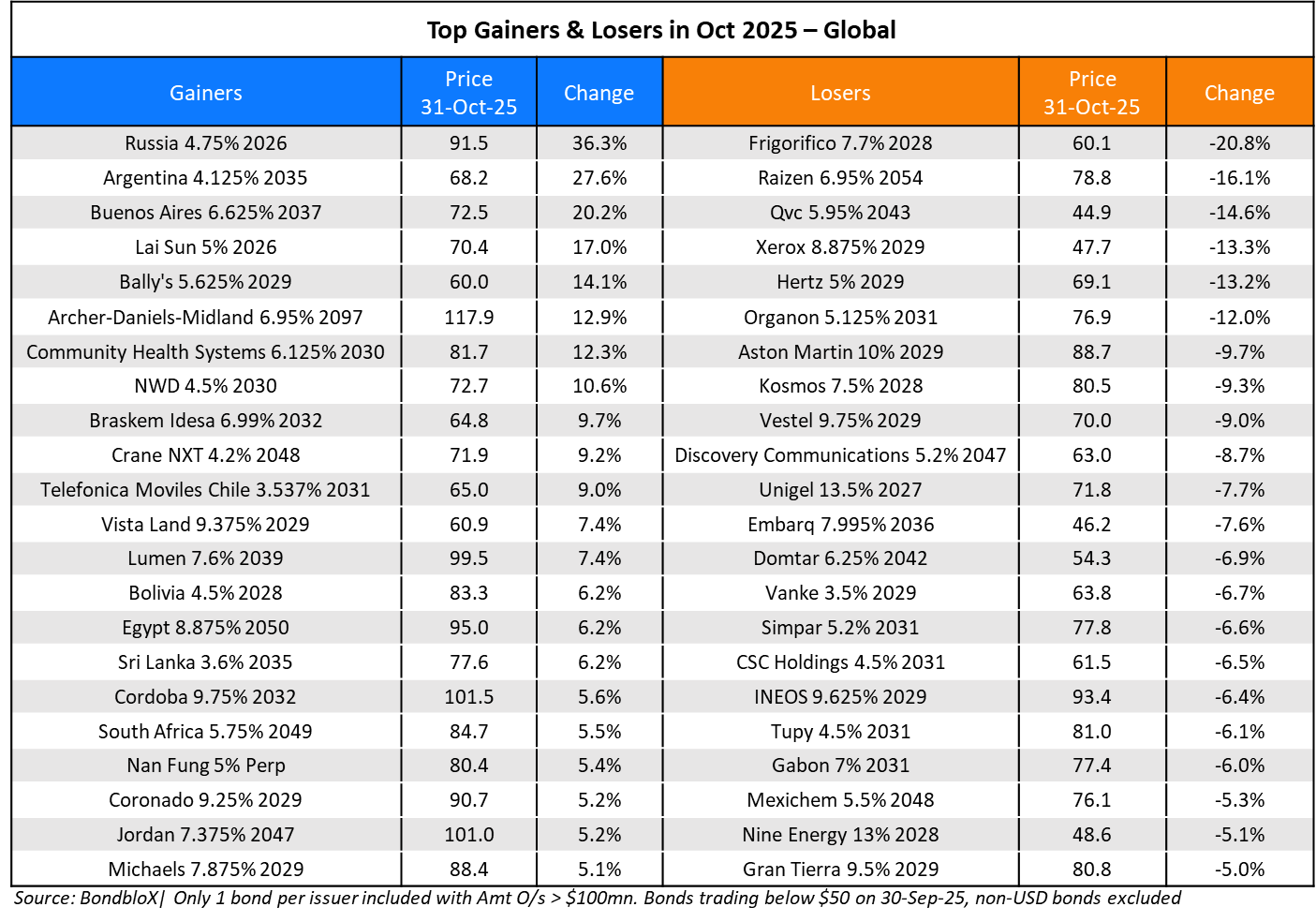

In the IG space, Israel’s sovereign bonds were among the top gainers, returning 3-4% during the month on the back of ceasefire agreement in Gaza. Romania’s dollar bonds also rallied about 3% across the curve. Among the top losers, Raizen’s bonds fell sharply by 13-16% due to increased leverage concerns and subsequent downgrade by Fitch. Oracle’s bonds also fell by 2-3% due to heavy investments in AI financed through significant borrowing, leading to a rise in CDS spreads.

