This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

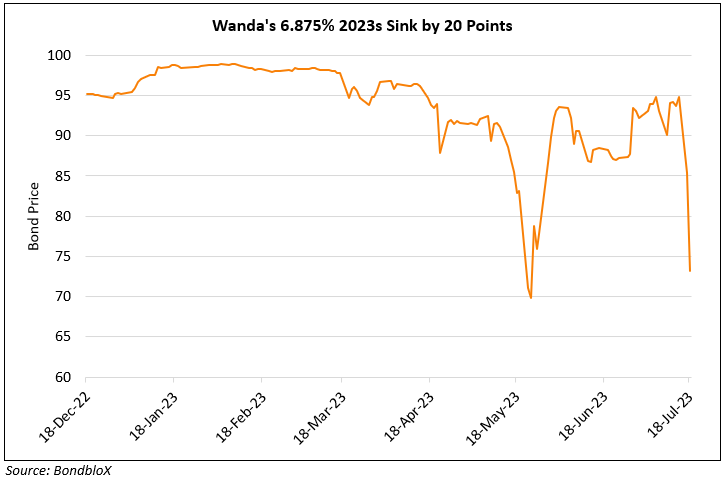

Wanda Reaches $314mn Asset Sale Agreement; Downgraded to C on Missed Coupon on 2025s

July 24, 2023

Market participants are closely watching out for Wanda Group’s $400mn 6.875% bond that matured Sunday, but is due to be redeemed today. The likelihood of the conglomerate repaying the bond has gone up after it has agreed to sell a 49% stake in one of its entertainment units, Beijing Wanda Cultural Industry Group for RMB 2.26bn ($314mn) to China Ruyi Holdings. Wanda’s notes have seen massive volatility lately, with the 6.875% 2023s witnessing the largest fluctuation. Early last week, the bonds had initially plunged over 40 points to 55 cents on the dollar when they said there was high uncertainty on its ability to repay the notes. However, prices jumped to over 92 cents on the dollar after the company’s representatives told creditors that they expect to complete the asset disposal and use the proceeds to repay the maturing note.

Separately, the company was downgraded to C from B by Fitch after a missed coupon payment on its $400mn 11% 2025s on Thursday. The notes thus entered into a 10-day grace period before an event of default is triggered. In a latest update, Wanda Commercial said that it plans to pay a 6.6% local bond’s principal and interest amounting to RMB 595mn ($83mn) that is due July 29.

For more details, click here

Go back to Latest bond Market News

Related Posts: