This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

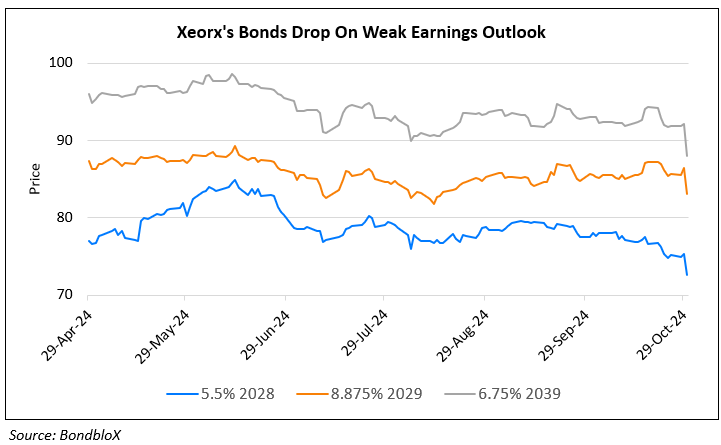

Xerox Bonds Drop on Weak Earnings and Lowered Guidance

October 30, 2024

Xerox’s bonds dropped by 2-4 points across the curve after the company reported weak set of results for 3Q and lowered its earning guidance for the full year FY24. The company reported revenue of $1.5bn, a decline of 7.5% YoY, with a GAAP net loss of $1.2bn. Adjusted net income fell to $34mn, while adjusted operating margin improved to 5.2%. Operating cash flow was $116mn, slightly down from the previous year, and free cash flow was $107mn. The company also lowered its 2024 revenue guidance to a decline of around 10% in constant currency and adjusted operating margin guidance to about 5.0%. Free cash flow guidance was also reduced to $450-$500mn. This revision reflects lower-than-expected equipment sales and reductions in non-strategic revenue. Xerox’s shares hit a 52 week low of $8.8 after the announcement and its dollar bonds also witnessed a drop as seen in the chart above.

Go back to Latest bond Market News

Related Posts: