This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Politburo Signals Property Easing as Developers Bonds Continue to Tumble; Wanda Says It Wired Funds

July 25, 2023

China’s 24-member Politburo signaled more support for the property sector, pledging to boost consumption and resolve local government debt. However, no details were provided and the announcement fell short of any large-scale stimulus. Bonds of developers like Country Garden are now at deeply distressed levels, and even IG-rated Longfor Group (Baa2/BBB/BBB) saw its dollar bonds fall over 10% yesterday. Last week, Bloomberg reported that China was considering easing home-buying restrictions in Tier 1 cities including scrapping mortgage rules that require higher down payments.

Separately, Dalian Wanda said that it communicated to bondholders after wiring funds to redeem its $400mn 6.875% dollar bond that effectively matured yesterday. Its 6.875% 2023s were last seen trading at ~90 cents on the dollar. Wanda still has a missed coupon payment worth $22mn that was due last Thursday on its 11% 2025s. The notes have entered into a 10-day grace period before an event of default is triggered.

Go back to Latest bond Market News

Related Posts:

Country Garden Reports a Massive 96% Profit Drop

August 31, 2022

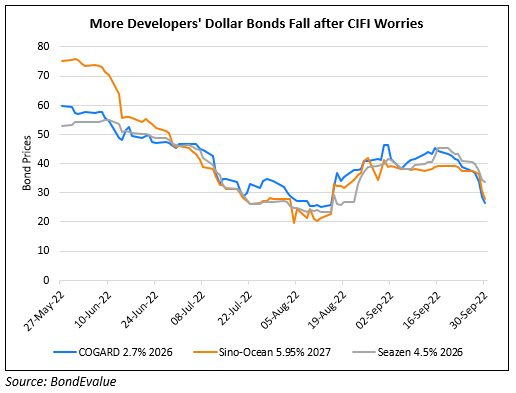

COGARD, Longfor, Seazen Bonds Drop 4-10 Points on CIFI’s Worries

September 30, 2022