This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

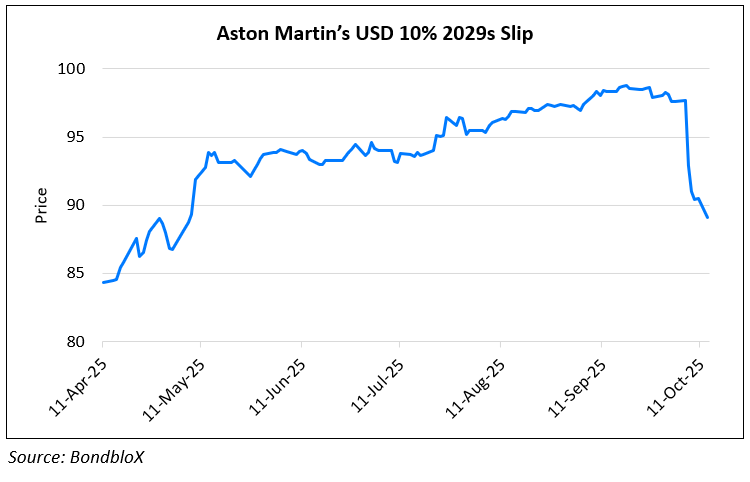

Aston Martin Downgraded to CCC+ by S&P; Dollar Bond Slips

October 13, 2025

Aston Martin Lagonda, the parent holding company was downgraded by a notch to CCC+ from B- by S&P. The downgrade reflects expectations of heavy cash burn and weak cash flow generation prospects in 2025. According to S&P, in 2025, the company’s revenue is expected to fall about 10–11% due to weaker demand in North America and Asia-Pacific, with EBITDA losses estimated at £50–75mn ($66.8-100.2mn) and negative free cash flow of £380–400mn ($507.5-534.2mn). Despite large outflows, Aston Martin’s liquidity is viewed as adequate, with £124mn ($165.6mn) in cash as of end-June 2025, £103mn ($137.6mn) of undrawn RCF headroom, £53mn ($70.8mn) in shareholder support raised during the year, and £110mn ($146.9mn) proceeds from the sale of AML’s Formula 1 stake. S&P expects no covenant breaches and that the company can meet funding needs over the next 12 months. A turnaround in 2026 hinges on successful Valhalla deliveries, expected to lift revenue to ~£1.8bn ($2.4bn) and EBIT to ~£100mn ($133.5mn) with limited cash burn. Its 10% 2029s plunged by almost 7- 8 points over the last week.

Go back to Latest bond Market News

Related Posts:

Aston Martin’s Bonds Drop on Profit Warning

October 1, 2024

Aston Martin’s Bonds up on US-UK Trade Deal

May 9, 2025