This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Xerox Downgraded to B by S&P

September 1, 2025

Xerox was downgraded to B from B+ by S&P, citing ongoing financial pressure, with expectations of negative core free operating cash flow (FOCF) over the next 12 months. S&P expects Xerox to see adjusted negative core FOCF of $50-60mn this year. This excludes Lexmark integration costs and the benefit from decreasing finance receivables, and is below their previous expectations of a return to positive FOCF. Additionally, S&P sees tariff-related cash expenses of $60–65mn in 2025 and delays in cost savings form the Lexmark integration. The rating agency added that execution risks around integration remain significant. Revenue and EBITDA margin forecasts were revised downward, with margins now expected at 9% in 2025 and 11% in 2026. S&P added that Xerox’s ratings could be downgraded if it fails to stabilize revenues, improve FOCF, or sustain margin gains.

Xerox’s bonds were trading stable, with its 13.5% 2031s at 100.4, yielding 13.4%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

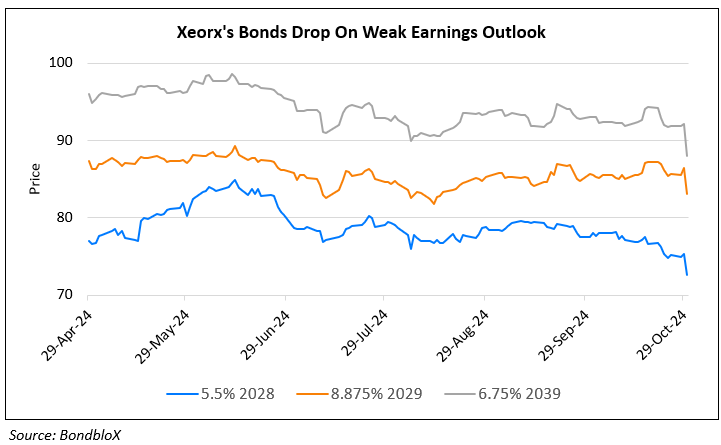

Xerox Bonds Drop on Weak Earnings and Lowered Guidance

October 30, 2024

Xerox Downgraded to B2 by Moody’s

November 13, 2024

Xerox Holdings Downgraded to B+ by S&P

November 19, 2024