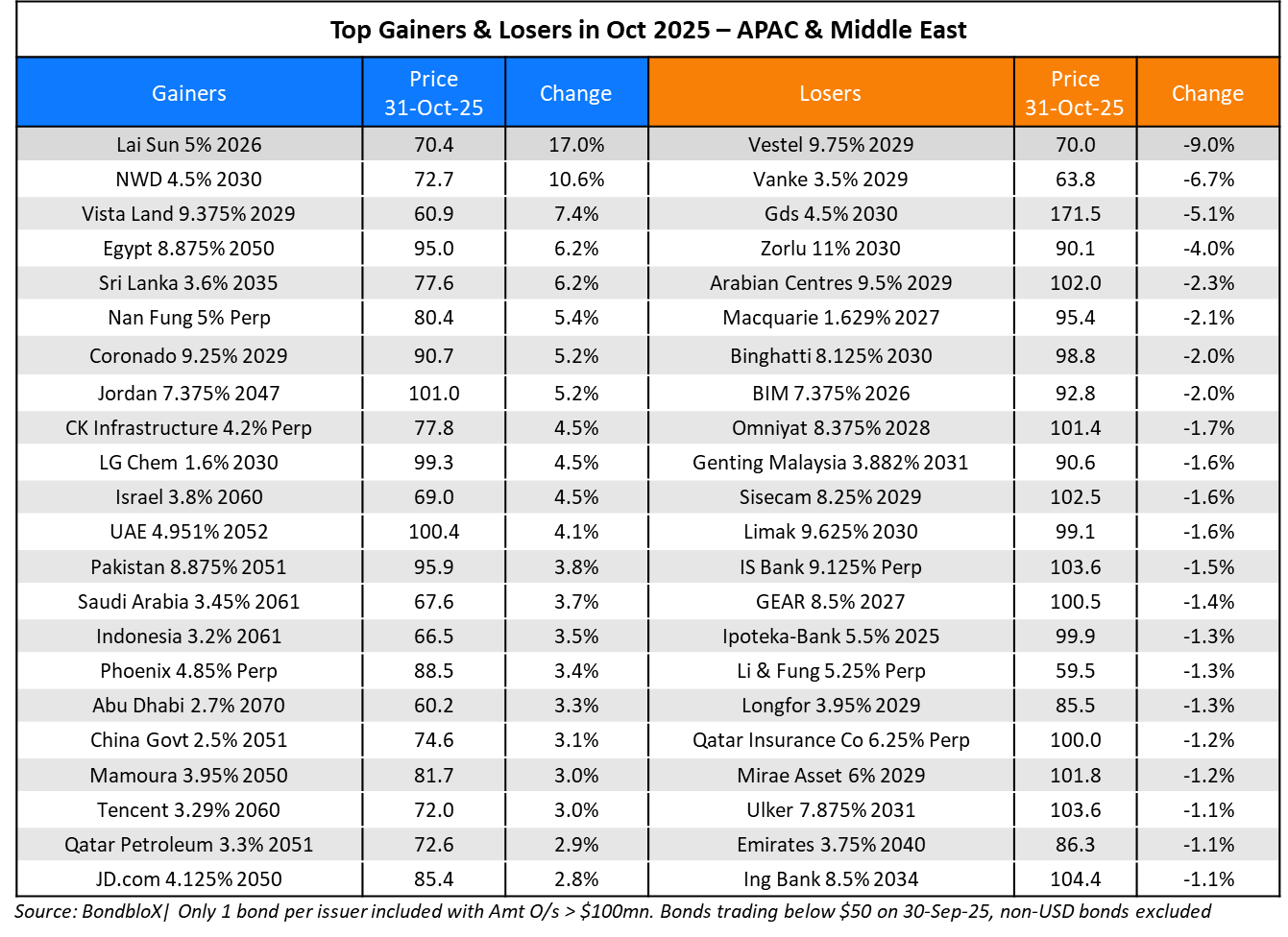

In the HY space, Argentina’s and Buenos Aires’ dollar bonds led the charts gaining by 17-25% after the US announced a $40bn support to the nation; also, Javier Milei’s party secured a victory in midterm elections leading to a positive investor sentiment. CHS’ bonds gained 11-12% on the back of its positive Q3 results. Dollar bonds of NWD, continuing their rally from previous quarter, increased by 8-10%, on the back of a media report on a potential refinancing and take-private deal. Besides, the company also secured $750mn loan facility from Deutsche Bank at end-September. Egypt’s dollar bonds were also up by 5-6% across the curve after it was upgraded to B by S&P.

QVC’s bonds were among the top losers in the category, retracing by 14% from the upmove seen in the previous quarter. Xerox’s bonds continued to ease, dropping by 10-13% after reporting weak 2Q25 results and a double downgrade by S&P in span of 2 months. Aston Martin’s bonds also slipped by ~9% after it was downgraded to CCC+ by S&P on the back of weak operating results and heavy cash burn.

Global corporate dollar bond issuances stood at $289bn in October, 35% lower MoM. As compared to October 2024, issuance volumes were up 11%. 83% of the issuance volumes came from IG issuers with HY comprising 15% and unrated issuers taking the remaining 1%.

Issuance Volumes

Global corporate dollar bond issuances stood at $289bn in October, 35% lower MoM. As compared to October 2024, issuance volumes were up 11%. 83% of the issuance volumes came from IG issuers with HY comprising 15% and unrated issuers taking the remaining 1%.

Asia ex-Japan & Middle East G3 issuance stood at $36bn, down 56% MoM but higher by 38% YoY. 59% of the volumes came from IG issuers with HY issuing 27% and unrated issuers taking the rest.

Largest Deals

The largest deal globally was led by Meta’s $30bn six-trancher, the largest deal this year. This was followed by the big banks including the likes of Goldman Sachs’ $10bn five-trancher, Morgan Stanley’s $8bn four-trancher, JPMorgan’s $5bn two-trancher and Lloyds’ $3.05bn three-part deal.

In the APAC and Middle East region, deal volumes were led by Saudi PIF’s €12.25bn three-part issuance. This was followed by other large deals like Indonesia’s $2.54bn multicurrency three-part deal, Bahrain’s $2.5bn two-trancher, Turkiye’s $2.25bn issuance and Meituan’s $2bn three-part issuance.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024