This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

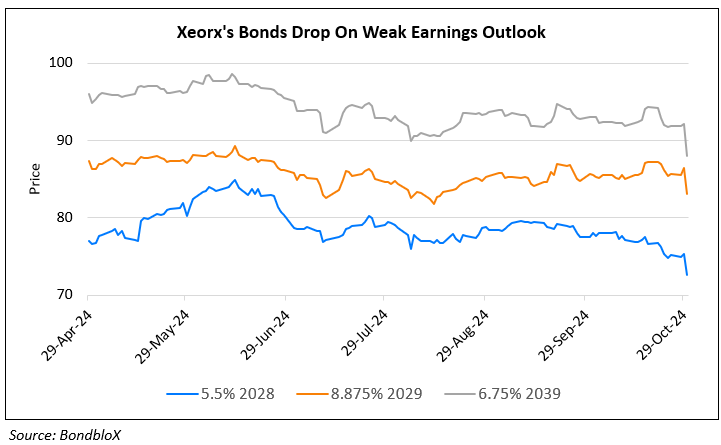

Xerox Downgraded to B- by S&P

October 14, 2025

Xerox was downgraded by a notch to B- from B by S&P. It’s first-lien notes, second-lien notes and senior unsecured notes were also downgraded by same measure to B+, B- and CCC+ respectively. The downgrade reflects heightened risks around refinancing its 2028 and 2029 debt maturities and weak core free operating cash flow (FOCF). It also reflects execution and integration risks tied to the Lexmark acquisition and Reinvention transformation program, alongside declining benefits from finance receivable reductions and a structurally shrinking print market. S&P believes Xerox to maintain adequate liquidity for the next two years, supported by planned receivable reductions, cost savings, and lower dividends. However, it does not consider this strategy a sustainable long-term source of liquidity. Weakening investor sentiment and its unsecured debt trading at distressed levels, further clouds refinancing prospects. The negative outlook highlights ongoing challenges in restoring organic revenue growth, profitability, and meaningful core FOCF amid macroeconomic and policy uncertainty. Last month, S&P had downgraded Xerox to B.

Xerox’s 8.875% 2029s have dropped by ~47% since beginning of this year and currently trade at 47.6 cents on the dollar, yielding 32.9%.

Go back to Latest bond Market News

Related Posts:

Xerox Bonds Drop on Weak Earnings and Lowered Guidance

October 30, 2024

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018