This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Country Garden Reports a Massive 96% Profit Drop

August 31, 2022

Country Garden (COGARD) reported a record 96% YoY drop in its net profits to RMB 612mn ($88mn) 1H 2022. The developer’s revenue dropped 31% YoY to RMB 162bn ($23mn). The Chinese property developer had warned of a sharp drop in its profits in mid-August. Its gross margin declined to a record low of 10.6%, as compared to 19.7% a year earlier. With regard to China’s three red-lines policy, the company continues to meet two of the metrics – its net debt-to-equity and cash-to-short-term debt were within the boundaries while its liabilities-to-assets breached the mark at 74%. With Country Garden’s broad focus on the lower-end of the market, the developer is more vulnerable to weakening demand from homebuyers during an economic slowdown, as per Bloomberg. The company has ~RMB 15bn ($2.2bn) in outstanding debts due in the upcoming year. Their CFO said, “The amount is not very big and we do not see much pressure repaying them”.

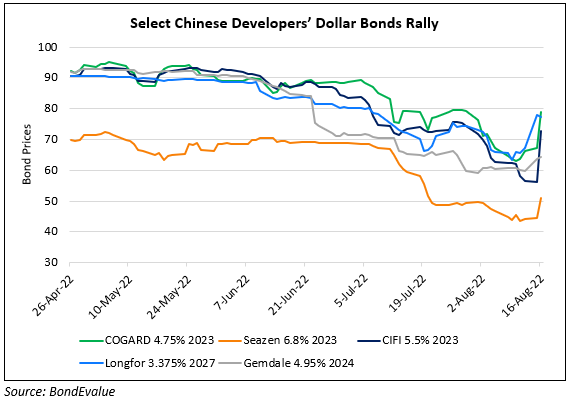

Separately, Country Garden said that it plans to issue RMB 5bn ($724.3mn) in state-backed guaranteed notes this year. The first batch would see an issuance size of RMB 1.5-1.6bn ($220-230mn) in September. This follows its peer Longfor Group’s RMB 1.5bn ($219mn) 3Y notes that priced at a yield of 3.3%. CIFI and Seazen have also planned issuance of these notes backed by China Bond Insurance Co.

Despite the weak results, COGARD’s dollar bonds were trading higher with its 4.8% 2030s up by 2.4 points to 41.5 cents on the dollar, yielding 19.7%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: