This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

July 2023: Mixed Month for Bonds as Markets Brace for a ‘Soft Landing’

August 1, 2023

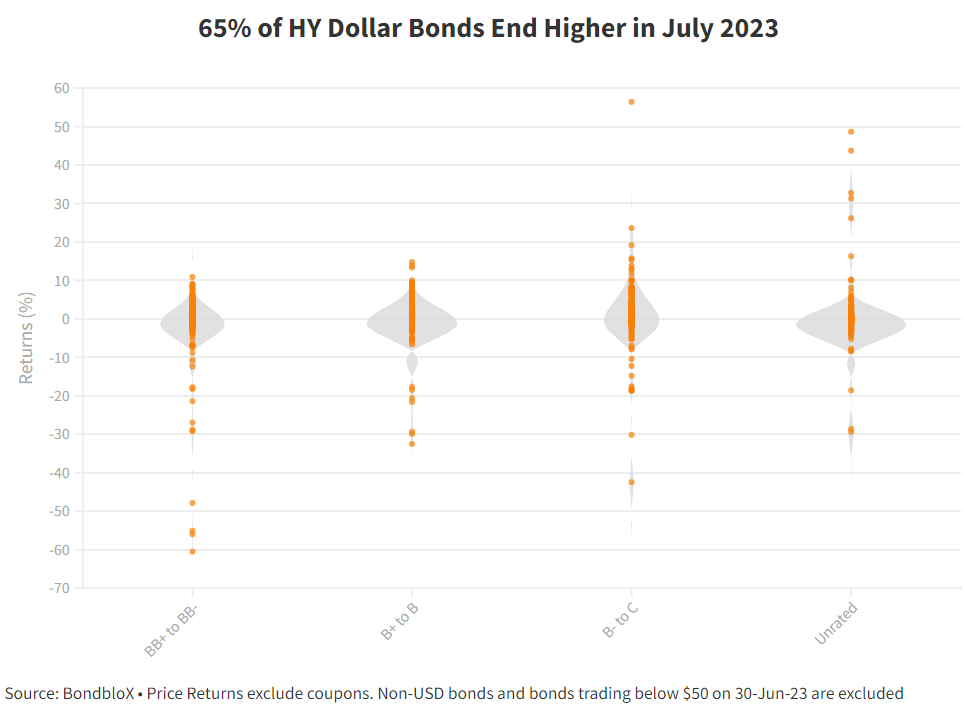

The month of July was a mixed one for bond markets with high yield bonds outperforming investment grade bonds, continuing the trend seen in Q2. In July, 65% of HY bonds ended in the green as compared to 42% of IG bonds that ended with a positive price return. The quarter ended June also painted a similar mixed picture with 61% of HY dollar bonds ending higher vs. 40% of IG bonds ending Q2 in the green. While US Treasuries did not witness a sharp sell-off during the month, higher yields saw IG bonds underperform albeit without large drawdowns.

The month of July saw sentiment shift towards supporting the case for a ‘soft landing’ and easing recession concerns. Initially, the US 2s10s spread inverted to its lowest since 1981 at -109.50bp earlier this month as there were fears of a possible recession stemming from the Fed hiking rates too quickly. However, a slew of economic indicators suggested cooling inflation against the backdrop of a resilient labor market and stable growth, bolstered the case for a ‘soft landing’ rather than a recession. This saw the yield curve steepen, with the 2s10s spread rising from -107bp to -92bp. NFP came at 209k for June, missing forecasts of 230k and lower than May’s revised 306k print. Average Hourly Earnings, on the other hand, grew 4.4% YoY, higher than the surveyed 4.2%. Inflation continued to tick lower with US CPI coming in at 3% for June, below expectations of 3.1% while Core CPI came at 4.8%, lower than expectations of 5.0%. Moreover, both figures were lower than the previous month’s print of 4.0% and 5.3% respectively. Similarly, headline PCE for June was up 3% and Core PCE also indicated a slowing inflation trend. US Q2 GDP grew by 2.4%, which surpassed expectations of 1.8%. At the July FOMC meeting, the US Fed did raise their interest rates by 25bp to 525-550bp as expected. However, Fed Chair Jerome Powell took a relatively dovish stance after the hike, stating that the interest rate decision in September will be "data dependent" with two more jobs reports and two more inflation reports to be released before the meeting takes place. He further added that Fed staff no longer forecast a recession.

Longer-dated bonds from issuers such as LNC, M&T, Kohls and of big banks such as Goldman Sachs, Bank of America, Barclays and BNP led the IG gainers list. Furthermore, Westpac’s 5.36% grandfathered Perp rose sharply by 8% after the bank announced that it will call the disco bond issued in 1986, in September this year. Meanwhile, highly-rated Chinese property developers like Longfor and China Jinmao were at the top of the IG losers list with losses of around 10% and 5% respectively after disappointing new home sales data and a lack of policy stimulus from the Chinese government in July. However, the 24-member Politburo has recently pledged more support to the ailing sector; the effects on the property market will be interesting to see next month.

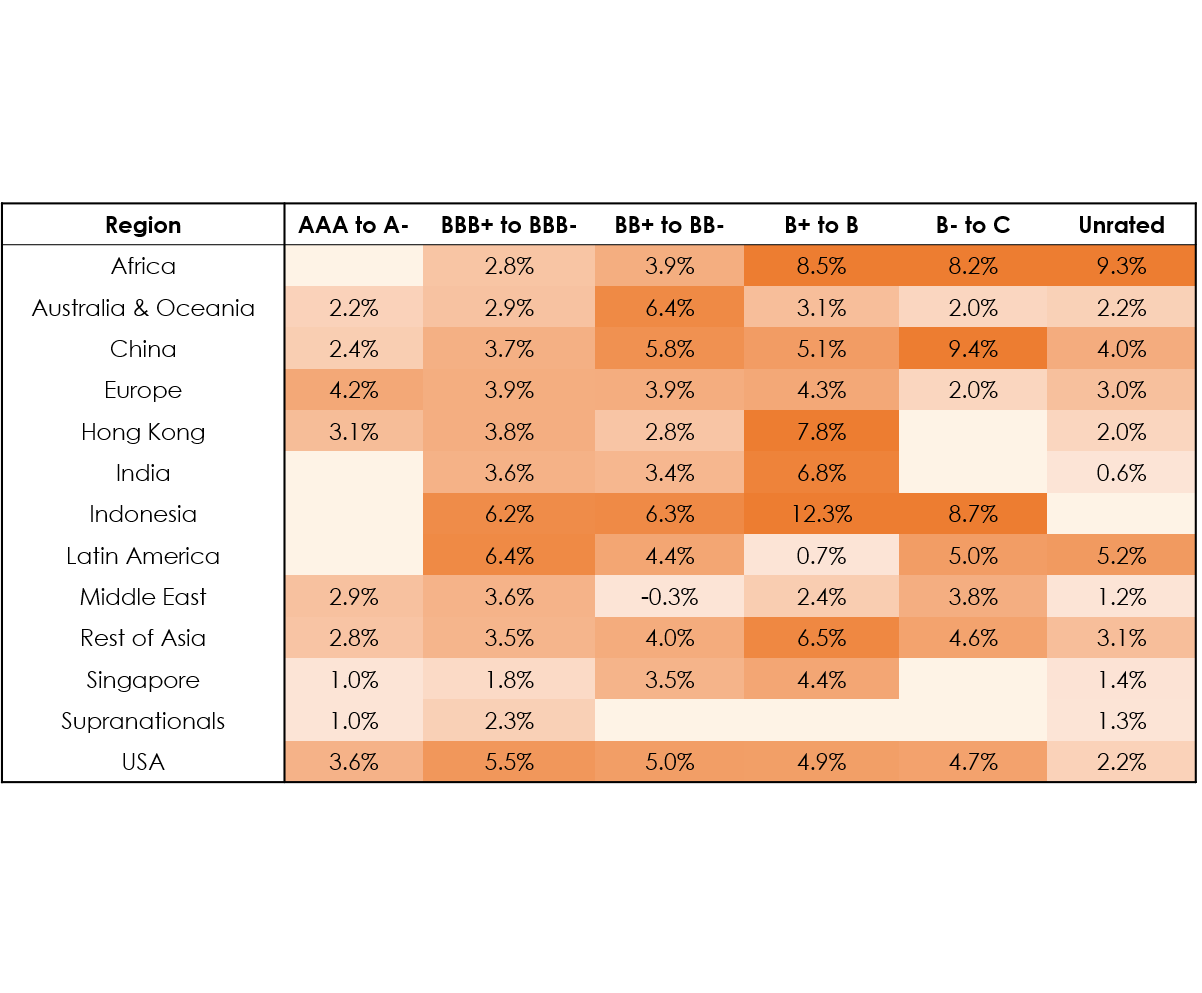

Pakistan's dollar bonds dominated the HY gainers list, exhibiting impressive gains of as much as 56% seen in its 8.25% 2024s. This follows the final approval given by the IMF Executive Board for the country’s $3bn bailout programme, which the cash-strapped country desperately needed given that its foreign exchange reserves were barely enough to cover one month’s worth of imports. Furthermore, many countries have pledged support for Pakistan, including Saudi Arabia and the UAE who gave $2bn and $1bn respectively in financial support and China who rolled over a $2.4bn loan. Egypt's dollar bonds also gained over 7% as it announced the sale of $1.9bn in state assets to raise their forex reserve levels. Several bonds from Russian issuers like Eurochem, RZD, TMK and EVRAZ also posted gains of over 20%, continuing the trend from the prior months. Another notable gainer is Transocean, whose dollar bonds rose over 12% after the offshore drilling contractor secured a $518mn long-term contract for an ultra-deepwater drillship in the Gulf of Mexico.

Meanwhile, many Chinese property developers appeared on the losers list. Country Garden's, bond prices fell by ~50% over investors’ concerns about a potential sector default, leading to weak sales and low cash flows for COGARD with an increased risk of non payment. Also, a major development was default concerns of Wanda Group where they managed to salvage an eleventh hour $314mn asset sale that helped it redeem its bond on July 23. However, worries still continue about Wanda's financial position and the broad property market. Shui On’s bonds also fell by over 20% after it made a move to identify bondholders holding two of its dollar notes, which could be a prelude to payment extensions. Aside from Chinese property developers, Vedanta’s dollar bonds also fell around 18% after Foxconn pulled out of its joint venture with Vedanta amid looming concerns over the company’s debt levels, which stand at $6.5bn as of May 2023. Altice’s dollar bonds have also trended lower by about 6% after its co-founder was detained in a corruption probe. Other notable losers include WeWork, Oriflame and Qwest.

Issuance Volumes

Global corporate dollar bond issuances stood at $140.3bn in Jul, 2% lower than June's $175bn. As compared to July 2022, issuance volumes were almost flat YoY. 90% of the issuance volumes came from IG issuers with HY and unrated issuers taking the remainder.

Asia ex-Japan & Middle East G3 issuance stood at $11.2bn, up 27% MoM and flat YoY. 83% of the volumes came from IG issuers with HY issuers taking 12% and the rest by unrated issuers.

Largest Deals

The largest deals globally were led by big US banks Wells Fargo, which raised $8.5bn via a two-part deal and Morgan Stanley’s $6.75bn four-part deal. This was followed by other American issuers like L3Harris’ $3.75bn three-trancher and American Express’ $3.5bn four-trancher.

In the APAC and Middle East region, deal volumes were led by KEPCO’s $1bn deal, followed by Gulf issuers Masdar and Almarai that raised $750mn each and Luso International’s $700mn two-trancher. Several other deals totaling $500mn were issued by the likes of Shinhan Financial, Korea Hydro and CICC Hong Kong and others.

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts:

Bond Yields – Explained

December 26, 2024

Bond Investors Up $75.4 Billion in 1Q19

April 10, 2019

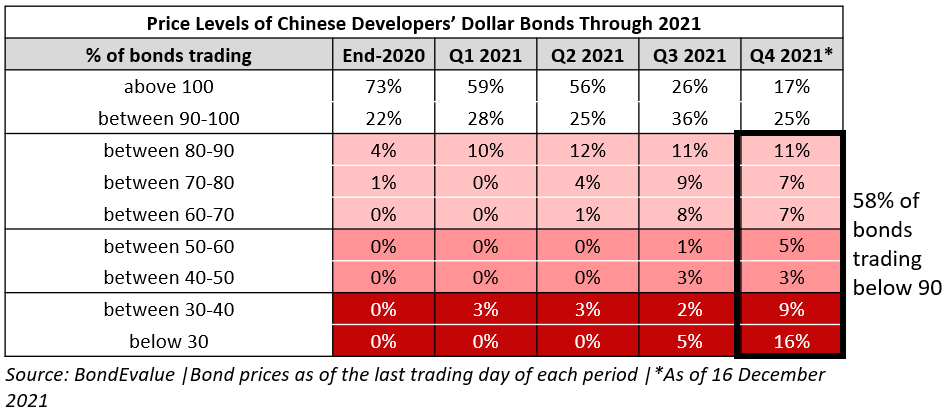

2021 Recap: China Real Estate – When Hope Went Up In Smoke

December 20, 2021