This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

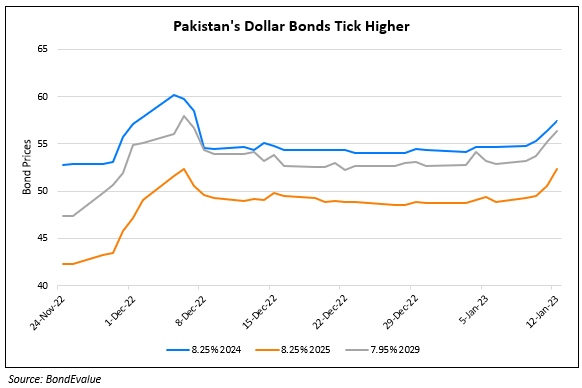

Pakistan’s Dollar Bonds Extend Rally as UAE Provides $1bn Support

July 13, 2023

Pakistan’s dollar bonds extended its rally by 1-2 points after the UAE has also provided $1bn in support to Pakistan, adding on to the $2bn in financial support provided by Saudi Arabia just a day earlier. The support from both countries would help Pakistan support its forex reserves, the finance minister said. In addition, the IMF also gave its final approval for the country’s $3bn bailout programme, unlocking funds that will provide significant help to the cash-strapped nation, who previously had barely enough foreign currency reserves to afford one month’s worth of imports. The bailout programme is a nine-month stand-by arrangement with the purpose of supporting Pakistan’s economic stabilization programme, with the approval allowing for $1.2bn to be immediately disbursed. The approval comes after the country has put in significant effort over the past few months to win an IMF deal in order to prevent a sovereign default, including amending its proposed 2023-24 budget to make it more in line with IMF requirements.

Pakistan’s 8.25% 2024s have breached the 80-cents mark for the first time since June 2022. It is currently trading at 80.7 cents on the dollar.

Go back to Latest bond Market News

Related Posts: