This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

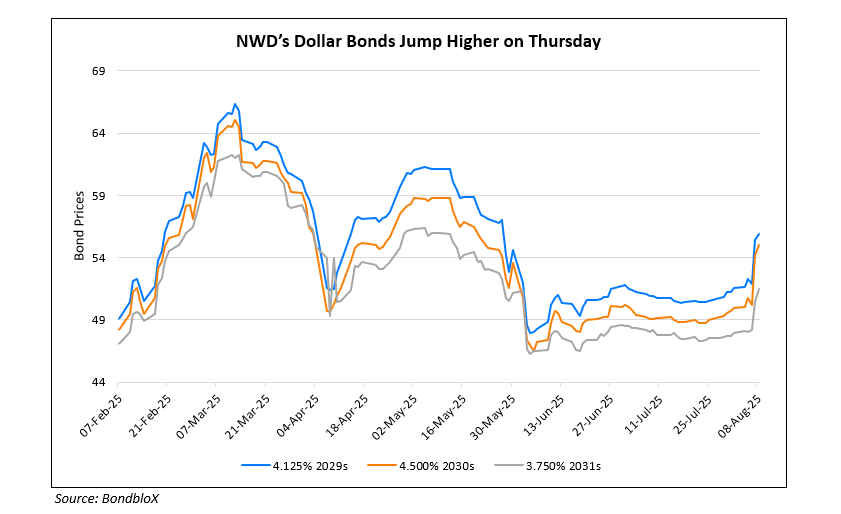

NWD’s Dollar Bonds Move Higher on Reports of a Potential Take-Private Deal

August 8, 2025

New World Development’s (NWD) shares and dollar bonds surged on Thursday after a media report on a potential refinancing and take-private deal. Its shares rallied by 8.7% and its dollar bonds were up by over 4 points across the curve (as seen in the chart below). It was reported that the developer, along with its controlling Cheng family, were in discussions with US private equity firm Blackstone regarding a financing deal of up to $2.5bn, which could result in a joint take-private offer. According to the media report, the discussions, which could involve preferred or ordinary shares, are in the early stages and are subject to change. However, NWD said in a filing to the Hong Kong stock exchange yesterday, that no share offers were given to the company by any person, including the controlling shareholders of NWD and Blackstone.

Its 5.875% 2027s were up by nearly 7 points to trade at 76.3 cents on the dollar, yielding 22.1%.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

Dr. Peng Telecom Seeks Extension of its Dollar Bonds

February 2, 2021

Cathay Sells $650mn 5.5Y Bond at 4.875%

May 11, 2021

Cathay’s Granted $1bn Loan Extension

June 9, 2021