This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

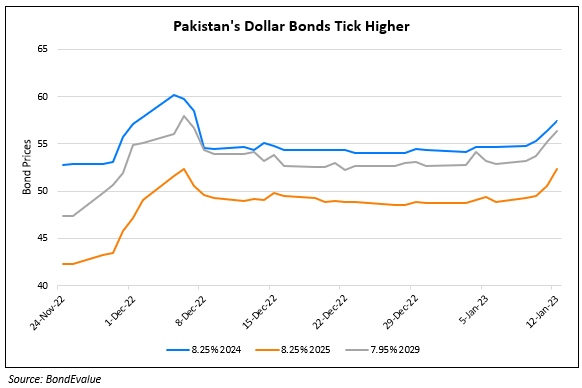

Pakistan Parliament Approves Revised Budget Hoping For Last Minute IMF Deal

June 26, 2023

Pakistan’s parliament has approved the 2023-24 budget it revised to meet IMF’s conditions just days before its $6.5bn Extended Fund Facility (EFF) is set to expire. This approval comes after the IMF criticised its budget in mid-June, saying that it is a “missed opportunity to broaden the tax base in a more progressive way”. The changes in the budget include the raising of an additional $752mn in new taxes and an expenditure cut of roughly $297mn to reduce its fiscal deficit. The country is currently facing a severe shortage in its currency reserves, which can barely cover one month’s imports. Some market participants believe that the nation could potentially default on its debt payments if it does not receive the IMF funds, which are vital to unlock further bilateral and multilateral financing for the country. Over the next few days, the IMF will conduct its ninth EFF review on Pakistan to determine whether or not to release some of the pending $2.5bn that have been stalled since November.

Pakistan’s dollar bonds have ticked higher by roughly 2-5% since last week but are still trading at distressed levels. In particular, its 6% 2026s rose 4.7% to trade at 37.9 cents on the dollar.

Go back to Latest bond Market News

Related Posts: