This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

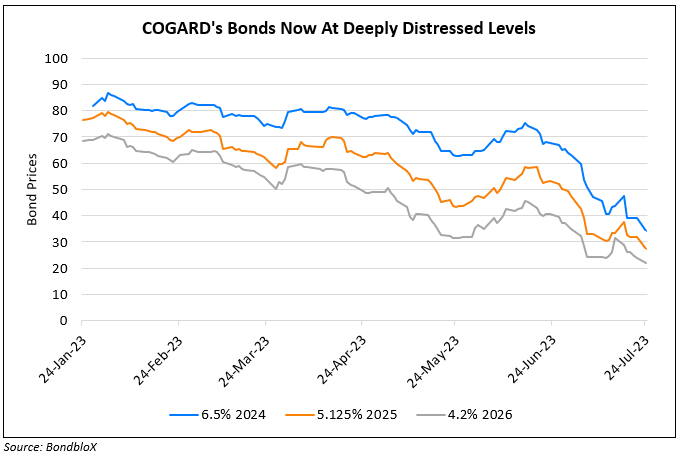

Country Garden’s Dollar Bonds Drop Again as Fears Rise About Sector Defaults

July 24, 2023

Country Garden’s dollar bonds continued to tumble to deeply distressed levels of 20-30 cents on the dollar as fears of a property sector crisis have risen again. While the developer last week refinanced part of a 2019 loan facility, yet analysts and bondholders cite risks that they are not “completely out of the woods”. Raymond Cheng, head of China research at CGS-CIMB Securities notes that COGARD is among the largest developers in terms of sales and any signs of default would not just wreak havoc in the sector, but also send a signal that the government “does not care (about) more developers going down and has no plan to bail out”. With the property sector facing $12.8bn in dollar-denominated repayments by end-2023. COGARD’s immediate repayments include coupons on its 4.8% 2030s and 4.2% 2026s due on August 6. Its next principal repayment is its $1bn 8% dollar bond due January 2024. With erstwhile high-rated developers like Shimao going into default and Wanda on the brink, COGARD is now on the radar. JPMorgan estimates another $9bn of defaults this year, but that does not include COGARD. Its analysts however mention that fresh government support would become crucial to the sector.

For more details, click here

Go back to Latest bond Market News

Related Posts: