This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt Upgraded to B by S&P

October 13, 2025

Egypt was upgraded by a notch to B from B- by S&P. The upgrade reflects successful reforms undertaken by Egypt over the past 18 months, including foreign exchange liberalization, which have spurred strong GDP growth, boosted tourism and remittances, and improved fiscal and external indicators. Large FDI inflows, particularly $35bn investment by ADQ, along with IMF and donor support, have strengthened foreign reserves and eased external financing pressures. S&P expects Egypt’s foreign reserves to reach $42bn by 2028, with net external debt falling sharply relative to current account receipts. Fiscal consolidation is progressing through tax broadening, subsidy rationalization, and expenditure control, leading to a primary surplus of 3.5% of GDP in FY2025, projected to persist through FY2028. Although Egypt’s debt-servicing burden remains high, falling inflation and the central bank’s rate cuts since April 2025 should gradually lower borrowing costs. Interest expenditure is expected to decline from 73% of government revenue in FY2025 to 49% by FY2028.

Egypt’s dollar bonds traded marginally weaker with its 7.625% 2030s at 101.2, yielding 7.35%

Go back to Latest bond Market News

Related Posts:

Egypt Seeking $2.5bn Loan from Banks

August 12, 2022

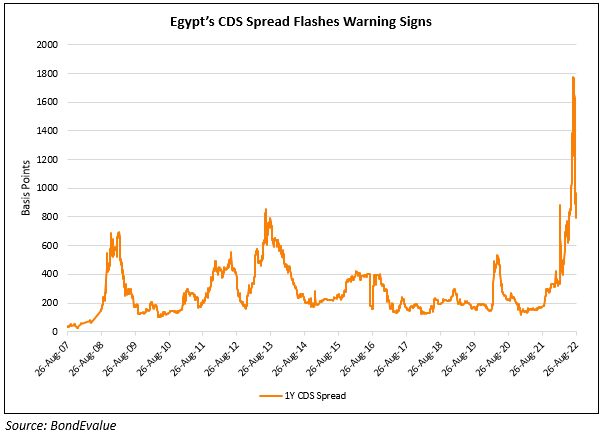

Egypt CDS Spreads Jump as Economic Health Worries Linger

August 29, 2022