This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Longfor Issues First State-Backed Bonds under Developer Rescue Program; CIFI Plans to Follow

August 26, 2022

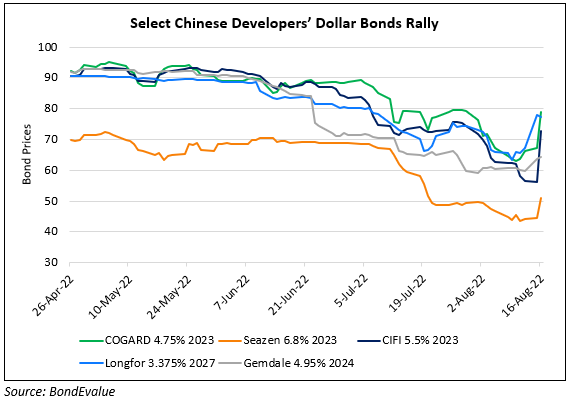

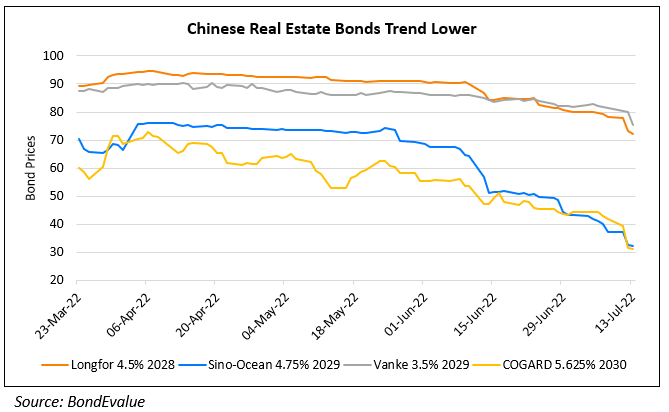

Chinese property developer Longfor Group became the first in the sector to issue state-backed bonds under Beijing’s program to provide respite to companies in the space. The developer issued RMB 1.5bn ($219mn) 3Y notes at a yield of 3.3%, with the issuance receiving a bid-to-cover of 2.86x. The bonds are guaranteed by China Bond Insurance Co. Proceeds will be used for project development and to repay debt. To recall the policy, Chinese authorities had identified 16 developers including names like Country Garden, CIFI, Seazen and Gemdale for a pilot program where China Bond Insurance would provide direct bond/asset securitization guarantees. The objective is to provide stronger support to developers to help restore market confidence.

Longfor’s dollar bonds were trading slightly higher – its 4.5% 2028s were up 0.4 points to 81.83, yielding 8.81%.

In this regard, another Chinese developer CIFI Holdings has also planned a similar bond issuance with a guarantee from China Bond Insurance Co. As per Bloomberg, a unit of CIFI plans to issue a 3Y note with a size of RMB 1-1.5bn ($146-219mn). The bond will be sold on the interbank market. Potential use of proceeds from the bonds include repaying and repurchasing offshore debt.

CIFI’s dollar bonds jumped higher – its 11.581% Perp as up 3 points to 44.49, yielding 12.08%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: