This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

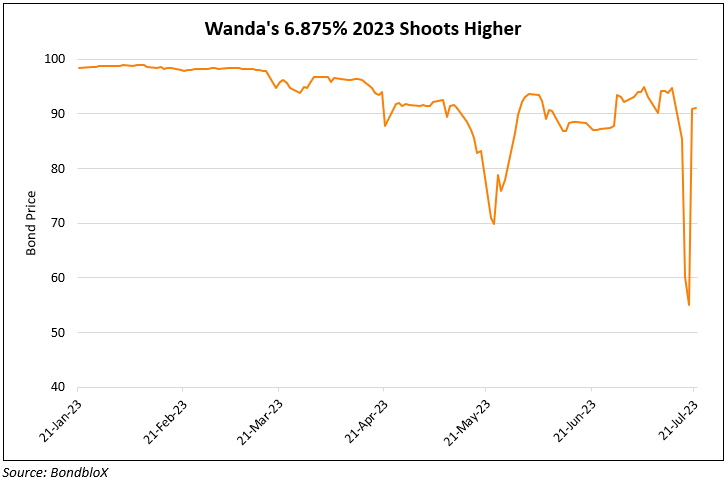

Wanda’s 6.875% Bond Due Sunday Soars 35 Points on Potential Eleventh Hour Asset Sale

July 21, 2023

Wanda Group’s 6.875% dollar bonds due July 23 saw a massive jump of over 35 cents on the dollar to currently trade at 91. This comes after representatives of Dalian Wanda Commercial Management Group told creditors that they expect to complete an asset disposal and use the proceeds to repay the maturing note. Details regarding the nature of the asset or the expected amount to be realized were not disclosed. Hedge funds and private banks were reported to be the main buyers of the notes. As per Bloomberg, the representatives said that the chances of repaying the bond had become relatively high. This is in contrast to Wednesday, when they said there was relatively high uncertainty, thus seeing its note drop over 40 points. The bond does not have a grace period to pay the principal and thus, not redeeming it would lead to a default.

Go back to Latest bond Market News

Related Posts: